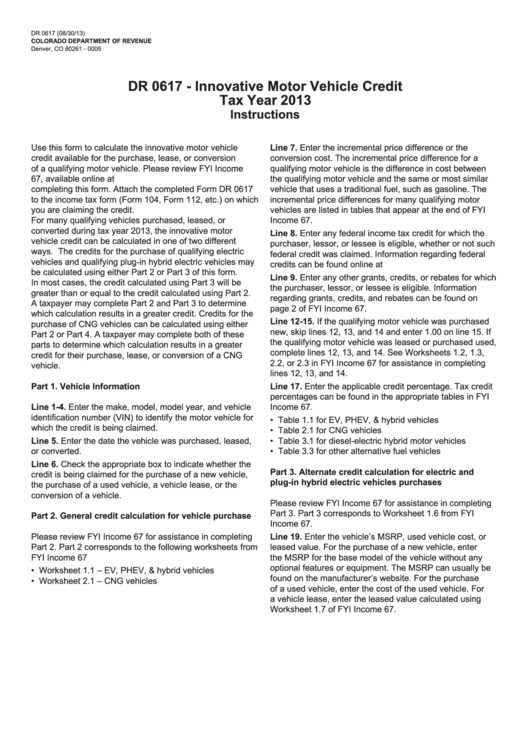

Form Dr 0617- Innovative Motor Vehicle Credit Tax Year 2013 Instructions

ADVERTISEMENT

DR 0617 (08/30/13)

COLORADO DEPARTMENT OF REVENUE

Denver, CO 80261 - 0005

DR 0617 - Innovative Motor Vehicle Credit

Tax Year 2013

Instructions

Use this form to calculate the innovative motor vehicle

Line 7. Enter the incremental price difference or the

credit available for the purchase, lease, or conversion

conversion cost. The incremental price difference for a

of a qualifying motor vehicle. Please review FYI Income

qualifying motor vehicle is the difference in cost between

67, available online at prior to

the qualifying motor vehicle and the same or most similar

completing this form. Attach the completed Form DR 0617

vehicle that uses a traditional fuel, such as gasoline. The

to the income tax form (Form 104, Form 112, etc.) on which

incremental price differences for many qualifying motor

you are claiming the credit.

vehicles are listed in tables that appear at the end of FYI

For many qualifying vehicles purchased, leased, or

Income 67.

converted during tax year 2013, the innovative motor

Line 8. Enter any federal income tax credit for which the

vehicle credit can be calculated in one of two different

purchaser, lessor, or lessee is eligible, whether or not such

ways. The credits for the purchase of qualifying electric

federal credit was claimed. Information regarding federal

vehicles and qualifying plug-in hybrid electric vehicles may

credits can be found online at

be calculated using either Part 2 or Part 3 of this form.

Line 9. Enter any other grants, credits, or rebates for which

In most cases, the credit calculated using Part 3 will be

the purchaser, lessor, or lessee is eligible. Information

greater than or equal to the credit calculated using Part 2.

regarding grants, credits, and rebates can be found on

A taxpayer may complete Part 2 and Part 3 to determine

page 2 of FYI Income 67.

which calculation results in a greater credit. Credits for the

Line 12-15. If the qualifying motor vehicle was purchased

purchase of CNG vehicles can be calculated using either

new, skip lines 12, 13, and 14 and enter 1.00 on line 15. If

Part 2 or Part 4. A taxpayer may complete both of these

the qualifying motor vehicle was leased or purchased used,

parts to determine which calculation results in a greater

complete lines 12, 13, and 14. See Worksheets 1.2, 1.3,

credit for their purchase, lease, or conversion of a CNG

2.2, or 2.3 in FYI Income 67 for assistance in completing

vehicle.

lines 12, 13, and 14.

Part 1. Vehicle Information

Line 17. Enter the applicable credit percentage. Tax credit

percentages can be found in the appropriate tables in FYI

Line 1-4. Enter the make, model, model year, and vehicle

Income 67.

identification number (VIN) to identify the motor vehicle for

• Table 1.1 for EV, PHEV, & hybrid vehicles

which the credit is being claimed.

• Table 2.1 for CNG vehicles

Line 5. Enter the date the vehicle was purchased, leased,

• Table 3.1 for diesel-electric hybrid motor vehicles

or converted.

• Table 3.3 for other alternative fuel vehicles

Line 6. Check the appropriate box to indicate whether the

Part 3. Alternate credit calculation for electric and

credit is being claimed for the purchase of a new vehicle,

plug-in hybrid electric vehicles purchases

the purchase of a used vehicle, a vehicle lease, or the

conversion of a vehicle.

Please review FYI Income 67 for assistance in completing

Part 3. Part 3 corresponds to Worksheet 1.6 from FYI

Part 2. General credit calculation for vehicle purchase

Income 67.

Please review FYI Income 67 for assistance in completing

Line 19. Enter the vehicle’s MSRP, used vehicle cost, or

Part 2. Part 2 corresponds to the following worksheets from

leased value. For the purchase of a new vehicle, enter

FYI Income 67

the MSRP for the base model of the vehicle without any

optional features or equipment. The MSRP can usually be

• Worksheet 1.1 – EV, PHEV, & hybrid vehicles

found on the manufacturer’s website. For the purchase

• Worksheet 2.1 – CNG vehicles

of a used vehicle, enter the cost of the used vehicle. For

a vehicle lease, enter the leased value calculated using

Worksheet 1.7 of FYI Income 67.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2