Deduction For Exemptions Worksheet For Form 1040me, Schedule Nrh - Maine Revenue Services - 2016

ADVERTISEMENT

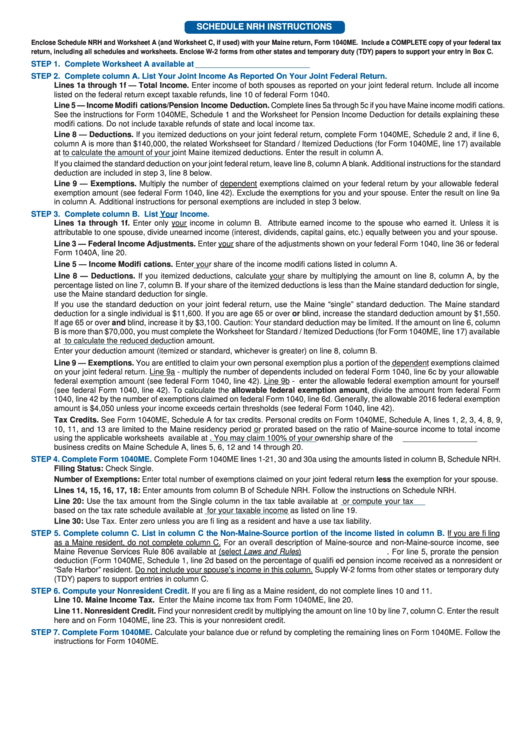

SCHEDULE NRH INSTRUCTIONS

Enclose Schedule NRH and Worksheet A (and Worksheet C, if used) with your Maine return, Form 1040ME. Include a COMPLETE copy of your federal tax

return, including all schedules and worksheets. Enclose W-2 forms from other states and temporary duty (TDY) papers to support your entry in Box C.

STEP 1. Complete Worksheet A available at before completing Schedule NRH.

STEP 2. Complete column A. List Your Joint Income As Reported On Your Joint Federal Return.

Lines 1a through 1f — Total Income. Enter income of both spouses as reported on your joint federal return. Include all income

listed on the federal return except taxable refunds, line 10 of federal Form 1040.

Line 5 — Income Modifi cations/Pension Income Deduction. Complete lines 5a through 5c if you have Maine income modifi cations.

See the instructions for Form 1040ME, Schedule 1 and the Worksheet for Pension Income Deduction for details explaining these

modifi cations. Do not include taxable refunds of state and local income tax.

Line 8 — Deductions. If you itemized deductions on your joint federal return, complete Form 1040ME, Schedule 2 and, if line 6,

column A is more than $140,000, the related Workshseet for Standard / Itemized Deductions (for Form 1040ME, line 17) available

at

to calculate the amount of your joint Maine itemized deductions. Enter the result in column A.

If you claimed the standard deduction on your joint federal return, leave line 8, column A blank. Additional instructions for the standard

deduction are included in step 3, line 8 below.

Line 9 — Exemptions. Multiply the number of dependent exemptions claimed on your federal return by your allowable federal

exemption amount (see federal Form 1040, line 42). Exclude the exemptions for you and your spouse. Enter the result on line 9a

in column A. Additional instructions for personal exemptions are included in step 3 below.

STEP 3. Complete column B. List Your Income.

Lines 1a through 1f. Enter only your income in column B. Attribute earned income to the spouse who earned it. Unless it is

attributable to one spouse, divide unearned income (interest, dividends, capital gains, etc.) equally between you and your spouse.

Line 3 — Federal Income Adjustments. Enter your share of the adjustments shown on your federal Form 1040, line 36 or federal

Form 1040A, line 20.

Line 5 — Income Modifi cations. Enter your share of the income modifi cations listed in column A.

Line 8 — Deductions. If you itemized deductions, calculate your share by multiplying the amount on line 8, column A, by the

percentage listed on line 7, column B. If your share of the itemized deductions is less than the Maine standard deduction for single,

use the Maine standard deduction for single.

If you use the standard deduction on your joint federal return, use the Maine “single” standard deduction. The Maine standard

deduction for a single individual is $11,600. If you are age 65 or over or blind, increase the standard deduction amount by $1,550.

If age 65 or over and blind, increase it by $3,100. Caution: Your standard deduction may be limited. If the amount on line 6, column

B is more than $70,000, you must complete the Worksheet for Standard / Itemized Deductions (for Form 1040ME, line 17) available

at

to calculate the reduced deduction amount.

Enter your deduction amount (itemized or standard, whichever is greater) on line 8, column B.

Line 9 — Exemptions. You are entitled to claim your own personal exemption plus a portion of the dependent exemptions claimed

on your joint federal return. Line 9a - multiply the number of dependents included on federal Form 1040, line 6c by your allowable

federal exemption amount (see federal Form 1040, line 42). Line 9b - enter the allowable federal exemption amount for yourself

(see federal Form 1040, line 42). To calculate the allowable federal exemption amount, divide the amount from federal Form

1040, line 42 by the number of exemptions claimed on federal Form 1040, line 6d. Generally, the allowable 2016 federal exemption

amount is $4,050 unless your income exceeds certain thresholds (see federal Form 1040, line 42).

Tax Credits. See Form 1040ME, Schedule A for tax credits. Personal credits on Form 1040ME, Schedule A, lines 1, 2, 3, 4, 8, 9,

10, 11, and 13 are limited to the Maine residency period or prorated based on the ratio of Maine-source income to total income

using the applicable worksheets available at . You may claim 100% of your ownership share of the

business credits on Maine Schedule A, lines 5, 6, 12 and 14 through 20.

STEP 4. Complete Form 1040ME.

Complete Form 1040ME lines 1-21, 30 and 30a using the amounts listed in column B, Schedule NRH.

Filing Status: Check Single.

Number of Exemptions: Enter total number of exemptions claimed on your joint federal return less the exemption for your spouse.

Lines 14, 15, 16, 17, 18: Enter amounts from column B of Schedule NRH. Follow the instructions on Schedule NRH.

Line 20: Use the tax amount from the Single column in the tax table available at

or compute your tax

based on the tax rate schedule available at

for your taxable income as listed on line 19.

Line 30: Use Tax. Enter zero unless you are fi ling as a resident and have a use tax liability.

STEP 5. Complete column C. List in column C the Non-Maine-Source portion of the income listed in column B.

If you are fi ling

as a Maine resident, do not complete column C. For an overall description of Maine-source and non-Maine-source income, see

Maine Revenue Services Rule 806 available at

(select Laws and Rules). For line 5, prorate the pension

deduction (Form 1040ME, Schedule 1, line 2d based on the percentage of qualifi ed pension income received as a nonresident or

“Safe Harbor” resident. Do not include your spouse’s income in this column. Supply W-2 forms from other states or temporary duty

(TDY) papers to support entries in column C.

STEP 6. Compute your Nonresident Credit.

If you are fi ling as a Maine resident, do not complete lines 10 and 11.

Line 10. Maine Income Tax. Enter the Maine income tax from Form 1040ME, line 20.

Line 11. Nonresident Credit. Find your nonresident credit by multiplying the amount on line 10 by line 7, column C. Enter the result

here and on Form 1040ME, line 23. This is your nonresident credit.

STEP 7. Complete Form 1040ME.

Calculate your balance due or refund by completing the remaining lines on Form 1040ME. Follow the

instructions for Form 1040ME.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2