Instructions For Completing And Filing Form 600 - Sales Tax - Navajo Tax Commission Page 2

ADVERTISEMENT

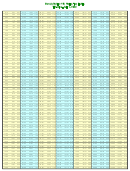

8. For sales at retail businesses as described in #7 - A and B, the taxpayer must indicate in which

chapter the sale occurred. Attachment A has the numerical code representing each chapter. Enter

this code in the “Chpt. Code” column. For Categories C-H, it is not necessary to enter a chapter

code.

9.

In Column 1, enter all Gross Receipts for each taxable activity for the reporting period.

10. In Column 3, enter the tax amount by multiplying the Gross Receipts, Column 1 by the tax rate of

4% in Column 2.

11. In Line 9, “Subtotal” from lines 1 thru 8.

12. In Line 10, enter the total from Form 601, a continuation sheet, if necessary.

13. In Line 11, enter the estimated taxes paid and submitted with the Form 145. The Form 145 is a

“Request for Extension.” If a taxpayer desires an extension of time for filing or paying taxes, the

taxpayer must file a Form 145 with the estimated tax due on or before the due date (see #2).

14. In Line 12, “Balance Due”, add lines 9 and 10, then subtract line 11.

15. In Line 13, “Interest” will be due for late payment. To calculate interest, multiply the tax due times

the number of days late, times the interest rate, divided by the number of days in the year. The

current interest rate can be found on our website: Attach interest calculation

with the tax return (i.e. tax due x number of days late x interest rate / number of days in a year =

interest).

16. In Line 14, “Penalties” will be due for late filing and late payment. Sections 112 – 114 of the

Uniform Tax Administration Statute describe the penalties. Attach penalties calculation with the

tax return.

17. In Line 15, “Credit for tax already withheld” applies to contract payments made by the Navajo

Nation whereby the 4% Sales Tax has been deducted from payment. For example, currently the

Sales Tax is withheld from all construction contract payments made by the Navajo Nation. Enter

this amount on line 15 and attach a copy of check stub for verification.

18. In Line 16, “Total Tax Due” Add lines 12, 13 &14 then subtract line 15.

19. For payments less than $10,000, make the check payable to the Office of the Navajo Tax

Commission and mail to: P.O. Box 1903, Window Rock, Arizona 86515. Payments greater than

$10,000 must be wire-transferred to the account listed on Form 600. Check the box for wire

transfers and indicate the amount being transferred.

20. The taxpayer or duly authorized agent must sign and date the tax return. The individual must print

his/her name and phone number. The taxpayer or authorized agent listed will be contacted if the

Office of Navajo Tax Commission has any questions about the tax return.

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3