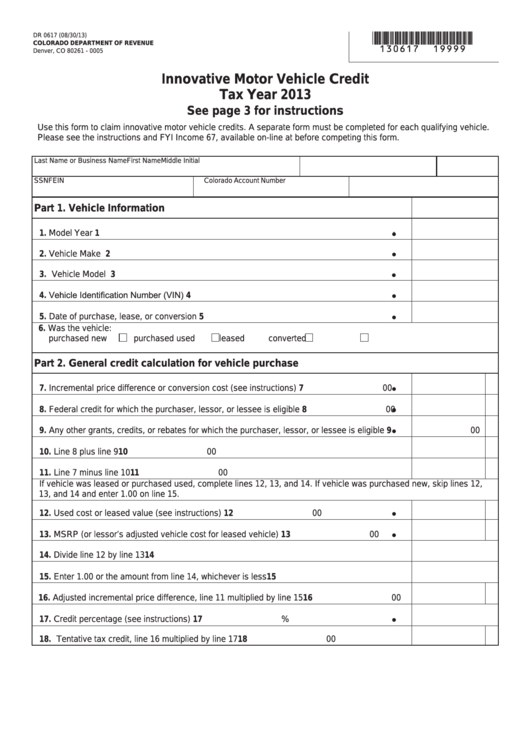

*130617==19999*

DR 0617 (08/30/13)

COLORADO DEPARTMENT OF REVENUE

Denver, CO 80261 - 0005

Innovative Motor Vehicle Credit

Tax Year 2013

See page 3 for instructions

Use this form to claim innovative motor vehicle credits. A separate form must be completed for each qualifying vehicle.

Please see the instructions and FYI Income 67, available on-line at before competing this form.

Last Name or Business Name

First Name

Middle Initial

SSN

FEIN

Colorado Account Number

Part 1. Vehicle Information

1. Model Year

1

2. Vehicle Make

2

3. Vehicle Model

3

4. Vehicle Identification Number (VIN)

4

5. Date of purchase, lease, or conversion

5

6. Was the vehicle:

purchased new

purchased used

leased

converted

Part 2. General credit calculation for vehicle purchase

7. Incremental price difference or conversion cost (see instructions)

7

00

8. Federal credit for which the purchaser, lessor, or lessee is eligible

8

00

9. Any other grants, credits, or rebates for which the purchaser, lessor, or lessee is eligible

9

00

10. Line 8 plus line 9

10

00

11. Line 7 minus line 10

11

00

If vehicle was leased or purchased used, complete lines 12, 13, and 14. If vehicle was purchased new, skip lines 12,

13, and 14 and enter 1.00 on line 15.

12. Used cost or leased value (see instructions)

12

00

13. MSRP (or lessor’s adjusted vehicle cost for leased vehicle)

13

00

14. Divide line 12 by line 13

14

15. Enter 1.00 or the amount from line 14, whichever is less

15

16. Adjusted incremental price difference, line 11 multiplied by line 15

16

00

17. Credit percentage (see instructions)

17

%

18. Tentative tax credit, line 16 multiplied by line 17

18

00

1

1 2

2 3

3 4

4