Instructions For Form St-121 - Exempt Use Certificate - New York State Department Of Taxation And Finance

ADVERTISEMENT

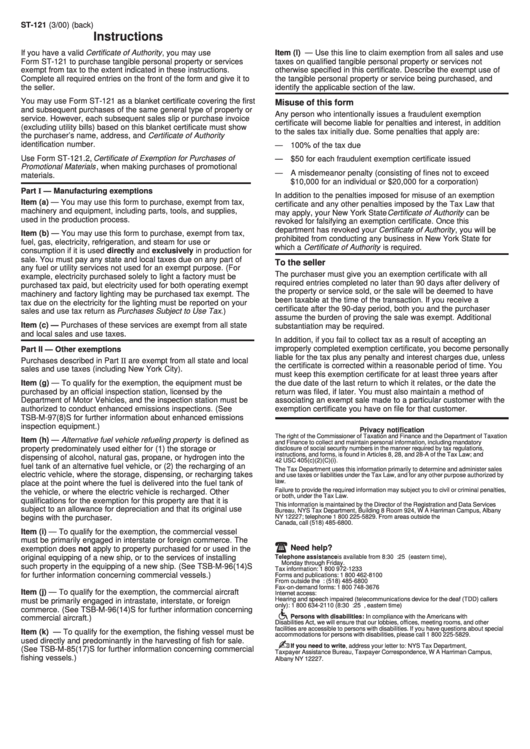

ST-121 (3/00) (back)

Instructions

If you have a valid Certificate of Authority , you may use

Item (l) — Use this line to claim exemption from all sales and use

Form ST-121 to purchase tangible personal property or services

taxes on qualified tangible personal property or services not

exempt from tax to the extent indicated in these instructions.

otherwise specified in this certificate. Describe the exempt use of

Complete all required entries on the front of the form and give it to

the tangible personal property or service being purchased, and

the seller.

identify the applicable section of the law.

You may use Form ST-121 as a blanket certificate covering the first

Misuse of this form

and subsequent purchases of the same general type of property or

Any person who intentionally issues a fraudulent exemption

service. However, each subsequent sales slip or purchase invoice

certificate will become liable for penalties and interest, in addition

(excluding utility bills) based on this blanket certificate must show

to the sales tax initially due. Some penalties that apply are:

the purchaser’s name, address, and Certificate of Authority

identification number.

— 100% of the tax due

Use Form ST-121.2, Certificate of Exemption for Purchases of

— $50 for each fraudulent exemption certificate issued

Promotional Materials , when making purchases of promotional

— A misdemeanor penalty (consisting of fines not to exceed

materials.

$10,000 for an individual or $20,000 for a corporation)

Part I — Manufacturing exemptions

In addition to the penalties imposed for misuse of an exemption

Item (a) — You may use this form to purchase, exempt from tax,

certificate and any other penalties imposed by the Tax Law that

machinery and equipment, including parts, tools, and supplies,

may apply, your New York State Certificate of Authority can be

used in the production process.

revoked for falsifying an exemption certificate. Once this

department has revoked your Certificate of Authority , you will be

Item (b) — You may use this form to purchase, exempt from tax,

prohibited from conducting any business in New York State for

fuel, gas, electricity, refrigeration, and steam for use or

which a Certificate of Authority is required.

consumption if it is used directly and exclusively in production for

sale. You must pay any state and local taxes due on any part of

To the seller

any fuel or utility services not used for an exempt purpose. (For

The purchaser must give you an exemption certificate with all

example, electricity purchased solely to light a factory must be

required entries completed no later than 90 days after delivery of

purchased tax paid, but electricity used for both operating exempt

the property or service sold, or the sale will be deemed to have

machinery and factory lighting may be purchased tax exempt. The

been taxable at the time of the transaction. If you receive a

tax due on the electricity for the lighting must be reported on your

certificate after the 90-day period, both you and the purchaser

sales and use tax return as Purchases Subject to Use Tax .)

assume the burden of proving the sale was exempt. Additional

Item (c) — Purchases of these services are exempt from all state

substantiation may be required.

and local sales and use taxes.

In addition, if you fail to collect tax as a result of accepting an

improperly completed exemption certificate, you become personally

Part II — Other exemptions

liable for the tax plus any penalty and interest charges due, unless

Purchases described in Part II are exempt from all state and local

the certificate is corrected within a reasonable period of time. You

sales and use taxes (including New York City).

must keep this exemption certificate for at least three years after

Item (g) — To qualify for the exemption, the equipment must be

the due date of the last return to which it relates, or the date the

purchased by an official inspection station, licensed by the

return was filed, if later. You must also maintain a method of

Department of Motor Vehicles, and the inspection station must be

associating an exempt sale made to a particular customer with the

authorized to conduct enhanced emissions inspections. (See

exemption certificate you have on file for that customer.

TSB-M-97(8)S for further information about enhanced emissions

inspection equipment.)

Privacy notification

The right of the Commissioner of Taxation and Finance and the Department of Taxation

Item (h) — Alternative fuel vehicle refueling property is defined as

and Finance to collect and maintain personal information, including mandatory

property predominately used either for (1) the storage or

disclosure of social security numbers in the manner required by tax regulations,

instructions, and forms, is found in Articles 8, 28, and 28-A of the Tax Law; and

dispensing of alcohol, natural gas, propane, or hydrogen into the

42 USC 405(c)(2)(C)(i).

fuel tank of an alternative fuel vehicle, or (2) the recharging of an

The Tax Department uses this information primarily to determine and administer sales

electric vehicle, where the storage, dispensing, or recharging takes

and use taxes or liabilities under the Tax Law, and for any other purpose authorized by

law.

place at the point where the fuel is delivered into the fuel tank of

Failure to provide the required information may subject you to civil or criminal penalties,

the vehicle, or where the electric vehicle is recharged. Other

or both, under the Tax Law.

qualifications for the exemption for this property are that it is

This information is maintained by the Director of the Registration and Data Services

subject to an allowance for depreciation and that its original use

Bureau, NYS Tax Department, Building 8 Room 924, W A Harriman Campus, Albany

NY 12227; telephone 1 800 225-5829. From areas outside the U.S. and outside

begins with the purchaser.

Canada, call (518) 485-6800.

Item (i) — To qualify for the exemption, the commercial vessel

must be primarily engaged in interstate or foreign commerce. The

Need help?

exemption does not apply to property purchased for or used in the

original equipping of a new ship, or to the services of installing

Telephone assistance is available from 8:30 a.m. to 4:25 p.m. (eastern time),

Monday through Friday.

such property in the equipping of a new ship. (See TSB-M-96(14)S

Tax information: 1 800 972-1233

for further information concerning commercial vessels.)

Forms and publications: 1 800 462-8100

From outside the U.S. and outside Canada: (518) 485-6800

Fax-on-demand forms: 1 800 748-3676

Item (j) — To qualify for the exemption, the commercial aircraft

Internet access:

Hearing and speech impaired (telecommunications device for the deaf (TDD) callers

must be primarily engaged in intrastate, interstate, or foreign

only): 1 800 634-2110 (8:30 a.m. to 4:25 p.m., eastern time)

commerce. (See TSB-M-96(14)S for further information concerning

Persons with disabilities: In compliance with the Americans with

commercial aircraft.)

Disabilities Act, we will ensure that our lobbies, offices, meeting rooms, and other

facilities are accessible to persons with disabilities. If you have questions about special

Item (k) — To qualify for the exemption, the fishing vessel must be

accommodations for persons with disabilities, please call 1 800 225-5829.

used directly and predominantly in the harvesting of fish for sale.

If you need to write, address your letter to: NYS Tax Department,

(See TSB-M-85(17)S for further information concerning commercial

Taxpayer Assistance Bureau, Taxpayer Correspondence, W A Harriman Campus,

fishing vessels.)

Albany NY 12227.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1