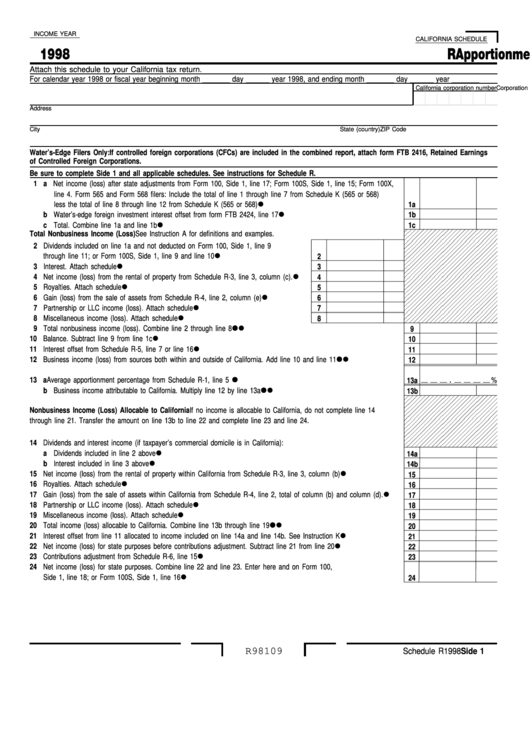

INCOME YEAR

CALIFORNIA SCHEDULE

1998

Apportionment and Allocation of Income

R

Attach this schedule to your California tax return.

For calendar year 1998 or fiscal year beginning month _______ day ______ year 1998, and ending month _______ day ______ year _______

Corporation name

California corporation number

Address

City

State (country)

ZIP Code

Water’s-Edge Filers Only: If controlled foreign corporations (CFCs) are included in the combined report, attach form FTB 2416, Retained Earnings

of Controlled Foreign Corporations.

Be sure to complete Side 1 and all applicable schedules. See instructions for Schedule R.

1 a Net income (loss) after state adjustments from Form 100, Side 1, line 17; Form 100S, Side 1, line 15; Form 100X,

line 4. Form 565 and Form 568 filers: Include the total of line 1 through line 7 from Schedule K (565 or 568)

•

less the total of line 8 through line 12 from Schedule K (565 or 568) . . . . . . . . . . . . . . . . . . . . . . . .

1a

•

b Water’s-edge foreign investment interest offset from form FTB 2424, line 17 . . . . . . . . . . . . . . . . . . . . .

1b

•

c Total. Combine line 1a and line 1b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1c

Total Nonbusiness Income (Loss) See Instruction A for definitions and examples.

2 Dividends included on line 1a and not deducted on Form 100, Side 1, line 9

•

through line 11; or Form 100S, Side 1, line 9 and line 10 . . . . . . . . . . . . . . .

2

•

3 Interest. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

•

4 Net income (loss) from the rental of property from Schedule R-3, line 3, column (c) .

4

•

5 Royalties. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

•

6 Gain (loss) from the sale of assets from Schedule R-4, line 2, column (e) . . . . . .

6

•

7 Partnership or LLC income (loss). Attach schedule . . . . . . . . . . . . . . . . . . .

7

•

8 Miscellaneous income (loss). Attach schedule . . . . . . . . . . . . . . . . . . . . . .

8

••

9 Total nonbusiness income (loss). Combine line 2 through line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

•

10 Balance. Subtract line 9 from line 1c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

•

11 Interest offset from Schedule R-5, line 7 or line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

••

12 Business income (loss) from sources both within and outside of California. Add line 10 and line 11 . . . . . . . . .

12

•

.

%

13 a Average apportionment percentage from Schedule R-1, line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13a

••

b Business income attributable to California. Multiply line 12 by line 13a . . . . . . . . . . . . . . . . . . . . . . .

13b

Nonbusiness Income (Loss) Allocable to California If no income is allocable to California, do not complete line 14

through line 21. Transfer the amount on line 13b to line 22 and complete line 23 and line 24.

14 Dividends and interest income (if taxpayer’s commercial domicile is in California):

•

a Dividends included in line 2 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14a

•

b Interest included in line 3 above. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14b

•

15 Net income (loss) from the rental of property within California from Schedule R-3, line 3, column (b) . . . . . . . . .

15

•

16 Royalties. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

•

17 Gain (loss) from the sale of assets within California from Schedule R-4, line 2, total of column (b) and column (d) .

17

•

18 Partnership or LLC income (loss). Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

•

19 Miscellaneous income (loss). Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

••

20 Total income (loss) allocable to California. Combine line 13b through line 19 . . . . . . . . . . . . . . . . . . . . . .

20

•

21 Interest offset from line 11 allocated to income included on line 14a and line 14b. See Instruction K . . . . . . . . .

21

•

22 Net income (loss) for state purposes before contributions adjustment. Subtract line 21 from line 20 . . . . . . . . . .

22

•

23 Contributions adjustment from Schedule R-6, line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

24 Net income (loss) for state purposes. Combine line 22 and line 23. Enter here and on Form 100,

•

Side 1, line 18; or Form 100S, Side 1, line 16. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

R98109

Schedule R 1998 Side 1

1

1 2

2 3

3 4

4