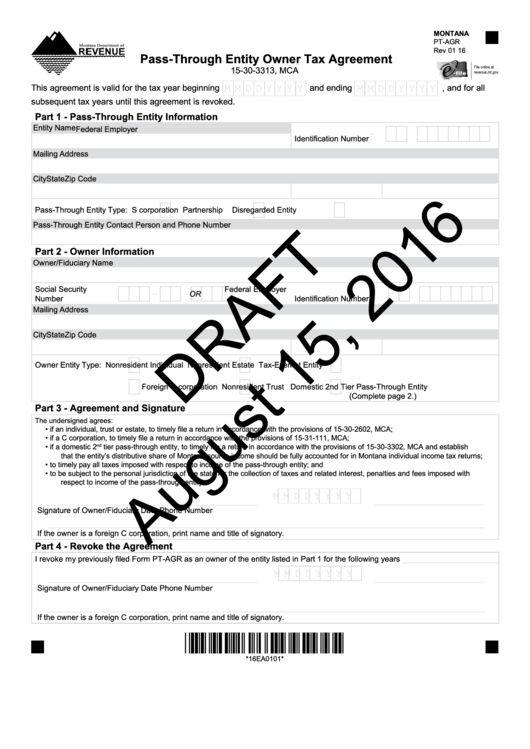

MONTANA

PT-AGR

Rev 01 16

Pass-Through Entity Owner Tax Agreement

15-30-3313, MCA

M M D D Y Y Y Y

M M D D Y Y Y Y

This agreement is valid for the tax year beginning

and ending

, and for all

subsequent tax years until this agreement is revoked.

Part 1 - Pass-Through Entity Information

Entity Name

Federal Employer

-

Identification Number

Mailing Address

City

State

Zip Code

Pass-Through Entity Type:

S corporation

Partnership

Disregarded Entity

Pass-Through Entity Contact Person and Phone Number

Part 2 - Owner Information

Owner/Fiduciary Name

Social Security

Federal Employer

-

-

-

OR

Number

Identification Number

Mailing Address

City

State

Zip Code

Owner Entity Type:

Nonresident Individual

Nonresident Estate

Tax-Exempt Entity

Foreign C corporation

Nonresident Trust

Domestic 2nd Tier Pass-Through Entity

(Complete page 2.)

Part 3 - Agreement and Signature

The undersigned agrees:

•

if an individual, trust or estate, to timely file a return in accordance with the provisions of 15-30-2602, MCA;

•

if a C corporation, to timely file a return in accordance with the provisions of 15-31-111, MCA;

•

if a domestic 2

tier pass-through entity, to timely file a return in accordance with the provisions of 15-30-3302, MCA and establish

nd

that the entity’s distributive share of Montana source income should be fully accounted for in Montana individual income tax returns;

•

to timely pay all taxes imposed with respect to income of the pass-through entity; and

•

to be subject to the personal jurisdiction of the state for the collection of taxes and related interest, penalties and fees imposed with

respect to income of the pass-through entity.

M M D D Y Y Y Y

____________________________________________

_______________________

Signature of Owner/Fiduciary

Date

Phone Number

____________________________________________________________________________________________

If the owner is a foreign C corporation, print name and title of signatory.

Part 4 - Revoke the Agreement

I revoke my previously filed Form PT-AGR as an owner of the entity listed in Part 1 for the following years

______________________

M M D D Y Y Y Y

____________________________________________

_______________________

Signature of Owner/Fiduciary

Date

Phone Number

____________________________________________________________________________________________

If the owner is a foreign C corporation, print name and title of signatory.

*16EA0101*

*16EA0101*

1

1 2

2 3

3 4

4