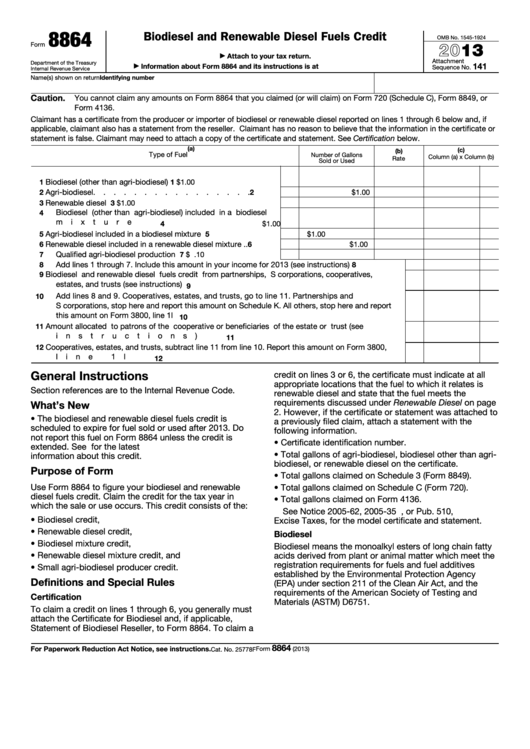

8864

Biodiesel and Renewable Diesel Fuels Credit

OMB No. 1545-1924

2013

Form

Attach to your tax return.

▶

Attachment

Department of the Treasury

141

Information about Form 8864 and its instructions is at

▶

Sequence No.

Internal Revenue Service

Identifying number

Name(s) shown on return

Caution.

You cannot claim any amounts on Form 8864 that you claimed (or will claim) on Form 720 (Schedule C), Form 8849, or

Form 4136.

Claimant has a certificate from the producer or importer of biodiesel or renewable diesel reported on lines 1 through 6 below and, if

applicable, claimant also has a statement from the reseller. Claimant has no reason to believe that the information in the certificate or

statement is false. Claimant may need to attach a copy of the certificate and statement. See Certification below.

(a)

(c)

(b)

Type of Fuel

Number of Gallons

Rate

Column (a) x Column (b)

Sold or Used

Biodiesel (other than agri-biodiesel) .

.

.

.

.

.

.

.

.

1

1

$1.00

2

Agri-biodiesel

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

$1.00

3

Renewable diesel .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

$1.00

Biodiesel (other than agri-biodiesel) included in a biodiesel

4

mixture

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

$1.00

5

Agri-biodiesel included in a biodiesel mixture .

.

.

.

.

.

5

$1.00

Renewable diesel included in a renewable diesel mixture .

.

6

6

$1.00

Qualified agri-biodiesel production

.

.

.

.

.

.

.

.

.

7

7

$ .10

Add lines 1 through 7. Include this amount in your income for 2013 (see instructions) .

.

.

.

.

8

8

Biodiesel and renewable diesel fuels credit from partnerships, S corporations, cooperatives,

9

estates, and trusts (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

Add lines 8 and 9. Cooperatives, estates, and trusts, go to line 11. Partnerships and

10

S corporations, stop here and report this amount on Schedule K. All others, stop here and report

this amount on Form 3800, line 1l .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10

Amount allocated to patrons of the cooperative or beneficiaries of the estate or trust (see

11

instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11

Cooperatives, estates, and trusts, subtract line 11 from line 10. Report this amount on Form 3800,

12

line 1l .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12

General Instructions

credit on lines 3 or 6, the certificate must indicate at all

appropriate locations that the fuel to which it relates is

Section references are to the Internal Revenue Code.

renewable diesel and state that the fuel meets the

requirements discussed under Renewable Diesel on page

What’s New

2. However, if the certificate or statement was attached to

• The biodiesel and renewable diesel fuels credit is

a previously filed claim, attach a statement with the

scheduled to expire for fuel sold or used after 2013. Do

following information.

not report this fuel on Form 8864 unless the credit is

• Certificate identification number.

extended. See for the latest

• Total gallons of agri-biodiesel, biodiesel other than agri-

information about this credit.

biodiesel, or renewable diesel on the certificate.

Purpose of Form

• Total gallons claimed on Schedule 3 (Form 8849).

Use Form 8864 to figure your biodiesel and renewable

• Total gallons claimed on Schedule C (Form 720).

diesel fuels credit. Claim the credit for the tax year in

• Total gallons claimed on Form 4136.

which the sale or use occurs. This credit consists of the:

See Notice 2005-62, 2005-35 I.R.B. 443, or Pub. 510,

• Biodiesel credit,

Excise Taxes, for the model certificate and statement.

• Renewable diesel credit,

Biodiesel

• Biodiesel mixture credit,

Biodiesel means the monoalkyl esters of long chain fatty

• Renewable diesel mixture credit, and

acids derived from plant or animal matter which meet the

registration requirements for fuels and fuel additives

• Small agri-biodiesel producer credit.

established by the Environmental Protection Agency

Definitions and Special Rules

(EPA) under section 211 of the Clean Air Act, and the

requirements of the American Society of Testing and

Certification

Materials (ASTM) D6751.

To claim a credit on lines 1 through 6, you generally must

attach the Certificate for Biodiesel and, if applicable,

Statement of Biodiesel Reseller, to Form 8864. To claim a

8864

For Paperwork Reduction Act Notice, see instructions.

Form

(2013)

Cat. No. 25778F

1

1 2

2 3

3 4

4