Application For Tax Status Report Form - Nyc Department Of Finance

ADVERTISEMENT

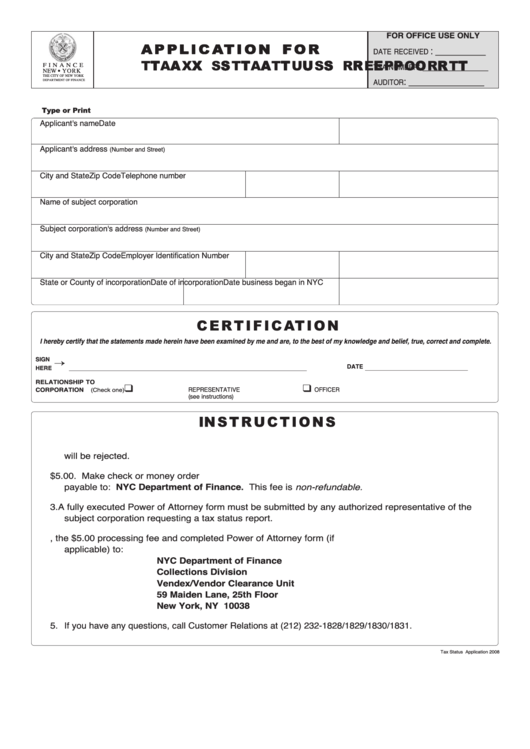

FOR OFFICE USE ONLY

A A P P P P L L I I C C A A T T I I O O N N F F O O R R

: __________

DATE RECEIVED

: _____________

T T A A X X S S T T A A T T U U S S R R E E P P O O R R T T

F I N A N C E

TSA NUMBER

NEW

YORK

: _______________

AUDITOR

G

THE CITY OF NEW YORK

DEPARTMENT OF FINANCE

n y c . g o v / f i n a n c e

Type or Print

Applicant's name

Date

Applicant's address

(Number and Street)

City and State

Zip Code

Telephone number

Name of subject corporation

Subject corporation's address

(Number and Street)

City and State

Zip Code

Employer Identification Number

State or County of incorporation

Date of incorporation

Date business began in NYC

C E R T I F I C AT I O N

I hereby certify that the statements made herein have been examined by me and are, to the best of my knowledge and belief, true, correct and complete.

SIGN

¡

DATE

HERE

__________________________________________________________________________

________________________________

RELATIONSHIP TO

K

K

CORPORATION

REPRESENTATIVE

OFFICER

(Check one)

(see instructions)

IN S T R U C T I O N S

1. Please complete this application in its entirety. Incomplete applications cannot be processed and

will be rejected.

2. The processing fee for the Application for Tax Status Report is $5.00. Make check or money order

payable to: NYC Department of Finance. This fee is non-refundable.

3. A fully executed Power of Attorney form must be submitted by any authorized representative of the

subject corporation requesting a tax status report.

4. Mail this completed application, the $5.00 processing fee and completed Power of Attorney form (if

applicable) to:

NYC Department of Finance

Collections Division

Vendex/Vendor Clearance Unit

59 Maiden Lane, 25th Floor

New York, NY 10038

5. If you have any questions, call Customer Relations at (212) 232-1828/1829/1830/1831.

Tax Status Application 2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1