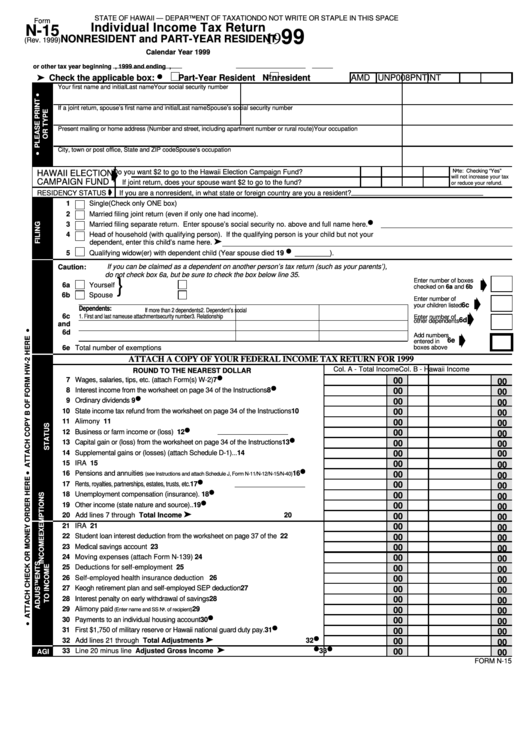

Form N-15 - Individual Income Tax Return Nonresident And Part-Year Resident - 1999

ADVERTISEMENT

STATE OF HAWAII — DEPARTMENT OF TAXATION

DO NOT WRITE OR STAPLE IN THIS SPACE

Form

Individual Income Tax Return

N-15

99

19

NONRESIDENT and PART-YEAR RESIDENT

(Rev. 1999)

Calendar Year 1999

or other tax year beginning

, 1999 and ending

,

•

Check the applicable box:

AMD UNP

008

PNT

INT

Part-Year Resident

Nonresident

Your first name and initial

Last name

Your social security number

If a joint return, spouse’s first name and initial

Last name

Spouse’s social security number

Present mailing or home address (Number and street, including apartment number or rural route)

Your occupation

City, town or post office, State and ZIP code

Spouse’s occupation

Note: Checking “Yes”

HAWAII ELECTION

Do you want $2 to go to the Hawaii Election Campaign Fund? .................

Yes

No

will not increase your tax

CAMPAIGN FUND

If joint return, does your spouse want $2 to go to the fund? ......................

Yes

No

or reduce your refund.

If you are a nonresident, in what state or foreign country are you a resident? __________________________________

RESIDENCY STATUS

1

Single

(Check only ONE box)

2

Married filing joint return (even if only one had income).

•

3

Married filing separate return. Enter spouse’s social security no. above and full name here.

4

Head of household (with qualifying person). If the qualifying person is your child but not your

dependent, enter this child’s name here.

•

5

Qualifying widow(er) with dependent child (Year spouse died 19

_________).

If you can be claimed as a dependent on another person’s tax return (such as your parents’),

Caution:

do not check box 6a, but be sure to check the box below line 35.

}

Enter number of boxes

6a

Yourself ...............................

Age 65 or over ..................................................................................

checked on 6a and 6b

6b

Spouse ................................

Age 65 or over ..................................................................................

Enter number of

6c

your children listed

Dependents:

If more than 2 dependents

2. Dependent’s social

6c

1. First and last name

use attachment

security number

3. Relationship

Enter number of

6d

other dependents

and

6d

Add numbers

6e

entered in

6e Total number of exemptions claimed

.........................................................................................................

boxes above

ATTACH A COPY OF YOUR FEDERAL INCOME TAX RETURN FOR 1999

Col. A - Total Income

Col. B - Hawaii Income

ROUND TO THE NEAREST DOLLAR

•

7 Wages, salaries, tips, etc. (attach Form(s) W-2)........................................................

00

7

00

•

8 Interest income from the worksheet on page 34 of the Instructions............................

8

00

00

•

9 Ordinary dividends ..................................................................................................

00

9

00

10 State income tax refund from the worksheet on page 34 of the Instructions ...............

10

00

00

11 Alimony received.....................................................................................................

00

11

00

•

12 Business or farm income or (loss) G.E. I.D. No.

.................

12

00

00

•

13 Capital gain or (loss) from the worksheet on page 34 of the Instructions....................

00

13

00

14 Supplemental gains or (losses) (attach Schedule D-1)..............................................

14

00

00

15 IRA distributions ......................................................................................................

00

15

00

•

16 Pensions and annuities

..............

16

00

(see Instructions and attach Schedule J, Form N-11/N-12/N-15/N-40)

00

•

17 Rents, royalties, partnerships, estates, trusts, etc. G.E. I.D. No.

........

00

17

00

•

18 Unemployment compensation (insurance). ..............................................................

18

00

00

•

19 Other income (state nature and source) ..................................................................

00

19

00

20 Add lines 7 through 19............................................................... Total Income

20

00

00

21 IRA deduction .........................................................................................................

00

21

00

22 Student loan interest deduction from the worksheet on page 37 of the Instructions ....

22

00

00

23 Medical savings account deduction..........................................................................

00

23

00

24 Moving expenses (attach Form N-139) ....................................................................

24

00

00

25 Deductions for self-employment tax .........................................................................

00

25

00

26 Self-employed health insurance deduction ..............................................................

26

00

00

27 Keogh retirement plan and self-employed SEP deduction.........................................

00

27

00

28 Interest penalty on early withdrawal of savings .........................................................

28

00

00

29 Alimony paid

..................................................................

00

29

(Enter name and SS No. of recipient)

00

•

30 Payments to an individual housing account ..............................................................

30

00

00

•

31 First $1,750 of military reserve or Hawaii national guard duty pay..............................

00

31

00

•

32 Add lines 21 through 31.................................................... Total Adjustments

32

00

00

•

•

33 Line 20 minus line 32.............................................. Adjusted Gross Income

00

33

AGI

00

FORM N-15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2