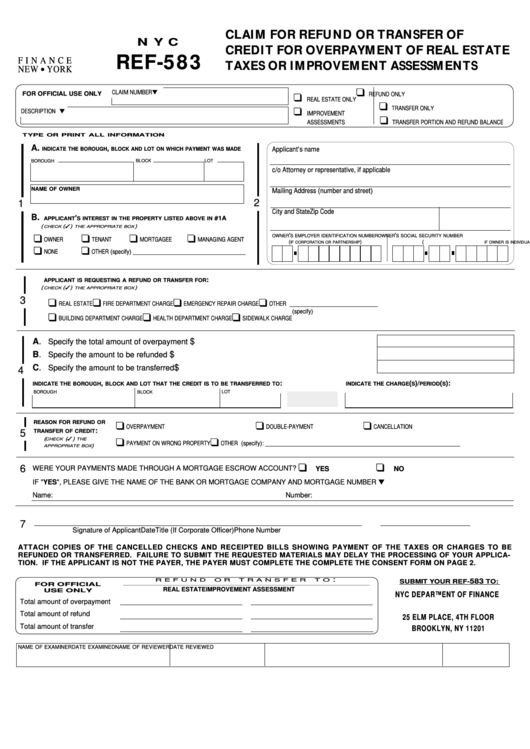

CLAIM FOR REFUND OR TRANSFER OF

N Y C

CREDIT FOR OVERPAYMENT OF REAL ESTATE

REF-583

F I N A N C E

TAXES OR IMPROVEMENT ASSESSMENTS

NEW YORK

CLAIM NUMBER

FOR OFFICIAL USE ONLY

REFUND ONLY

REAL ESTATE ONLY

TRANSFER ONLY

DESCRIPTION

IMPROVEMENT

ASSESSMENTS

TRANSFER PORTION AND REFUND BALANCE

TYPE OR PRINT ALL INFORMATION

A.

,

Applicant's name

INDICATE THE BOROUGH

BLOCK AND LOT ON WHICH PAYMENT WAS MADE

BLOCK

LOT

BOROUGH

c/o Attorney or representative, if applicable

NAME OF OWNER

Mailing Address (number and street)

2

1

City and State

Zip Code

B.

'

#1A

APPLICANT

S INTEREST IN THE PROPERTY LISTED ABOVE IN

(

( )

)

CHECK

THE APPROPRIATE BOX

'

'

OWNER

S EMPLOYER IDENTIFICATION NUMBER

OWNER

S SOCIAL SECURITY NUMBER

OWNER

TENANT

MORTGAGEE

MANAGING AGENT

(

)

(

)

IF CORPORATION OR PARTNERSHIP

IF OWNER IS INDIVIDUAL

NONE

OTHER (specify) _____________________________________

:

APPLICANT IS REQUESTING A REFUND OR TRANSFER FOR

(

( )

)

CHECK

THE APPROPRIATE BOX

3

REAL ESTATE

FIRE DEPARTMENT CHARGE

EMERGENCY REPAIR CHARGE

OTHER _____________________________

(specify)

BUILDING DEPARTMENT CHARGE

HEALTH DEPARTMENT CHARGE

SIDEWALK CHARGE

A.

........................................................................ $

Specify the total amount of overpayment

B.

................................................................................. $

Specify the amount to be refunded

C.

.............................................................................. $

Specify the amount to be transferred

4

,

:

(

)/

(

):

INDICATE THE BOROUGH

BLOCK AND LOT THAT THE CREDIT IS TO BE TRANSFERRED TO

INDICATE THE CHARGE

S

PERIOD

S

BOROUGH

BLOCK

LOT

REASON FOR REFUND OR

OVERPAYMENT

DOUBLE-PAYMENT

CANCELLATION

:

TRANSFER OF CREDIT

5

(

( )

CHECK

THE

PAYMENT ON WRONG PROPERTY

OTHER (specify): ________________________________________________________________

)

APPROPRIATE BOX

6

WERE YOUR PAYMENTS MADE THROUGH A MORTGAGE ESCROW ACCOUNT? ....................................

YES

NO

IF "YES", PLEASE GIVE THE NAME OF THE BANK OR MORTGAGE COMPANY AND MORTGAGE NUMBER

Name:

Number:

_____________________________________

___________________

____________________________

_______________________

7

Signature of Applicant

Date

Title (If Corporate Officer)

Phone Number

ATTACH COPIES OF THE CANCELLED CHECKS AND RECEIPTED BILLS SHOWING PAYMENT OF THE TAXES OR CHARGES TO BE

REFUNDED OR TRANSFERRED. FAILURE TO SUBMIT THE REQUESTED MATERIALS MAY DELAY THE PROCESSING OF YOUR APPLICA-

TION. IF THE APPLICANT IS NOT THE PAYER, THE PAYER MUST COMPLETE THE COMPLETE THE CONSENT FORM ON PAGE 2.

:

R E F U N D

O R

T R A N S F E R

T O

583

SUBMIT YOUR REF-

TO:

FOR OFFICIAL

REAL ESTATE

IMPROVEMENT ASSESSMENT

USE ONLY

NYC DEPARTMENT OF FINANCE

Total amount of overpayment

Total amount of refund

25 ELM PLACE, 4TH FLOOR

Total amount of transfer

BROOKLYN, NY 11201

NAME OF EXAMINER

DATE EXAMINED

NAME OF REVIEWER

DATE REVIEWED

1

1 2

2