Form Pt-Agr - Pass-Through Entity Owner Tax Agreement - Montana Dept.of Revenue

ADVERTISEMENT

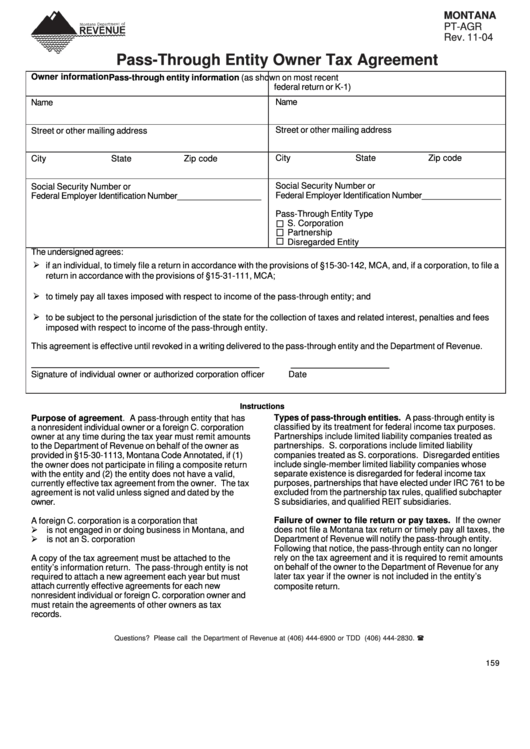

MONTANA

PT-AGR

Rev. 11-04

Pass-Through Entity Owner Tax Agreement

Owner information

Pass-through entity information (as shown on most recent

federal return or K-1)

Name

Name

Street or other mailing address

Street or other mailing address

City

State

Zip code

City

State

Zip code

Social Security Number or

Social Security Number or

Federal Employer Identification Number_________________

Federal Employer Identification Number__________________

Pass-Through Entity Type

S. Corporation

Partnership

Disregarded Entity

The undersigned agrees:

if an individual, to timely file a return in accordance with the provisions of §15-30-142, MCA, and, if a corporation, to file a

return in accordance with the provisions of §15-31-111, MCA;

to timely pay all taxes imposed with respect to income of the pass-through entity; and

to be subject to the personal jurisdiction of the state for the collection of taxes and related interest, penalties and fees

imposed with respect to income of the pass-through entity.

This agreement is effective until revoked in a writing delivered to the pass-through entity and the Department of Revenue.

Signature of individual owner or authorized corporation officer

Date

Instructions

Purpose of agreement. A pass-through entity that has

Types of pass-through entities. A pass-through entity is

classified by its treatment for federal income tax purposes.

a nonresident individual owner or a foreign C. corporation

Partnerships include limited liability companies treated as

owner at any time during the tax year must remit amounts

to the Department of Revenue on behalf of the owner as

partnerships. S. corporations include limited liability

companies treated as S. corporations. Disregarded entities

provided in §15-30-1113, Montana Code Annotated, if (1)

the owner does not participate in filing a composite return

include single-member limited liability companies whose

separate existence is disregarded for federal income tax

with the entity and (2) the entity does not have a valid,

currently effective tax agreement from the owner. The tax

purposes, partnerships that have elected under IRC 761 to be

excluded from the partnership tax rules, qualified subchapter

agreement is not valid unless signed and dated by the

owner.

S subsidiaries, and qualified REIT subsidiaries.

A foreign C. corporation is a corporation that

Failure of owner to file return or pay taxes. If the owner

does not file a Montana tax return or timely pay all taxes, the

is not engaged in or doing business in Montana, and

is not an S. corporation

Department of Revenue will notify the pass-through entity.

Following that notice, the pass-through entity can no longer

rely on the tax agreement and it is required to remit amounts

A copy of the tax agreement must be attached to the

on behalf of the owner to the Department of Revenue for any

entity’s information return. The pass-through entity is not

later tax year if the owner is not included in the entity’s

required to attach a new agreement each year but must

attach currently effective agreements for each new

composite return.

nonresident individual or foreign C. corporation owner and

must retain the agreements of other owners as tax

records.

Questions? Please call the Department of Revenue at (406) 444-6900 or TDD (406) 444-2830.

159

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1