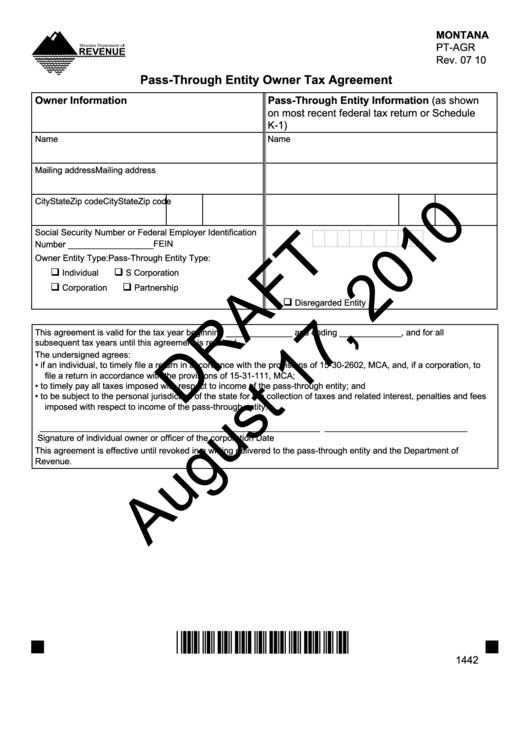

Montana Form Pt-Agr Draft - Pass-Through Entity Owner Tax Agreement - 2010

ADVERTISEMENT

Montana

PT-AGR

Rev. 07 10

Pass-through Entity owner tax agreement

owner Information

Pass-through Entity Information (as shown

on most recent federal tax return or Schedule

K-1)

Name

Name

Mailing address

Mailing address

City

State

Zip code

City

State

Zip code

Social Security Number or Federal Employer Identification

FEIN

Number __________________

Owner Entity Type:

Pass-Through Entity Type:

q

q

Individual

S Corporation

q

q

Corporation

Partnership

q

Disregarded Entity

This agreement is valid for the tax year beginning ______________ and ending _____________ , and for all

subsequent tax years until this agreement is revoked.

The undersigned agrees:

• if an individual, to timely file a return in accordance with the provisions of 15-30-2602, MCA, and, if a corporation, to

file a return in accordance with the provisions of 15-31-111, MCA;

• to timely pay all taxes imposed with respect to income of the pass-through entity; and

• to be subject to the personal jurisdiction of the state for the collection of taxes and related interest, penalties and fees

imposed with respect to income of the pass-through entity.

___________________________________________________________

______________________________

Signature of individual owner or officer of the corporation

Date

This agreement is effective until revoked in a writing delivered to the pass-through entity and the Department of

Revenue.

*14420101*

1442

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2