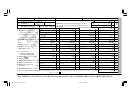

Colorado Sales Tax Returns Form - 2000 Page 5

ADVERTISEMENT

The business is a small grocery store that is located in Morrison Colorado.

(Line 3). The net taxable sales for the State and RTD/CD/BD are $3,089. That

number is Net (Line 3) minus the exemption for food (Line 3b).

The sales tax rate to be collected at this location is 7.3%. State sales tax rate

is 3%, RTD/CD/BD is 0.8%, Jefferson County is 0.5%, and the City of

Line 5: The amount of sales tax for this company is $45 for County tax, $267

Morrison is 3%.

for City $25 for RTD/CD/BD, and $93 for State tax. The Net Taxable Sales (Line

4) is multiplied by the applicable rate in each column.

Line 1: The store had total gross sales and services receipts of $9,247.26 for

the quarter of January 1, 1999 through March 31, 1999. (Not including sales

Line 6: The store did not collect any excess tax for this period.

tax collected.)

Line 7: Lines 5 and 6 are added together to arrive at the total.

Line 2a: During this quarter, the store had no sales to other licensed dealers

Line 8a: The Service fee, also known as the Vendor's fee, is a fee retained by

for resale.

a business for collecting the tax and is taken when the return is filed on time

Line 2b: The store made a sale of $131 to a governmental agency. This amount

with the Department of Revenue. In this example the City of Morrison,

was calculated and recorded on the back of the return under itemizations.

Jefferson County, RTD/CD/BD, and the State Service fees are all 3 1/3%. That

rate is multiplied by the total on Line 7.

Line 2c: This is the total of sales to other licensed dealers for resale and other

deductions. The store's total deductions for this period was $131 (Line 2a plus

Line 8b: The amount of the Service fee to be retained is $2 for county, $9 for

Line 2b).

city, $1 for RTD/CD/BD, and $3 for State.

Line 3: The store had $9,116 in Net Sales. This was derived from subtracting

Line 9: The sales tax due is arrived at by subtracting the Service Fee (line 8b)

from the Total (Line 7).

Line 2c from Line 1 ($9,247 minus $131). The Net Sales Total amount is written

in all columns - county, city, special district and state.

Line 10: The store took $300 worth of merchandise that was purchased tax

Line 3a: This store had $210 of merchandise that was delivered to a customer

free from their inventory to use in the store. (Cleaning supplies, toilet paper and

paper towels for public restrooms.) State tax must be paid on this amount. Also,

in unincorporated Adams County. The city of Morrison tax and the Jefferson

if local sales tax would have applied to the original purchase, then the $300

County tax were not collected, only the state and RTD/CD/BD taxes.

must be multiplied by the local sales tax rate and entered on Line 10.

Line 3b: Since this company is a grocery store, they must exempt food for home

Line 11: The calculated tax on the $300 is added to the Sales tax due in Line

consumption for State and RTD/CD/BD taxes. However, the City of Morrison

9 to arrive at the Total Tax Due.

and Jefferson County do not allow this exemption. On the back of the sales tax

return, all of the exemptions are listed. Local jurisdictions have the option to

Line 12 & 13: This return is being filed before the April due date so there is no

exempt or not exempt these items. Exemptions must be itemized on the back

penalty or interest due.

of the return and the total placed on Line 3b.

Line 14: Because this return is on time, the Total Tax Due amount in Line 11

is entered in all columns on this line.

Line 3c: The store has not overpaid on any previous return, therefore, this

amount is zero.

Line 15: This company must remit $437 to the Department of Revenue. This

Line 4: Net taxable sales are $8,906 for County and city tax. This amount is

amount is the total of County tax, City tax, RTD/CD/BD tax and State tax

obtained by subtracting sales out of taxing area (Line 3a) from the Net sales

(all columns on Line 14).

'99 retail sales coupon bk

10

2/8/00, 7:54 AM

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5