Print Form

Reset Form

Iowa Department of Revenue

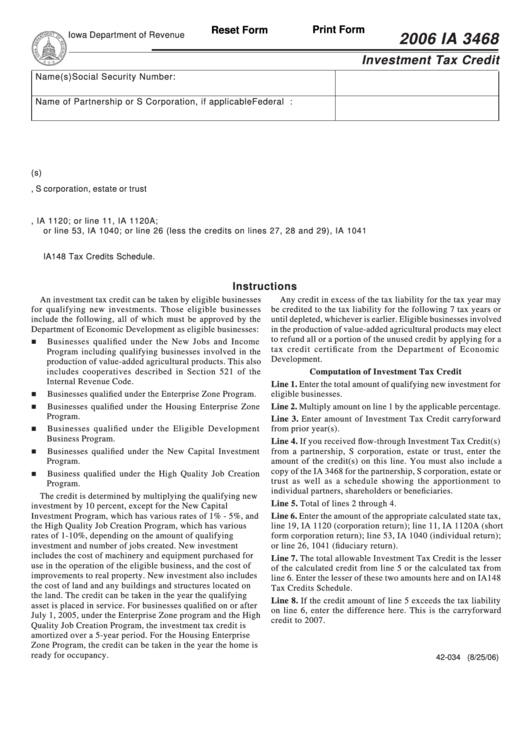

2006 IA 3468

Investment Tax Credit

Name(s)

Social Security Number:

Name of Partnership or S Corporation, if applicable

Federal T.I.N.:

1. Qualifying new investment for eligible businesses .................................................................... 1. _________________

2. Calculated credit. Multiply line 1 by the applicable percentage ............................................... 2. _________________

3. Investment Tax Credit Carryforward from prior year(s) ............................................................. 3. _________________

4. Flow-through Iowa Investment Tax Credit from partnership, S corporation, estate or trust ........ 4. _________________

5. Total Investment Tax Credit. Add lines 2 through 4. ................................................................. 5. _________________

6. Enter calculated state tax from line 19, IA 1120; or line 11, IA 1120A;

or line 53, IA 1040; or line 26 (less the credits on lines 27, 28 and 29), IA 1041 ................ 6. _________________

7. Total allowable Investment Tax Credit. Enter the smaller of line 5 or line 6 and enter on

IA148 Tax Credits Schedule. ........................................................................................................... 7. _________________

8. Total Carryforward Credit to 2007. See instructions. ................................................................. 8. _________________

Instructions

An investment tax credit can be taken by eligible businesses

Any credit in excess of the tax liability for the tax year may

for qualifying new investments. Those eligible businesses

be credited to the tax liability for the following 7 tax years or

include the following, all of which must be approved by the

until depleted, whichever is earlier. Eligible businesses involved

Department of Economic Development as eligible businesses:

in the production of value-added agricultural products may elect

to refund all or a portion of the unused credit by applying for a

Businesses qualified under the New Jobs and Income

tax credit certificate from the Department of Economic

Program including qualifying businesses involved in the

Development.

production of value-added agricultural products. This also

includes cooperatives described in Section 521 of the

Computation of Investment Tax Credit

Internal Revenue Code.

Line 1. Enter the total amount of qualifying new investment for

Businesses qualified under the Enterprise Zone Program.

eligible businesses.

Businesses qualified under the Housing Enterprise Zone

Line 2. Multiply amount on line 1 by the applicable percentage.

Program.

Line 3. Enter amount of Investment Tax Credit carryforward

Businesses qualified under the Eligible Development

from prior year(s).

Business Program.

Line 4. If you received flow-through Investment Tax Credit(s)

Businesses qualified under the New Capital Investment

from a partnership, S corporation, estate or trust, enter the

Program.

amount of the credit(s) on this line. You must also include a

copy of the IA 3468 for the partnership, S corporation, estate or

Business qualified under the High Quality Job Creation

trust as well as a schedule showing the apportionment to

Program.

individual partners, shareholders or beneficiaries.

The credit is determined by multiplying the qualifying new

Line 5. Total of lines 2 through 4.

investment by 10 percent, except for the New Capital

Investment Program, which has various rates of 1% - 5%, and

Line 6. Enter the amount of the appropriate calculated state tax,

the High Quality Job Creation Program, which has various

line 19, IA 1120 (corporation return); line 11, IA 1120A (short

rates of 1-10%, depending on the amount of qualifying

form corporation return); line 53, IA 1040 (individual return);

investment and number of jobs created. New investment

or line 26, 1041 (fiduciary return).

includes the cost of machinery and equipment purchased for

Line 7. The total allowable Investment Tax Credit is the lesser

use in the operation of the eligible business, and the cost of

of the calculated credit from line 5 or the calculated tax from

improvements to real property. New investment also includes

line 6. Enter the lesser of these two amounts here and on IA148

the cost of land and any buildings and structures located on

Tax Credits Schedule.

the land. The credit can be taken in the year the qualifying

Line 8. If the credit amount of line 5 exceeds the tax liability

asset is placed in service. For businesses qualified on or after

on line 6, enter the difference here. This is the carryforward

July 1, 2005, under the Enterprise Zone program and the High

credit to 2007.

Quality Job Creation Program, the investment tax credit is

amortized over a 5-year period. For the Housing Enterprise

Zone Program, the credit can be taken in the year the home is

ready for occupancy.

42-034 (8/25/06)

1

1