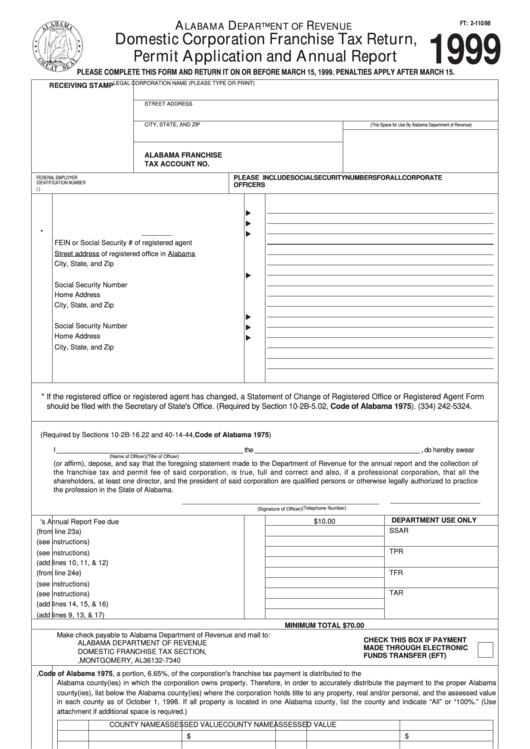

Domestic Corporation Franchise Tax Return, Permit Application And Annual Report - Alabama Department Of Revenue - 1999

ADVERTISEMENT

A

D

R

FT: 2-1

10/98

LABAMA

EPARTMENT OF

EVENUE

Domestic Corporation Franchise Tax Return,

1999

Permit Application and Annual Report

PLEASE COMPLETE THIS FORM AND RETURN IT ON OR BEFORE MARCH 15, 1999. PENALTIES APPLY AFTER MARCH 15.

LEGAL CORPORATION NAME (PLEASE TYPE OR PRINT)

RECEIVING STAMP

STREET ADDRESS

CITY, STATE, AND ZIP

(This Space for Use By Alabama Department of Revenue)

ALABAMA FRANCHISE

TAX ACCOUNT NO.

FEDERAL EMPLOYER

PLEASE INCLUDE SOCIAL SECURITY NUMBERS FOR ALL CORPORATE

IDENTIFICATION NUMBER

OFFICERS

(F.E.I.N.)

1.

County of incorporation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

2.

Date of incorporation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3.

Name of registered agent in Alabama*. . . . . . . . . . . . . . . . . . . .

3.

FEIN or Social Security # of registered agent . . . . . . . . . . . . . .

Street address of registered office in Alabama . . . . . . . . . . . . .

City, State, and Zip . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

Name of president of corporation . . . . . . . . . . . . . . . . . . . . . . . .

4.

Social Security Number. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Home Address . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

City, State, and Zip . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

Name of secretary of corporation . . . . . . . . . . . . . . . . . . . . . . . .

5.

Social Security Number. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Home Address . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

City, State, and Zip . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

Type of business done in Alabama . . . . . . . . . . . . . . . . . . . . . . .

6.

7.

Principal place of business in Alabama . . . . . . . . . . . . . . . . . . .

7.

* If the registered office or registered agent has changed, a Statement of Change of Registered Office or Registered Agent Form

should be filed with the Secretary of State's Office. (Required by Section 10-2B-5.02, Code of Alabama 1975). (334) 242-5324.

8.

EXECUTION AND VERIFICATION (Required by Sections 10-2B-16.22 and 40-14-44, Code of Alabama 1975)

I _____________________________________________________ the _______________________________________________ , do hereby swear

(Name of Officer)

(Title of Officer)

(or affirm), depose, and say that the foregoing statement made to the Department of Revenue for the annual report and the collection of

the franchise tax and permit fee of said corporation, is true, full and correct and also, if a professional corporation, that all the

shareholders, at least one director, and the president of said corporation are qualified persons or otherwise legally authorized to practice

the profession in the State of Alabama.

(Telephone Number)

(Signature of Officer)

DEPARTMENT USE ONLY

9.

Secretary of State's Annual Report Fee due . . . . . . . . . . . . . .

9.

$10.00

SSAR

10.

Permit Fee due (from line 23a). . . . . . . . . . . . . . . . . . . . . . . . . .

10.

11.

Permit Fee penalty due (see instructions) . . . . . . . . . . . . . . . .

11.

TPR

12.

Permit Fee interest due (see instructions) . . . . . . . . . . . . . . . .

12.

13.

Total Permit Fee due (add lines 10, 11, & 12) . . . . . . . . . . . . .

13.

TFR

14.

Franchise Tax due(from line 24e) . . . . . . . . . . . . . . . . . . . . . . .

14.

15.

Franchise Tax penalty due(see instructions) . . . . . . . . . . . . . .

15.

TAR

16.

Franchise Tax interest due (see instructions) . . . . . . . . . . . . .

16.

17.

Total Franchise Tax due (add lines 14, 15, & 16) . . . . . . . . . .

17.

18.

Total amount due (add lines 9, 13, & 17) . . . . . . . . . . . . . . . . .

18.

MINIMUM TOTAL $70.00

Make check payable to Alabama Department of Revenue and mail to:

CHECK THIS BOX IF PAYMENT

ALABAMA DEPARTMENT OF REVENUE

MADE THROUGH ELECTRONIC

DOMESTIC FRANCHISE TAX SECTION,

FUNDS TRANSFER (EFT) . . . . . . . .

P.O. BOX 327340, MONTGOMERY, AL 36132-7340

19.

In accordance with Section 40-14-43, Code of Alabama 1975, a portion, 6.65%, of the corporation's franchise tax payment is distributed to the

Alabama county(ies) in which the corporation owns property. Therefore, in order to accurately distribute the payment to the proper Alabama

county(ies), list below the Alabama county(ies) where the corporation holds title to any property, real and/or personal, and the assessed value

in each county as of October 1, 1998. If all property is located in one Alabama county, list the county and indicate “All” or “100%.” (Use

attachment if additional space is required.)

COUNTY NAME

ASSESSED VALUE

COUNTY NAME

ASSESSED VALUE

$

$

Total Alabama Assessment

$

WARNING!!! IF THE FRANCHISE TAX IS NOT PAID, THE CORPORATION WILL BE CERTIFIED TO THE SECRETARY

OF STATE FOR ADMINISTRATIVE DISSOLUTION AS REQUIRED BY THE ALABAMA BUSINESS CORPORATION ACT!!!

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2