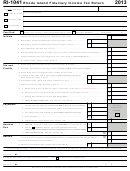

Form Ri-1041 - Rhode Island Fiduciary Income Tax Return 2002 Page 3

ADVERTISEMENT

2002

RI-1041

Name(s) shown on Form RI-1041

Employer identification number

RHODE ISLAND SCHEDULE D

PART 1

TAX COMPUTATION USING MAXIMUM CAPITAL GAINS RATES

(FOR TAXPAYERS WHO FILED FEDERAL SCHEDULE D OR

column A

COMPLETING PARTS 2 OR 3 BELOW)

column B

column C

1. RI Taxable Income - RI-1041, page 1, line 7……………………………………………………………..

1.

X 2.00% =

2. 8% capital gains - Federal Form 1041, schedule D, line 28……………………………………………………..

2.

X 2.50% =

3. 10% capital gains - Federal Form 1041, schedule D, line 30………………………………………………………..

3.

X 5.00% =

4. 20% capital gains - Federal Form 1041, schedule D, line 34……………………………………………………..

4.

X 6.25% =

5. 25% capitol gains - Federal Form 1041, schedule D worksheet, line 30………………………………….

5.

X 7.00% =

6. 28% capitol gains - Federal Form 1041, schedule D worksheet, line 33………………………………………..

6.

7. Total capital gains - add lines 2, 3, 4, 5 and 6 from column A……………………………………………………..

7.

8. Tax on RI capital gain income - add lines 2, 3, 4, 5 and 6 from column C…………………………………………………………………………………………

8.

9. RI ordinary income - subtract line 7 from line 1……………………………………………………………………….

9.

10. RI tax on line 9 - use RI Fiduciary Tax Rate Schedule…………………………………………………………………………………………….. 10.

11. RI tax on capital gain income and ordinary income - add lines 8 and 10………………………………………………………………………………………..

11.

12. RI tax on amount on line 1 - use RI Fiduciary Tax Rate Schedule………………………………………………………………………………………………………………………..

12.

13. Total RI income tax - (the smaller of line 11 or line 12)……………………………………………………………………………………………………………

13.

IF YOU HAVE NO TAX ON LUMP-SUM DISTRIBUTIONS OR RECAPTURE OF FEDERAL TAX CREDITS, ENTER AMOUNT

FROM LINE 13 ON LINE 18 BELOW. OTHERWISE, CONTINUE TO PARTS 2, 3 AND 4.

PART 2

TAX ON LUMP-SUM DISTRIBUTIONS

(FOR TAXPAYERS WHO FILED FEDERAL FORM 4972)

14. Tax on lump-sum distributions - Federal Form 1041, schedule G, line 1b…………………………………………………………………………………………………

14.

15. RI tax on lump-sum distributions - multiply line 14 by 25%…………………………………………………………………………………….. 15.

PART 3

RECAPTURE OF FEDERAL TAX CREDITS

(FOR TAXPAYERS WHO HAVE A RECAPTURE OF FEDERAL TAX CREDITS INCLUDED IN THEIR TAX)

16. Amount of recapture of federal tax credits - Federal Form 1041, schedule G, line 5………………………………………………………………………………..

16.

17. RI recapture taxes - multiply line 16 by 25%……………………………………………………………………………………………………….. 17.

PART 4

TOTAL OF PARTS 1, 2 AND 3

18. Total - add part 1, line 13; part 2, line 15 and part 3, line 17

Enter here and on RI-1041, page 1, line 8 and check the RI schedule D box……………………………………………………………………………….

18.

RI-6251 RHODE ISLAND ALTERNATIVE MINIMUM TAX

(FOR TAXPAYERS WHO FILED A FEDERAL FORM 6251)

19. Federal tentative alternative minimum tax - Federal Form 1041, schedule I, line 54…………………………………………………………………………………..

19.

20. RI tentative alternative minimum tax - multiply line 19 by 25 %…………………………………………………………………………………………………

20.

21. RI income tax - RI-1041, page 1, line 8…………………………………………………………………………………………………………………………………..

21.

22. Foreign tax credit - Federal Form 1041, schedule G, line 2a…………………………………………………………………………………….

22.

23. Multiply line 22 by line 25%……………………………………………………………………………………………………………………………………….

23.

24. Subtract line 23 from line 21…………………………………………………………………………………………………………………………………………

24.

25. RI alternative minimum tax - subtract line 24 from line 20 (if zero or less enter zero) - enter here and on RI-1041, line 9………………………………………………..

25.

page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3