Form Ia 137 - Ethanol Promotion Tax Credit - Iowa Department Of Revenue - 2008

ADVERTISEMENT

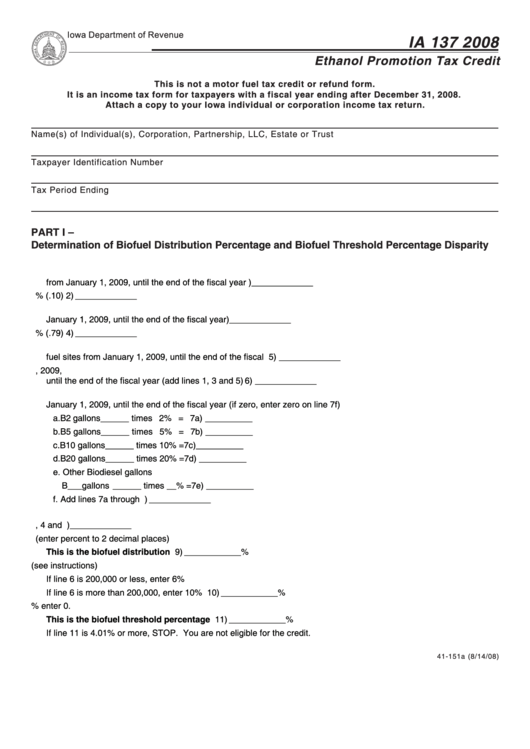

Iowa Department of Revenue

IA 137 2008

Ethanol Promotion Tax Credit

This is not a motor fuel tax credit or refund form.

It is an income tax form for taxpayers with a fiscal year ending after December 31, 2008.

Attach a copy to your Iowa individual or corporation income tax return.

Name(s) of Individual(s), Corporation, Partnership, LLC, Estate or Trust

Taxpayer Identification Number

Tax Period Ending

PART I –

Determination of Biofuel Distribution Percentage and Biofuel Threshold Percentage Disparity

1. Total amount of E10 gasoline gallons sold at all retail motor fuel sites

from January 1, 2009, until the end of the fiscal year ...................................... 1) _____________

2. Multiply line 1 by 10% (.10) ............................................................................................................. 2) _____________

3. Total amount of E85 gasoline gallons sold at all retail motor fuel sites from

January 1, 2009, until the end of the fiscal year .............................................. 3) _____________

4. Multiply line 3 by 79% (.79) ............................................................................................................. 4) _____________

5. Total amount of non-ethanol blended gasoline gallons sold at all retail motor

fuel sites from January 1, 2009, until the end of the fiscal year ....................... 5) _____________

6. Total gasoline gallons sold at all retail motor fuel sites from January 1, 2009,

until the end of the fiscal year (add lines 1, 3 and 5) ....................................... 6) _____________

7. Total gallons of biodiesel blended fuel sold at all retail motor fuel sites from

January 1, 2009, until the end of the fiscal year (if zero, enter zero on line 7f)

a. B2 gallons ______ times 2% = 7a) __________

b. B5 gallons ______ times 5% = 7b) __________

c. B10 gallons ______ times 10% = 7c) __________

d. B20 gallons ______ times 20% = 7d) __________

e. Other Biodiesel gallons

B___gallons ______ times __% = 7e) __________

f. Add lines 7a through 7e ............................................................................................................ 7f) _____________

8. Add lines 2, 4 and 7f ........................................................................................................................ 8) _____________

9. Divide line 8 by line 6 (enter percent to 2 decimal places)

This is the biofuel distribution percentage ................................................................................. 9) ____________ %

10. Biofuel threshold percentage (see instructions)

If line 6 is 200,000 or less, enter 6%

If line 6 is more than 200,000, enter 10% ...................................................................................... 10) ____________ %

11. Subtract line 9 from line 10. If less than 0% enter 0.

This is the biofuel threshold percentage disparity ................................................................... 11) ____________ %

If line 11 is 4.01% or more, STOP. You are not eligible for the credit.

41-151a (8/14/08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4