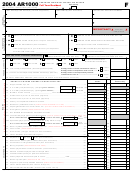

Form Ar1000s - Arkansas Individual Income Tax Return - 2015 Page 2

ADVERTISEMENT

S2

Part 1

INTEREST INCOME

Part 2

DIVIDEND INCOME

Interest on bank deposits, notes, mortgages from indi-

Dividends and other distributions on stock are fully

viduals, corporation bonds, savings and loan deposits,

taxable. There is no dividend exclusion applicable to

and credit union deposits are taxable. Interest on obliga-

Arkansas.

tions of other states and subdivisions is fully taxable.

List below the names of the dividend sources and des-

List below the names of the interest sources and desig-

ignate ownership by writing Y (Yours), S (Spouse’s) or

nate ownership by writing Y (Yours), S (Spouse’s) or J

J (Joint).

(Joint).

Y S J

Y S J

NAME OF PAYER

AMOUNT

NAME OF PAYER

AMOUNT

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

Total Interest Income: Enter here and on Line 9 .....

Total Dividend Income: Enter here and on Line 9 ....

If you owe an amount due from Line 29, AR1000S, you have the option

of paying by credit card.

or call (800) 272-9829

Page ARS2 (R 6/13/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2