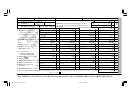

Colorado Sales Tax Returns Form - 2000 Page 3

ADVERTISEMENT

SPECIFIC INSTRUCTIONS FOR SALES TAX RETURN

LINE 1: Enter the total amount of money received from all sales and services, including

vehicle emission standard. Some cities and counties do not allow this exemption.

LINE 3C: If an overpayment of tax was made on a previous return, enter the amount

taxable and nontaxable sales and collections of bad debts previously deducted. Do not

include the amount of sales tax collected.

of gross sales on which that tax was based. Overpayment taken here must not result in

LINE 2A: Enter the amount of sales to other licensed dealers. Keep documentation for

a negative amount. Tax credit can only be used against the same type of tax.

verification of these sales.

LINE 4: Enter net taxable sales. Subtract the total lines 3A, 3B, and 3C from line 3 in

LINE 2B: Enter the amount of any other deductions. These deductions should be

each column. The net taxable sales amount must be entered in each column.

itemized on the back of the return. Keep a copy of itemized deductions for your records.

LINE 5: Enter amount of tax for each type of sales tax collected. Multiply the amount

LINE 3: The net sales amount must be entered in each column.

of line 4 by the applicable tax rates which are printed below line 4.

LINE 6: Enter the amount of excess tax collected. Do not include any amounts already

LINE 3A: Enter the amount of sales delivered out of your taxing area.

LINE 3B: Enter the total amount of state exemptions and any applicable local

included in line 3c.

exemptions. Exemptions must be itemized on the back of sales tax return.

LINE 7: Add lines 5 and 6.

Food covers food advertised or marketed for human consumption and sold in the same

LINE 8A: Service fee rate. If this rate is not shown, see Colorado Sales/Use Tax Rates

form, condition, quantities, and packaging as is commonly sold by grocers and food

(DRP 1002) to determine appropriate rate.

sold through vending machines. Some cities and counties do not allow this exemption.

LINE 8B: Enter deduction for service (vendor's) fee allowed to the seller for each

applicable tax. Multiply line 7 by the applicable service fee rate shown in each column.

Machinery exemption is for machinery and machine tools sales where the buyer

This deduction is only allowed if the complete return is filed and the tax is paid on or

provides the seller with a completed Machinery and Machine Tools Exemption form

(DR 1191). Machinery is exempt from State sales tax but not from RTD tax.

before due date.

Sales of "Electricity," coal, gas, fuel oil, coke, and wood sold for home use are exempt

LINE 10: Goods purchased tax free for resale but taken out of stock for personal or

from State and RTD tax.

business use must be reported and tax paid on the items. Enter cost of goods next to the

Farm Equipment exemption is for farm tractors, implements of husbandry, and

$ sign. Then multiply that amount by the tax rate for each separate tax that applies (e.g.

irrigation equipment that have a per unit purchase price of at least $1,000. Some cities

county, city, RTD) and enter that amount in the appropriate column. Other tax free

purchases of any kind which will not be resold should be reported and taxed on Use

and counties do not allow this exemption.

Pesticide exemption is for all sales of pesticides that are registered by the Commissioner

Tax Return (DR 252).

of Agriculture for use in the production of agricultural and livestock products and sold

LINE 12: Penalty. Failure to file the return and pay the tax on time subjects the vendor

by dealers licensed to sell the pesticides. Some cities and counties do not allow this

to a penalty of 10% of the tax due.

exemption.

LINE 13: Interest and penalty interest. Failure to file the return and pay the tax on time

Clean Fuel Vehicles. The sale of any motor vehicle, power source for a motor vehicle,

subjects the vendor to interest at the prime rate effective on July 1 of the previous year

or parts used for converting the power source for a motor vehicle if the gross vehicle

and to penalty interest at the same amount. Monthly interest rate may be prorated for

a part of a month. Current interest rates are available on Department of Revenue

weight rating of the motor vehicle is greater than 10,000 pounds and the motor vehicle

power source, or parts used for converting the power source are certified by the Federal

website.

Environmental Protection Agency or any state provided in the "Federal Clean Air Act"

LINE 15: Add the total of ALL taxes shown in each column of line 14. Amount shown

as meeting an emission standard equal to or more stringent than the low-emitting

in line 15 must equal amount remitted. If paying by EFT, be sure to mark the box.

'99 retail sales coupon bk

5

2/8/00, 7:54 AM

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5