Form Dp-6 - Application For Education Property Tax Hardship Relief

ADVERTISEMENT

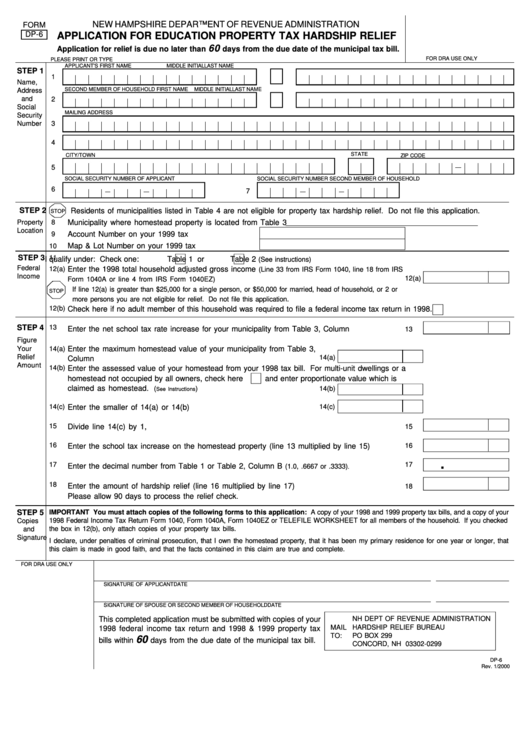

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

DP-6

APPLICATION FOR EDUCATION PROPERTY TAX HARDSHIP RELIEF

60

Application for relief is due no later than

days from the due date of the municipal tax bill.

FOR DRA USE ONLY

PLEASE PRINT OR TYPE

APPLICANT'S FIRST NAME

MIDDLE INITIAL

LAST NAME

STEP 1

1

Name,

SECOND MEMBER OF HOUSEHOLD FIRST NAME

MIDDLE INITIAL

LAST NAME

Address

and

2

Social

MAILING ADDRESS

Security

Number

3

4

STATE

CITY/TOWN

ZIP CODE

5

SOCIAL SECURITY NUMBER OF APPLICANT

SOCIAL SECURITY NUMBER SECOND MEMBER OF HOUSEHOLD

6

7

STEP 2

Residents of municipalities listed in Table 4 are not eligible for property tax hardship relief. Do not file this application.

STOP

8

Municipality where homestead property is located from Table 3

Property

Location

Account Number on your 1999 tax bill...........................

9

Map & Lot Number on your 1999 tax bill.......................

10

STEP 3

11

I qualify under: Check one:

Table 1 or

Table 2

(See instructions)

Federal

12(a)

Enter the 1998 total household adjusted gross income

(Line 33 from IRS Form 1040, line 18 from IRS

Income

12(a)

Form 1040A or line 4 from IRS Form 1040EZ)...................................................................................................

If line 12(a) is greater than $25,000 for a single person, or $50,000 for married, head of household, or 2 or

STOP

more persons you are not eligible for relief. Do not file this application.

12(b)

Check here if no adult member of this household was required to file a federal income tax return in 1998.

STEP 4

13

Enter the net school tax rate increase for your municipality from Table 3, Column B......................

13

Figure

Your

14(a)

Enter the maximum homestead value of your municipality from Table 3,

Relief

14(a)

Column C..................................................................................................

Amount

14(b)

Enter the assessed value of your homestead from your 1998 tax bill. For multi-unit dwellings or a

homestead not occupied by all owners, check here

and enter proportionate value which is

claimed as homestead.

........................................................

(

)

14(b)

See Instructions

14(c)

Enter the smaller of 14(a) or 14(b)............................................................

14(c)

15

Divide line 14(c) by 1,000.................................................................................................................

15

16

16

Enter the school tax increase on the homestead property (line 13 multiplied by line 15)................

.

17

17

Enter the decimal number from Table 1 or Table 2, Column B

..........................

(1.0, .6667 or .3333)

.

18

Enter the amount of hardship relief (line 16 multiplied by line 17)....................................................

18

Please allow 90 days to process the relief check.

STEP 5

IMPORTANT You must attach copies of the following forms to this application: A copy of your 1998 and 1999 property tax bills, and a copy of your

1998 Federal Income Tax Return Form 1040, Form 1040A, Form 1040EZ or TELEFILE WORKSHEET for all members of the household. If you checked

Copies

the box in 12(b), only attach copies of your property tax bills.

and

Signature

I declare, under penalties of criminal prosecution, that I own the homestead property, that it has been my primary residence for one year or longer, that

this claim is made in good faith, and that the facts contained in this claim are true and complete.

FOR DRA USE ONLY

SIGNATURE OF APPLICANT

DATE

SIGNATURE OF SPOUSE OR SECOND MEMBER OF HOUSEHOLD

DATE

NH DEPT OF REVENUE ADMINISTRATION

This completed application must be submitted with copies of your

MAIL

HARDSHIP RELIEF BUREAU

1998 federal income tax return and 1998 & 1999 property tax

PO BOX 299

TO:

60

bills within

days from the due date of the municipal tax bill.

CONCORD, NH 03302-0299

DP-6

Rev. 1/2000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1