Form M-14 - Estimated Tax Payment Record - Minnesota Department Of Revenue 1999

ADVERTISEMENT

1999

MINNESOTA Department of Revenue

Instructions for Estimated Income Tax

M-14

How to estimate your

Individuals use Form M-14 payment

cross out the numbers (the scan line) at the

voucher to make regular installment

income tax for 1999

bottom of the voucher.

payments of estimated tax on their annual

First, figure your federal estimated income

If your address has changed since you last

income.

for 1999 on federal Form 1040ES. Then,

filed, use the address card to write in your

use the 1998 Minnesota Form M-1 and

new address—do not make the changes to

What is estimated tax?

instructions as a worksheet to estimate

the voucher. Personalized forms with the

Estimated tax is the method you use to pay

your tax for 1999. Complete the 1998 Form

correction will be sent to you next year.

tax on income that is not subject to

M-1 using your estimated 1999 income and

withholding; for example, earnings from

withholding, child care, working family,

Blank forms (Form M-14)

self-employment, pensions, unemploy-

and education credits. For a more accurate

Fill in the required information on Form

ment compensation, interest, dividends,

estimate of the amount to enter on line 7 of

M-14:

rents, alimony, etc.

your worksheet, use the 1999 tax rates

• your Social Security number. Be sure

(shown below) rather than the tax tables in

You estimate what your total 1999 income

you fill in your correct Social Security

the booklet.

will be, figure the income tax on your

number. If your Social Security number

estimated income, and pay the tax in

If the amount on line 21 of your M-1

is not correct, we cannot properly credit

installments.

worksheet is less than $500, you do not

your account.

have to pay estimated tax payments. If the

You will determine the actual amount of

• you must list your spouse’s Social

amount is $500 or more, you are required to

your 1999 Minnesota income tax in early

Security number if you will be filing a

make installment payments of estimated tax.

2000 when you fill out your 1999 Minnesota

joint return. If you will be filing a

Income Tax Return, Form M-1.

separate return, list only your Social

Keep your worksheet for your records.

Security number.

You do not have to send it to the Depart-

Who must make estimated

ment of Revenue.

tax payments?

Installment amounts and

How to determine if you must

In most cases, you must make estimated tax

payment due dates

payments if you expect to owe $500 or more

pay alternative minimum tax. . .

One-fourth of your estimated tax is due by

in Minnesota income tax for 1999 after you

each of the dates shown below. Your

Follow the instructions in the section titled

subtract your withholding and credits (for

payment must be postmarked no later than

“Schedule M-1MT, If you have to pay

example, your child and dependent care,

the due date. (Farmers: See specific

Minnesota alternative minimum tax” of

working family, and education credits),

instructions on the next page.)

the 1998 Minnesota income tax instruc-

and you expect your withholding and

tions. Include any alternative minimum

1st installment

April 15, 1999

credits to be less than the smaller of:

tax you expect to pay in the amount you

2nd installment

June 15, 1999

list on line 7 of your M-1 worksheet.

• 90 percent of the tax shown on your

3rd installment

September 15, 1999

1999 Form M-1 (66.7 percent if you are a

4th installment

January 18, 2000*

Personalized forms (Form M-14)

farmer), or

The Department of Revenue mails person-

* If you file your 1999 Form M-1 by

• 100 percent of your 1998 tax (line 7 of

alized, scannable forms (Form M-14) and

January 31, 2000, and pay the entire

your 1998 Form M-1) if your federal

an address card to those who filed pay-

balance due with your return, you do not

adjusted gross income on your 1998

ment vouchers in the previous year. The

have to make the payment due on

return is $150,000 or less. If your 1998

personalized forms should be used to

January 18, 2000.

federal adjusted gross income is more

ensure timely and accurate processing of

If you file on a fiscal year basis, your

than $150,000, use 110 percent instead

your estimated tax payments. If you use a

installment payments must be postmarked

of 100 percent. Nonresidents and part-

tax preparer, please bring your personal-

no later than the 15th day of the 4th, 6th, and

year residents use Minnesota assignable

ized forms to your preparer.

9th months for your current fiscal year and

adjusted gross income.

When you use your personalized Form

the 1st month of the following fiscal year. If

If you were a Minnesota resident for all of

M-14, check to make sure the preprinted

any payment date falls on a Saturday, Sunday

1998 and your 1998 return covered a 12-

Social Security number(s) is correct. If the

or legal holiday, use the next business day.

month period, you do not have to make

number is wrong, cross out the incorrect

You must use 1999 vouchers for your fiscal

estimated tax payments if the tax on line 7

number and write in the correct number

year beginning in 1999.

of your 1998 Form M-1 was zero.

next to it. It is important that you also

Continued on back.

If you receive salaries and wages, you may

be able to avoid having to pay estimated

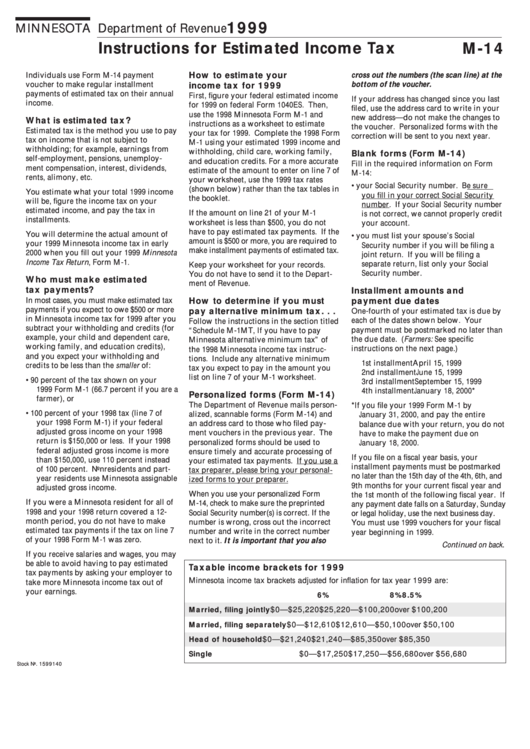

Taxable income brackets for 1999

tax payments by asking your employer to

Minnesota income tax brackets adjusted for inflation for tax year 1999 are:

take more Minnesota income tax out of

your earnings.

6%

8%

8.5%

Married, filing jointly

$0—$25,220

$25,220—$100,200

over $100,200

$0—$12,610

$12,610—$50,100

over $50,100

Married, filing separately

Head of household

$0—$21,240

$21,240—$85,350

over $85,350

$0—$17,250

$17,250—$56,680

over $56,680

Single

Stock No. 1599140

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3