Form Omc-11a - Connecticut Motor Carrier Road Tax Return

ADVERTISEMENT

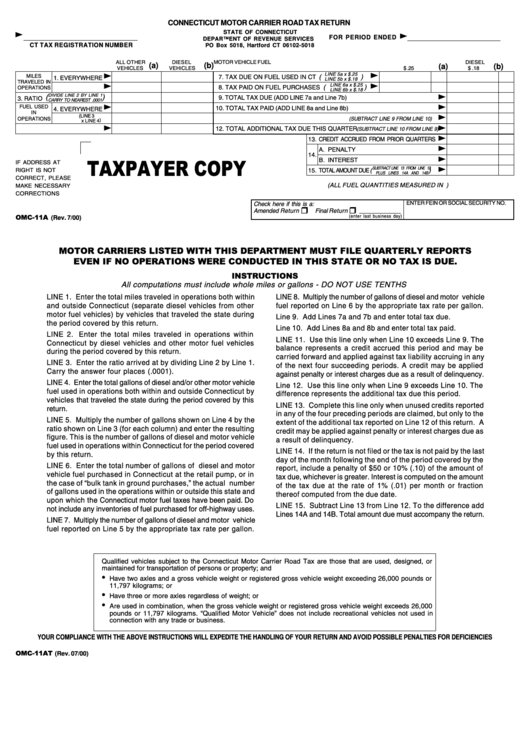

CONNECTICUT MOTOR CARRIER ROAD TAX RETURN

<

<

STATE OF CONNECTICUT

FOR PERIOD ENDED

DEPARTMENT OF REVENUE SERVICES

CT TAX REGISTRATION NUMBER

PO Box 5018, Hartford CT 06102-5018

ALL OTHER

DIESEL

MOTOR VEHICLE FUEL

DIESEL

(a)

(b)

(a)

(b)

VEHICLES

VEHICLES

$ .25

$ .18

<

<

LINE 5a x $.25

MILES

(

)

7. TAX DUE ON FUEL USED IN CT

1. EVERYWHERE

LINE 5b x $.18

<

<

TRAVELED IN

LINE 6a x $.25

(

)

8. TAX PAID ON FUEL PURCHASES

OPERATIONS

2. IN CT

LINE 6b x $.18

<

DIVIDE LINE 2 BY LINE 1

(

)

9. TOTAL TAX DUE (ADD LINE 7a and Line 7b)

3. RATIO

CARRY TO NEAREST .0001

<

<

FUEL USED

10. TOTAL TAX PAID (ADD LINE 8a and Line 8b)

4. EVERYWHERE

<

IN

(LINE 3

11. TOTAL CREDIT ACCRUED THIS QUARTER

OPERATIONS

(SUBTRACT LINE 9 FROM LINE 10)

5. IN CT

x LINE 4 )

<

<

12. TOTAL ADDITIONAL TAX DUE THIS QUARTER

(SUBTRACT LINE 10 FROM LINE 9)

6. FUEL PURCHASED IN CT

<

13. CREDIT ACCRUED FROM PRIOR QUARTERS

<

A. PENALTY

<

14.

TAXPAYER COPY

B. INTEREST

IF ADDRESS AT

<

SUBTRACT LINE 13 FROM LINE 12

)

RIGHT IS NOT

15. TOTAL AMOUNT DUE (

PLUS LINES 14A AND 14B

CORRECT, PLEASE

(ALL FUEL QUANTITIES MEASURED IN U.S. GALLONS)

MAKE NECESSARY

CORRECTIONS

ENTER FEIN OR SOCIAL SECURITY NO.

Check here if this is a:

H

H

Amended Return

Final Return

_______________

OMC-11A

(enter last business day)

(Rev. 7/00)

MOTOR CARRIERS LISTED WITH THIS DEPARTMENT MUST FILE QUARTERLY REPORTS

EVEN IF NO OPERATIONS WERE CONDUCTED IN THIS STATE OR NO TAX IS DUE.

INSTRUCTIONS

All computations must include whole miles or gallons - DO NOT USE TENTHS

LINE 1. Enter the total miles traveled in operations both within

LINE 8. Multiply the number of gallons of diesel and motor vehicle

and outside Connecticut (separate diesel vehicles from other

fuel reported on Line 6 by the appropriate tax rate per gallon.

motor fuel vehicles) by vehicles that traveled the state during

Line 9. Add Lines 7a and 7b and enter total tax due.

the period covered by this return.

Line 10. Add Lines 8a and 8b and enter total tax paid.

LINE 2. Enter the total miles traveled in operations within

LINE 11. Use this line only when Line 10 exceeds Line 9. The

Connecticut by diesel vehicles and other motor fuel vehicles

balance represents a credit accrued this period and may be

during the period covered by this return.

carried forward and applied against tax liability accruing in any

LINE 3. Enter the ratio arrived at by dividing Line 2 by Line 1.

of the next four succeeding periods. A credit may be applied

Carry the answer four places (.0001).

against penalty or interest charges due as a result of delinquency.

LINE 4. Enter the total gallons of diesel and/or other motor vehicle

Line 12. Use this line only when Line 9 exceeds Line 10. The

fuel used in operations both within and outside Connecticut by

difference represents the additional tax due this period.

vehicles that traveled the state during the period covered by this

LINE 13. Complete this line only when unused credits reported

return.

in any of the four preceding periods are claimed, but only to the

LINE 5. Multiply the number of gallons shown on Line 4 by the

extent of the additional tax reported on Line 12 of this return. A

ratio shown on Line 3 (for each column) and enter the resulting

credit may be applied against penalty or interest charges due as

figure. This is the number of gallons of diesel and motor vehicle

a result of delinquency.

fuel used in operations within Connecticut for the period covered

LINE 14. If the return is not filed or the tax is not paid by the last

by this return.

day of the month following the end of the period covered by the

LINE 6. Enter the total number of gallons of diesel and motor

report, include a penalty of $50 or 10% (.10) of the amount of

vehicle fuel purchased in Connecticut at the retail pump, or in

tax due, whichever is greater. Interest is computed on the amount

the case of “bulk tank in ground purchases,” the actual number

of the tax due at the rate of 1% (.01) per month or fraction

of gallons used in the operations within or outside this state and

thereof computed from the due date.

upon which the Connecticut motor fuel taxes have been paid. Do

LINE 15. Subtract Line 13 from Line 12. To the difference add

not include any inventories of fuel purchased for off-highway uses.

Lines 14A and 14B. Total amount due must accompany the return.

LINE 7. Multiply the number of gallons of diesel and motor vehicle

fuel reported on Line 5 by the appropriate tax rate per gallon.

Qualified vehicles subject to the Connecticut Motor Carrier Road Tax are those that are used, designed, or

maintained for transportation of persons or property; and

•

Have two axles and a gross vehicle weight or registered gross vehicle weight exceeding 26,000 pounds or

11,797 kilograms; or

•

Have three or more axles regardless of weight; or

•

Are used in combination, when the gross vehicle weight or registered gross vehicle weight exceeds 26,000

pounds or 11,797 kilograms. “Qualified Motor Vehicle” does not include recreational vehicles not used in

connection with any trade or business.

YOUR COMPLIANCE WITH THE ABOVE INSTRUCTIONS WILL EXPEDITE THE HANDLING OF YOUR RETURN AND AVOID POSSIBLE PENALTIES FOR DEFICIENCIES

OMC-11AT

(Rev. 07/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2