Instructions For Form St-121 - Department Of Taxation And Finance

ADVERTISEMENT

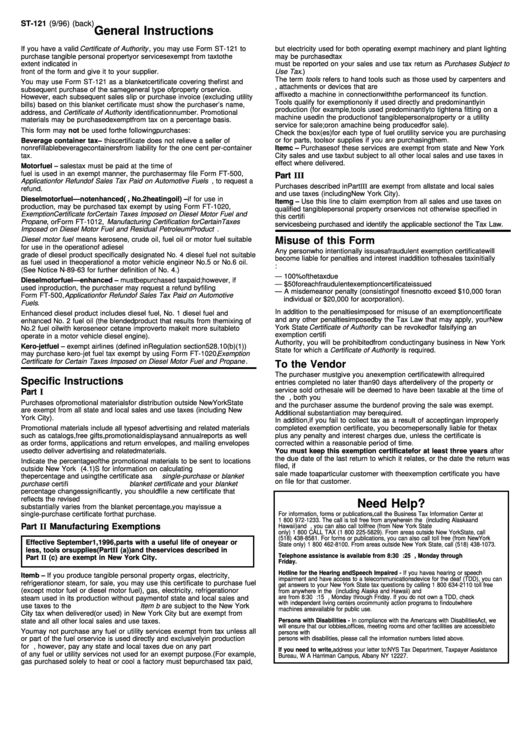

ST-121 (9/96) (back)

General Instructions

If you have a valid Certificate of Authority , you may use Form ST-121 to

but electricity used for both operating exempt machinery and plant lighting

purchase tangible personal property or services exempt from tax to the

may be purchased tax exempt. The tax due on the electricity for the lighting

must be reported on your sales and use tax return as Purchases Subject to

extent indicated in these instructions. Complete all required entries on the

front of the form and give it to your supplier.

Use Tax .)

The term tools refers to hand tools such as those used by carpenters and

You may use Form ST-121 as a blanket certificate covering the first and

machinists. It does not include parts, attachments or devices that are

subsequent purchase of the same general type of property or service.

affixed to a machine in connection with the performance of its function.

However, each subsequent sales slip or purchase invoice (excluding utility

Tools qualify for exemption only if used directly and predominantly in

bills) based on this blanket certificate must show the purchaser’s name,

production (for example, tools used predominantly to tighten a fitting on a

address, and Certificate of Authority identification number. Promotional

machine used in the production of tangible personal property or a utility

materials may be purchased exempt from tax on a percentage basis.

service for sale; or on a machine being produced for sale).

This form may not be used for the following purchases:

Check the box(es) for each type of fuel or utility service you are purchasing

or for parts, tools or supplies if you are purchasing them.

Beverage container tax – this certificate does not relieve a seller of

nonrefillable beverage containers from liability for the one cent per-container

Item c – Purchases of these services are exempt from state and New York

tax.

City sales and use tax but subject to all other local sales and use taxes in

effect where delivered.

Motor fuel – sales tax must be paid at the time of purchase. If the motor

fuel is used in an exempt manner, the purchaser may file Form FT-500,

Part III

Application for Refund of Sales Tax Paid on Automotive Fuels , to request a

Purchases described in Part III are exempt from all state and local sales

refund.

and use taxes (including New York City).

Diesel motor fuel — not enhanced (e.g., No. 2 heating oil) – if for use in

Item g – Use this line to claim exemption from all sales and use taxes on

production, may be purchased tax exempt by using Form FT-1020,

qualified tangible personal property or services not otherwise specified in

Exemption Certificate for Certain Taxes Imposed on Diesel Motor Fuel and

this certificate. Describe the exempt use of the tangible personal property or

Propane , or Form FT-1012, Manufacturing Certification for Certain Taxes

services being purchased and identify the applicable section of the Tax Law.

Imposed on Diesel Motor Fuel and Residual Petroleum Product .

Misuse of this Form

Diesel motor fuel means kerosene, crude oil, fuel oil or motor fuel suitable

for use in the operation of a diesel engine. It does not include that special

Any person who intentionally issues a fraudulent exemption certificate will

grade of diesel product specifically designated No. 4 diesel fuel not suitable

become liable for penalties and interest in addition to the sales tax initially

as fuel used in the operation of a motor vehicle engine or No. 5 or No. 6 oil.

due. Some penalties that apply are:

(See Notice N-89-63 for further definition of No. 4.)

— 100% of the tax due

Diesel motor fuel — enhanced – must be purchased tax paid; however, if

— $50 for each fraudulent exemption certificate issued

used in production, the purchaser may request a refund by filing

— A misdemeanor penalty (consisting of fines not to exceed $10,000 for an

Form FT-500, Application for Refund of Sales Tax Paid on Automotive

individual or $20,000 for a corporation).

Fuels .

In addition to the penalties imposed for misuse of an exemption certificate

Enhanced diesel product includes diesel fuel, No. 1 diesel fuel and

and any other penalties imposed by the Tax Law that may apply, your New

enhanced No. 2 fuel oil (the blended product that results from the mixing of

York State Certificate of Authority can be revoked for falsifying an

No. 2 fuel oil with kerosene or cetane improver to make it more suitable to

exemption certificate. Once this Department has revoked your Certificate of

operate in a motor vehicle diesel engine).

Authority, you will be prohibited from conducting any business in New York

Kero-jet fuel – exempt airlines (defined in Regulation section 528.10(b)(1))

State for which a Certificate of Authority is required.

may purchase kero-jet fuel tax exempt by using Form FT-1020, Exemption

Certificate for Certain Taxes Imposed on Diesel Motor Fuel and Propane .

To the Vendor

The purchaser must give you an exemption certificate with all required

Specific Instructions

entries completed no later than 90 days after delivery of the property or

service sold or the sale will be deemed to have been taxable at the time of

Part I

the transaction. If you receive a certificate after the 90-day period, both you

Purchases of promotional materials for distribution outside New York State

and the purchaser assume the burden of proving the sale was exempt.

are exempt from all state and local sales and use taxes (including New

Additional substantiation may be required.

York City).

In addition, if you fail to collect tax as a result of accepting an improperly

Promotional materials include all types of advertising and related materials

completed exemption certificate, you become personally liable for the tax

such as catalogs, free gifts, promotional displays and annual reports as well

plus any penalty and interest charges due, unless the certificate is

as order forms, applications and return envelopes, and mailing envelopes

corrected within a reasonable period of time.

used to deliver advertising and related materials.

You must keep this exemption certificate for at least three years after

the due date of the last return to which it relates, or the date the return was

Indicate the percentage of the promotional materials to be sent to locations

filed, if later. You must also maintain a method of associating an exempt

outside New York State. See TSB-M-92(4.1)S for information on calculating

sale made to a particular customer with the exemption certificate you have

the percentage and using the certificate as a single-purchase or blanket

on file for that customer.

purchase certificate. If you issue a blanket certificate and your blanket

percentage changes significantly, you should file a new certificate that

reflects the revised percentage. If the percentage for a particular purchase

Need Help?

substantially varies from the blanket percentage, you may issue a

single-purchase certificate for that purchase.

For information, forms or publications, call the Business Tax Information Center at

1 800 972-1233. The call is toll free from anywhere in the U.S. (including Alaska and

Part II Manufacturing Exemptions

Hawaii) and Canada. For information, you can also call toll free (from New York State

only) 1 800 CALL TAX (1 800 225-5829). From areas outside New York State, call

(518) 438-8581. For forms or publications, you can also call toll free (from New York

Effective September 1, 1996, parts with a useful life of one year or

State only) 1 800 462-8100. From areas outside New York State, call (518) 438-1073.

less, tools or supplies (Part II (a)) and the services described in

Telephone assistance is available from 8:30 a.m. to 4:25 p.m., Monday through

Part II (c) are exempt in New York City.

Friday.

Hotline for the Hearing and Speech Impaired - If you have a hearing or speech

Item b – If you produce tangible personal property or gas, electricity,

impairment and have access to a telecommunications device for the deaf (TDD), you can

refrigeration or steam, for sale, you may use this certificate to purchase fuel

get answers to your New York State tax questions by calling 1 800 634-2110 toll free

(except motor fuel or diesel motor fuel), gas, electricity, refrigeration or

from anywhere in the U.S. (including Alaska and Hawaii) and Canada. Hours of operation

are from 8:30 a.m. to 4:15 p.m., Monday through Friday. If you do not own a TDD, check

steam used in its production without payment of state and local sales and

with independent living centers or community action programs to find out where

use taxes to the vendor. Purchases in Item b are subject to the New York

machines are available for public use.

City tax when delivered (or used) in New York City but are exempt from

Persons with Disabilities - In compliance with the Americans with Disabilities Act, we

state and all other local sales and use taxes.

will ensure that our lobbies, offices, meeting rooms and other facilities are accessible to

You may not purchase any fuel or utility services exempt from tax unless all

persons with disabilities. If you have questions about special accommodations for

or part of the fuel or service is used directly and exclusively in production

persons with disabilities, please call the information numbers listed above.

for sale. You must, however, pay any state and local taxes due on any part

If you need to write, address your letter to: NYS Tax Department, Taxpayer Assistance

of any fuel or utility services not used for an exempt purpose. (For example,

Bureau, W A Harriman Campus, Albany NY 12227.

gas purchased solely to heat or cool a factory must be purchased tax paid,

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1