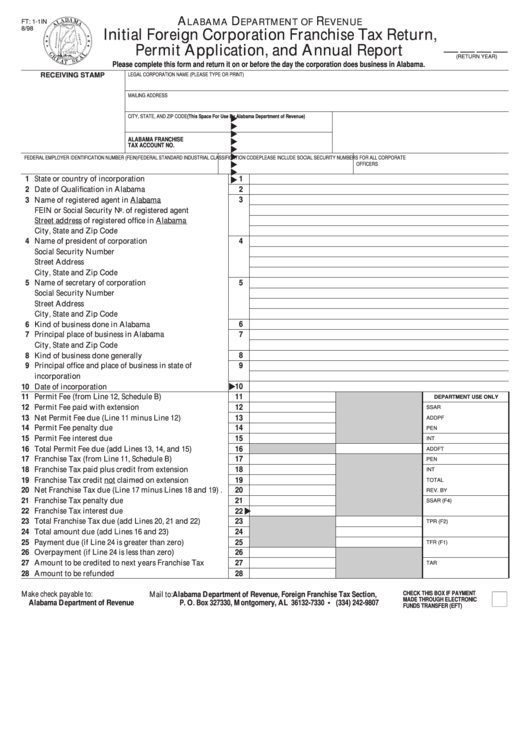

A

D

R

LABAMA

EPARTMENT OF

EVENUE

FT: 1-1IN

8/98

Initial Foreign Corporation Franchise Tax Return,

___ ___ ___ ___

Permit Application, and Annual Report

(RETURN YEAR)

Please complete this form and return it on or before the day the corporation does business in Alabama.

RECEIVING STAMP

LEGAL CORPORATION NAME (PLEASE TYPE OR PRINT)

MAILING ADDRESS

CITY, STATE, AND ZIP CODE

(This Space For Use By Alabama Department of Revenue)

ALABAMA FRANCHISE

TAX ACCOUNT NO.

FEDERAL EMPLOYER IDENTIFICATION NUMBER (FEIN)

FEDERAL STANDARD INDUSTRIAL CLASSIFICATION CODE

PLEASE INCLUDE SOCIAL SECURITY NUMBERS FOR ALL CORPORATE

OFFICERS

1 State or country of incorporation . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Date of Qualification in Alabama. . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Name of registered agent in Alabama. . . . . . . . . . . . . . . . . . . .

3

FEIN or Social Security No. of registered agent . . . . . . . . . .

Street address of registered office in Alabama . . . . . . . . . . .

City, State and Zip Code. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 Name of president of corporation . . . . . . . . . . . . . . . . . . . . . . . .

4

Social Security Number. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Street Address . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

City, State and Zip Code. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Name of secretary of corporation. . . . . . . . . . . . . . . . . . . . . . . . .

5

Social Security Number. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Street Address . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

City, State and Zip Code. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Kind of business done in Alabama . . . . . . . . . . . . . . . . . . . . . . .

6

7 Principal place of business in Alabama. . . . . . . . . . . . . . . . . . .

7

City, State and Zip Code. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 Kind of business done generally. . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Principal office and place of business in state of

9

incorporation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10 Date of incorporation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11 Permit Fee (from Line 12, Schedule B). . . . . . . . . . . . . . . . . . . .

11

DEPARTMENT USE ONLY

12 Permit Fee paid with extension. . . . . . . . . . . . . . . . . . . . . . . . . . .

12

SSAR

13 Net Permit Fee due (Line 11 minus Line 12) . . . . . . . . . . . . .

13

ADDPF

14 Permit Fee penalty due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

PEN

15 Permit Fee interest due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

INT

16 Total Permit Fee due (add Lines 13, 14, and 15) . . . . . . . . . .

16

ADDFT

17 Franchise Tax (from Line 11, Schedule B) . . . . . . . . . . . . . . . .

17

PEN

18 Franchise Tax paid plus credit from extension . . . . . . . . . . .

18

INT

19 Franchise Tax credit not claimed on extension . . . . . . . . . . .

19

TOTAL

20 Net Franchise Tax due (Line 17 minus Lines 18 and 19) .

20

REV. BY

21 Franchise Tax penalty due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

SSAR (F4)

22 Franchise Tax interest due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

23 Total Franchise Tax due (add Lines 20, 21 and 22) . . . . . . .

23

TPR (F2)

24 Total amount due (add Lines 16 and 23) . . . . . . . . . . . . . . . . .

24

25 Payment due (if Line 24 is greater than zero) . . . . . . . . . . . .

25

TFR (F1)

26 Overpayment (if Line 24 is less than zero) . . . . . . . . . . . . . . .

26

27 Amount to be credited to next years Franchise Tax . . . . . .

27

TAR

28 Amount to be refunded. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

Make check payable to:

Mail to: Alabama Department of Revenue, Foreign Franchise Tax Section,

CHECK THIS BOX IF PAYMENT

MADE THROUGH ELECTRONIC

Alabama Department of Revenue

P. O. Box 327330, Montgomery, AL 36132-7330 • (334) 242-9807

FUNDS TRANSFER (EFT)

1

1 2

2