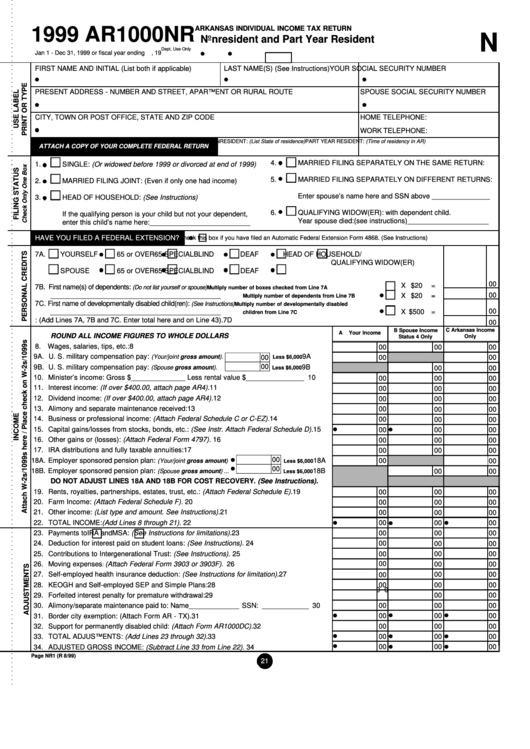

Form Ar1000nr - Arkansas Individual Income Tax Return Nonresident And Part Year Resident - 1999

ADVERTISEMENT

ARKANSAS INDIVIDUAL INCOME TAX RETURN

1999 AR1000NR

N

Nonresident and Part Year Resident

Dept. Use Only

Jan 1 - Dec 31, 1999 or fiscal year ending

, 19

FIRST NAME AND INITIAL (List both if applicable)

LAST NAME(S) (See Instructions)

YOUR SOCIAL SECURITY NUMBER

PRESENT ADDRESS - NUMBER AND STREET, APARTMENT OR RURAL ROUTE

SPOUSE SOCIAL SECURITY NUMBER

CITY, TOWN OR POST OFFICE, STATE AND ZIP CODE

HOME TELEPHONE:

WORK TELEPHONE:

NONRESIDENT: (List State of residence)

PART YEAR RESIDENT: (Time of residency in AR)

ATTACH A COPY OF YOUR COMPLETE FEDERAL RETURN

4.

MARRIED FILING SEPARATELY ON THE SAME RETURN:

1.

SINGLE: (Or widowed before 1999 or divorced at end of 1999)

5.

MARRIED FILING SEPARATELY ON DIFFERENT RETURNS:

2.

MARRIED FILING JOINT: (Even if only one had income)

Enter spouse’s name here and SSN above _______________

3.

HEAD OF HOUSEHOLD: (See Instructions)

6.

QUALIFYING WIDOW(ER): with dependent child.

If the qualifying person is your child but not your dependent,

Year spouse died:(see instructions) _____________________

enter this child’s name here: __________________________

HAVE YOU FILED A FEDERAL EXTENSION?

Check this box if you have filed an Automatic Federal Extension Form 4868. (See Instructions)

7A.

YOURSELF

65 or OVER

65 SPECIAL

BLIND

DEAF

HEAD OF HOUSEHOLD/

QUALIFYING WIDOW(ER)

SPOUSE

65 or OVER

65 SPECIAL

BLIND

DEAF

00

X $20

=

7B. First name(s) of dependents:

(Do not list yourself or spouse)

Multiply number of boxes checked from Line 7A ..........

____________________________________________

00

X $20

=

Multiply number of dependents from Line 7B ................

7C. First name of developmentally disabled child(ren):

(See Instructions)

Multiply number of developmentally disabled

00

____________________________________________

X $500 =

children from Line 7C .......................................................

7D.TOTAL PERSONAL CREDITS: (Add Lines 7A, 7B and 7C. Enter total here and on Line 43). ............................................ 7D

00

B Spouse Income

C Arkansas Income

A

Your Income

ROUND ALL INCOME FIGURES TO WHOLE DOLLARS

Status 4 Only

Only

8. Wages, salaries, tips, etc.: ............................................................................................ 8

00

00

00

9A. U. S. military compensation pay:

9A

(Your/joint gross amount).

00

00

00

Less $6,000

00

9B. U. S. military compensation pay:

9B

(Spouse gross amount).

Less $6,000

00

00

10. Minister’s income: Gross $ ______________ Less rental value $ _______________ 10

00

00

00

11. Interest income: (If over $400.00, attach page AR4). .................................................... 11

00

00

00

12. Dividend income: (If over $400.00, attach page AR4). .................................................. 12

00

00

00

13. Alimony and separate maintenance received: .............................................................. 13

00

00

00

14. Business or professional income: (Attach Federal Schedule C or C-EZ). ..................... 14

00

00

00

15. Capital gains/losses from stocks, bonds, etc.: (See Instr. Attach Federal Schedule D). 15

00

00

00

16. Other gains or (losses): (Attach Federal Form 4797). ................................................... 16

00

00

00

17. IRA distributions and fully taxable annuities: ................................................................. 17

00

00

00

00

18A. Employer sponsored pension plan:

18A

00

(Your/joint gross amount)

00

Less $6,000

00

18B. Employer sponsored pension plan:

18B

(Spouse gross amount) ...

00

00

Less $6,000

DO NOT ADJUST LINES 18A AND 18B FOR COST RECOVERY. (See Instructions).

19. Rents, royalties, partnerships, estates, trust, etc.: (Attach Federal Schedule E). .......... 19

00

00

00

20. Farm Income: (Attach Federal Schedule F). ................................................................. 20

00

00

00

21. Other income: (List type and amount. See Instructions). .............................................. 21

00

00

00

22. TOTAL INCOME: (Add Lines 8 through 21). ................................................................. 22

00

00

00

23. Payments to

IRA and

MSA: (See Instructions for limitations). ...................... 23

00

00

00

00

24. Deduction for interest paid on student loans: (See Instructions). .................................. 24

00

00

25. Contributions to Intergenerational Trust: (See Instructions). ......................................... 25

00

00

00

00

26. Moving expenses

(Attach Federal Form 3903 or 3903F). ............................................. 26

00

00

:

27. Self-employed health insurance deduction: (See Instructions for limitation). ................ 27

00

00

00

28. KEOGH and Self-employed SEP and Simple Plans: .................................................... 28

00

00

00

0 0

00

00

29. Forfeited interest penalty for premature withdrawal: ..................................................... 29

30. Alimony/separate maintenance paid to: Name _____________ SSN: ____________ 30

00

00

00

31. Border city exemption: (Attach Form AR - TX). ............................................................. 31

00

00

00

00

00

00

32. Support for permanently disabled child: (Attach Form AR1000DC). ............................. 32

33. TOTAL ADJUSTMENTS: (Add Lines 23 through 32). ................................................... 33

00

00

00

00

00

00

34. ADJUSTED GROSS INCOME: (Subtract Line 33 from Line 22). .................................. 34

Page NR1 (R 8/99)

21

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2