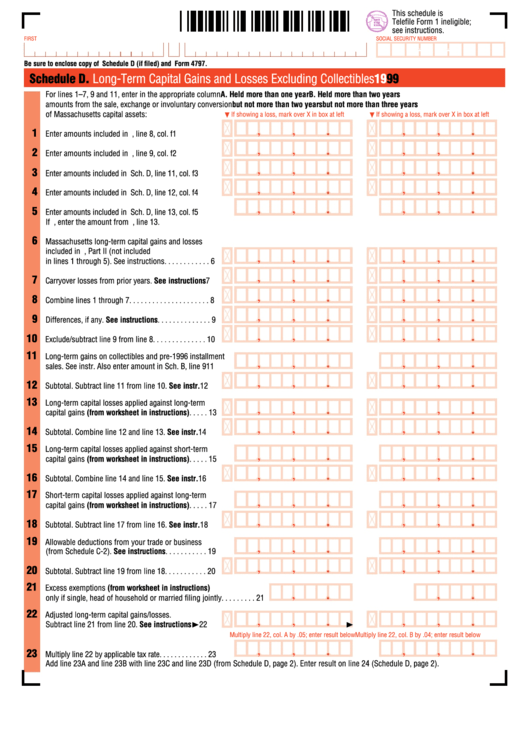

Schedule D - . Long-Term Capital Gains And Losses Excluding Collectibles - 1999

ADVERTISEMENT

q

This schedule is

q

Telefile Form 1 ineligible;

see instructions.

FIRST NAME

M.I.

LAST NAME

SOCIAL SECURITY NUMBER

–

–

Be sure to enclose copy of U.S. Schedule D (if filed) and U.S. Form 4797.

Schedule D.

Long-Term Capital Gains and Losses Excluding Collectibles

1999

For lines 1–7, 9 and 11, enter in the appropriate column

A. Held more than one year

B. Held more than two years

amounts from the sale, exchange or involuntary conversion

but not more than two years

but not more than three years

of Massachusetts capital assets:

If showing a loss, mark over X in box at left

If showing a loss, mark over X in box at left

,

,

,

,

1

Enter amounts included in U.S. Sch. D, line 8, col. f 1

,

,

,

,

2

Enter amounts included in U.S. Sch. D, line 9, col. f 2

,

,

,

,

3

Enter amounts included in U.S. Sch. D, line 11, col. f 3

,

,

,

,

4

Enter amounts included in U.S. Sch. D, line 12, col. f 4

,

,

,

,

5

Enter amounts included in U.S. Sch. D, line 13, col. f 5

If U.S. Schedule D not filed, enter the amount from U.S. Form 1040, line 13.

6

Massachusetts long-term capital gains and losses

included in U.S. Form 4797, Part II (not included

,

,

,

,

in lines 1 through 5). See instructions . . . . . . . . . . . . 6

,

,

,

,

7

Carryover losses from prior years. See instructions 7

,

,

,

,

8

Combine lines 1 through 7 . . . . . . . . . . . . . . . . . . . . . 8

,

,

,

,

9

Differences, if any. See instructions. . . . . . . . . . . . . . 9

,

,

,

,

10

Exclude/subtract line 9 from line 8. . . . . . . . . . . . . . 10

11

Long-term gains on collectibles and pre-1996 installment

,

,

,

,

sales. See instr. Also enter amount in Sch. B, line 9 11

,

,

,

,

12

Subtotal. Subtract line 11 from line 10. See instr.

12

13

Long-term capital losses applied against long-term

,

,

,

,

capital gains (from worksheet in instructions). . . . . 13

,

,

,

,

14

Subtotal. Combine line 12 and line 13. See instr.

14

15

Long-term capital losses applied against short-term

,

,

,

,

capital gains (from worksheet in instructions). . . . . 15

,

,

,

,

16

Subtotal. Combine line 14 and line 15. See instr.

16

17

Short-term capital losses applied against long-term

,

,

,

,

capital gains (from worksheet in instructions). . . . . 17

,

,

,

,

18

Subtotal. Subtract line 17 from line 16. See instr.

18

19

Allowable deductions from your trade or business

,

,

,

,

(from Schedule C-2). See instructions. . . . . . . . . . . 19

,

,

,

,

20

Subtotal. Subtract line 19 from line 18 . . . . . . . . . . . 20

21

Excess exemptions (from worksheet in instructions)

,

,

only if single, head of household or married filing jointly . . . . . . . . . 21

22

Adjusted long-term capital gains/losses.

,

,

,

,

¨22

¨

Subtract line 21 from line 20. See instructions

Multiply line 22, col. A by .05; enter result below

Multiply line 22, col. B by .04; enter result below

,

,

,

,

23

Multiply line 22 by applicable tax rate. . . . . . . . . . . . . 23

Add line 23A and line 23B with line 23C and line 23D (from Schedule D, page 2). Enter result on line 24 (Schedule D, page 2).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2