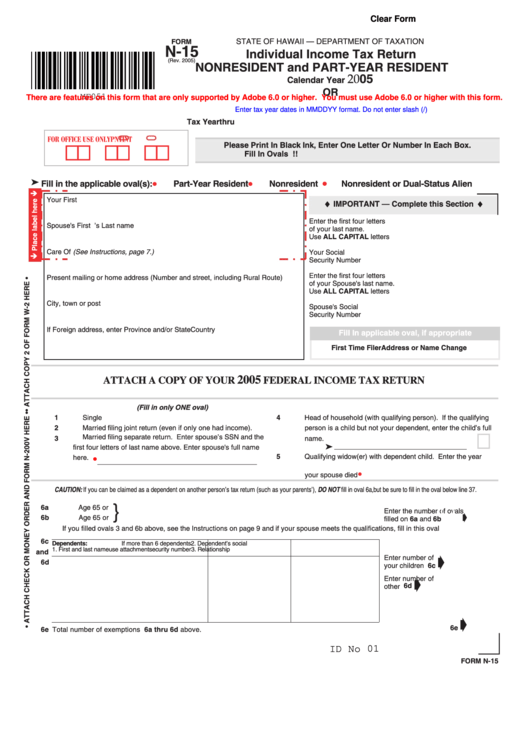

Clear Form

STATE OF HAWAII — DEPARTMENT OF TAXATION

FORM

N-15

Individual Income Tax Return

(Rev. 2005)

NONRESIDENT and PART-YEAR RESIDENT

2005

Calendar Year

OR

MF051

There are features on this form that are only supported by Adobe 6.0 or higher. You must use Adobe 6.0 or higher with this form.

Enter tax year dates in MMDDYY format. Do not enter slash (/) e.g. 123106.

Tax Year

thru

FOR OFFICE USE ONLY

PNT

INT

!! !! !!

Please Print In Black Ink, Enter One Letter Or Number In Each Box.

Fill In Ovals Completely. Do NOT Submit a Photocopy!!

=

=

➤ Fill in the applicable oval(s):

•

•

•

Part-Year Resident

Nonresident

Nonresident or Dual-Status Alien

}

Your First name

M.I.

Your Last Name

IMPORTANT — Complete this Section

Enter the first four letters

Spouse's First name

M.I.

Spouse’s Last name

of your last name.

Use ALL CAPITAL letters

Care Of (See Instructions, page 7.)

Your Social

Security Number

Enter the first four letters

Present mailing or home address (Number and street, including Rural Route)

of your Spouse's last name.

Use ALL CAPITAL letters

City, town or post office.

State

ZIP code

Spouse's Social

Security Number

If Foreign address, enter Province and/or State

Country

Fill In applicable oval, if appropriate

First Time Filer

Address or Name Change

2005

ATTACH A COPY OF YOUR

FEDERAL INCOME TAX RETURN

(Fill in only ONE oval)

=

1

Single

4

Head of household (with qualifying person). If the qualifying

=

2

Married filing joint return (even if only one had income).

person is a child but not your dependent, enter the child’s full

=

Married filing separate return. Enter spouse’s SSN and the

3

name.

ä __________________________________

first four letters of last name above. Enter spouse's full name

=

—

5

Qualifying widow(er) with dependent child. Enter the year

here.

_________________________________________

—

your spouse died

.

CAUTION: If you can be claimed as a dependent on another person’s tax return (such as your parents’), DO NOT fill in oval 6a, but be sure to fill in the oval below line 37.

=

=

}

6a

Yourself............................................

Age 65 or over ................................................................

!

=

=

Enter the number of ovals

6b

Spouse.............................................

Age 65 or over ................................................................

filled on 6a and 6b...........

=

If you filled ovals 3 and 6b above, see the Instructions on page 9 and if your spouse meets the qualifications, fill in this oval

6c

Dependents:

If more than 6 dependents

2. Dependent’s social

1. First and last name

use attachment

security number

3. Relationship

and

➧

!!

Enter number of

6d

your children listed ... 6c

!!

➧

Enter number of

other dependents ...... 6d

!!

➧

6e

]

6e Total number of exemptions claimed. Add numbers entered in boxes 6a thru 6d above. ...............................................................

ID No 01

FORM N-15

1

1 2

2 3

3 4

4