Form Omc-11a - Connecticut Motor Carrier Road Tax Return (Back)

ADVERTISEMENT

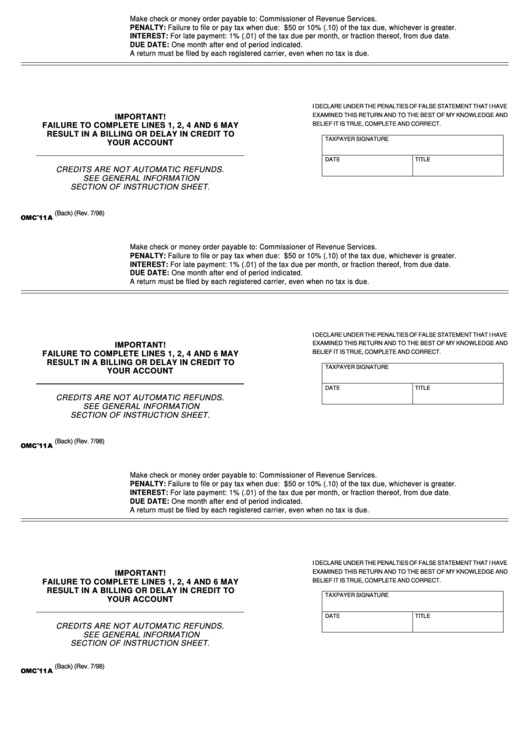

Make check or money order payable to: Commissioner of Revenue Services.

PENALTY: Failure to file or pay tax when due: $50 or 10% (.10) of the tax due, whichever is greater.

INTEREST: For late payment: 1% (.01) of the tax due per month, or fraction thereof, from due date.

DUE DATE: One month after end of period indicated.

A return must be filed by each registered carrier, even when no tax is due.

I DECLARE UNDER THE PENALTIES OF FALSE STATEMENT THAT I HAVE

EXAMINED THIS RETURN AND TO THE BEST OF MY KNOWLEDGE AND

IMPORTANT!

BELIEF IT IS TRUE, COMPLETE AND CORRECT.

FAILURE TO COMPLETE LINES 1, 2, 4 AND 6 MAY

RESULT IN A BILLING OR DELAY IN CREDIT TO

TAXPAYER SIGNATURE

YOUR ACCOUNT

DATE

TITLE

CREDITS ARE NOT AUTOMATIC REFUNDS.

SEE GENERAL INFORMATION

SECTION OF INSTRUCTION SHEET.

(Back) (Rev. 7/98)

Make check or money order payable to: Commissioner of Revenue Services.

PENALTY: Failure to file or pay tax when due: $50 or 10% (.10) of the tax due, whichever is greater.

INTEREST: For late payment: 1% (.01) of the tax due per month, or fraction thereof, from due date.

DUE DATE: One month after end of period indicated.

A return must be filed by each registered carrier, even when no tax is due.

I DECLARE UNDER THE PENALTIES OF FALSE STATEMENT THAT I HAVE

EXAMINED THIS RETURN AND TO THE BEST OF MY KNOWLEDGE AND

IMPORTANT!

BELIEF IT IS TRUE, COMPLETE AND CORRECT.

FAILURE TO COMPLETE LINES 1, 2, 4 AND 6 MAY

RESULT IN A BILLING OR DELAY IN CREDIT TO

TAXPAYER SIGNATURE

YOUR ACCOUNT

DATE

TITLE

CREDITS ARE NOT AUTOMATIC REFUNDS.

SEE GENERAL INFORMATION

SECTION OF INSTRUCTION SHEET.

(Back) (Rev. 7/98)

Make check or money order payable to: Commissioner of Revenue Services.

PENALTY: Failure to file or pay tax when due: $50 or 10% (.10) of the tax due, whichever is greater.

INTEREST: For late payment: 1% (.01) of the tax due per month, or fraction thereof, from due date.

DUE DATE: One month after end of period indicated.

A return must be filed by each registered carrier, even when no tax is due.

I DECLARE UNDER THE PENALTIES OF FALSE STATEMENT THAT I HAVE

EXAMINED THIS RETURN AND TO THE BEST OF MY KNOWLEDGE AND

IMPORTANT!

BELIEF IT IS TRUE, COMPLETE AND CORRECT.

FAILURE TO COMPLETE LINES 1, 2, 4 AND 6 MAY

RESULT IN A BILLING OR DELAY IN CREDIT TO

TAXPAYER SIGNATURE

YOUR ACCOUNT

DATE

TITLE

CREDITS ARE NOT AUTOMATIC REFUNDS.

SEE GENERAL INFORMATION

SECTION OF INSTRUCTION SHEET.

(Back) (Rev. 7/98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1