Instructions For Form Dp-6 - Application For Education Property Tax Hardship Relief

ADVERTISEMENT

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

DP-6

APPLICATION FOR EDUCATION PROPERTY TAX HARDSHIP RELIEF

Instructions

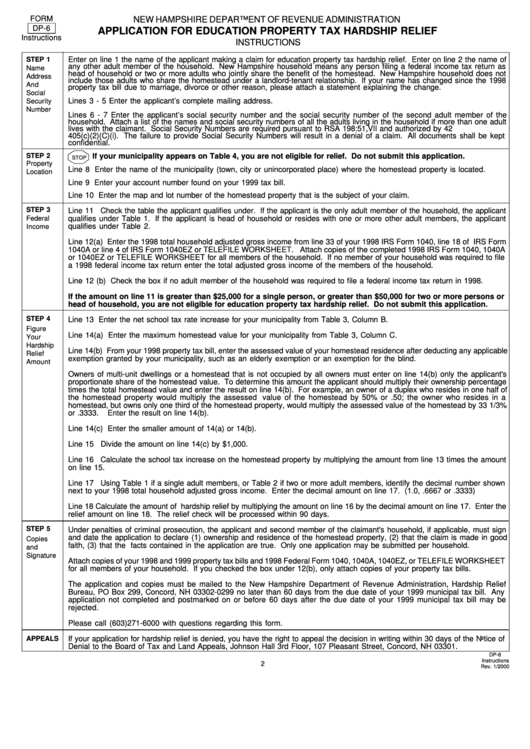

INSTRUCTIONS

STEP 1

Enter on line 1 the name of the applicant making a claim for education property tax hardship relief. Enter on line 2 the name of

any other adult member of the household. New Hampshire household means any person filing a federal income tax return as

Name

head of household or two or more adults who jointly share the benefit of the homestead. New Hampshire household does not

Address

include those adults who share the homestead under a landlord-tenant relationship. If your name has changed since the 1998

And

property tax bill due to marriage, divorce or other reason, please attach a statement explaining the change.

Social

Lines 3 - 5 Enter the applicant’s complete mailing address.

Security

Number

Lines 6 - 7 Enter the applicant’s social security number and the social security number of the second adult member of the

household. Attach a list of the names and social security numbers of all the adults living in the household if more than one adult

lives with the claimant. Social Security Numbers are required pursuant to RSA 198:51,VII and authorized by 42 U.S.C. Section

405(c)(2)(C)(i). The failure to provide Social Security Numbers will result in a denial of a claim. All documents shall be kept

confidential.

STEP 2

If your municipality appears on Table 4, you are not eligible for relief. Do not submit this application.

STOP

Property

Line 8 Enter the name of the municipality (town, city or unincorporated place) where the homestead property is located.

Location

Line 9 Enter your account number found on your 1999 tax bill.

Line 10 Enter the map and lot number of the homestead property that is the subject of your claim.

STEP 3

Line 11 Check the table the applicant qualifies under. If the applicant is the only adult member of the household, the applicant

Federal

qualifies under Table 1. If the applicant is head of household or resides with one or more other adult members, the applicant

qualifies under Table 2.

Income

Line 12(a) Enter the 1998 total household adjusted gross income from line 33 of your 1998 IRS Form 1040, line 18 of IRS Form

1040A or line 4 of IRS Form 1040EZ or TELEFILE WORKSHEET. Attach copies of the completed 1998 IRS Form 1040, 1040A

or 1040EZ or TELEFILE WORKSHEET for all members of the household. If no member of your household was required to file

a 1998 federal income tax return enter the total adjusted gross income of the members of the household.

Line 12 (b) Check the box if no adult member of the household was required to file a federal income tax return in 1998.

If the amount on line 11 is greater than $25,000 for a single person, or greater than $50,000 for two or more persons or

head of household, you are not eligible for education property tax hardship relief. Do not submit this application.

STEP 4

Line 13 Enter the net school tax rate increase for your municipality from Table 3, Column B.

Figure

Line 14(a) Enter the maximum homestead value for your municipality from Table 3, Column C.

Your

Hardship

Line 14(b) From your 1998 property tax bill, enter the assessed value of your homestead residence after deducting any applicable

Relief

exemption granted by your municipality, such as an elderly exemption or an exemption for the blind.

Amount

Owners of multi-unit dwellings or a homestead that is not occupied by all owners must enter on line 14(b) only the applicant's

proportionate share of the homestead value. To determine this amount the applicant should multiply their ownership percentage

times the total homestead value and enter the result on line 14(b). For example, an owner of a duplex who resides in one half of

the homestead property would multiply the assessed value of the homestead by 50% or .50; the owner who resides in a

homestead, but owns only one third of the homestead property, would multiply the assessed value of the homestead by 33 1/3%

or .3333.

Enter the result on line 14(b).

Line 14(c) Enter the smaller amount of 14(a) or 14(b).

Line 15 Divide the amount on line 14(c) by $1,000.

Line 16 Calculate the school tax increase on the homestead property by multiplying the amount from line 13 times the amount

on line 15.

Line 17 Using Table 1 if a single adult members, or Table 2 if two or more adult members, identify the decimal number shown

next to your 1998 total household adjusted gross income. Enter the decimal amount on line 17. (1.0, .6667 or .3333)

Line 18 Calculate the amount of hardship relief by multiplying the amount on line 16 by the decimal amount on line 17. Enter the

relief amount on line 18. The relief check will be processed within 90 days.

STEP 5

Under penalties of criminal prosecution, the applicant and second member of the claimant's household, if applicable, must sign

and date the application to declare (1) ownership and residence of the homestead property, (2) that the claim is made in good

Copies

faith, (3) that the facts contained in the application are true. Only one application may be submitted per household.

and

Signature

Attach copies of your 1998 and 1999 property tax bills and 1998 Federal Form 1040, 1040A, 1040EZ, or TELEFILE WORKSHEET

for all members of your household. If you checked the box under 12(b), only attach copies of your property tax bills.

The application and copies must be mailed to the New Hampshire Department of Revenue Administration, Hardship Relief

Bureau, PO Box 299, Concord, NH 03302-0299 no later than 60 days from the due date of your 1999 municipal tax bill. Any

application not completed and postmarked on or before 60 days after the due date of your 1999 municipal tax bill may be

rejected.

Please call (603)271-6000 with questions regarding this form.

APPEALS

If your application for hardship relief is denied, you have the right to appeal the decision in writing within 30 days of the Notice of

Denial to the Board of Tax and Land Appeals, Johnson Hall 3rd Floor, 107 Pleasant Street, Concord, NH 03301.

DP-6

Instructions

2

Rev. 1/2000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3