Instructions For Arizona Form 308 - Research And Development Expenses Credit - 1999

ADVERTISEMENT

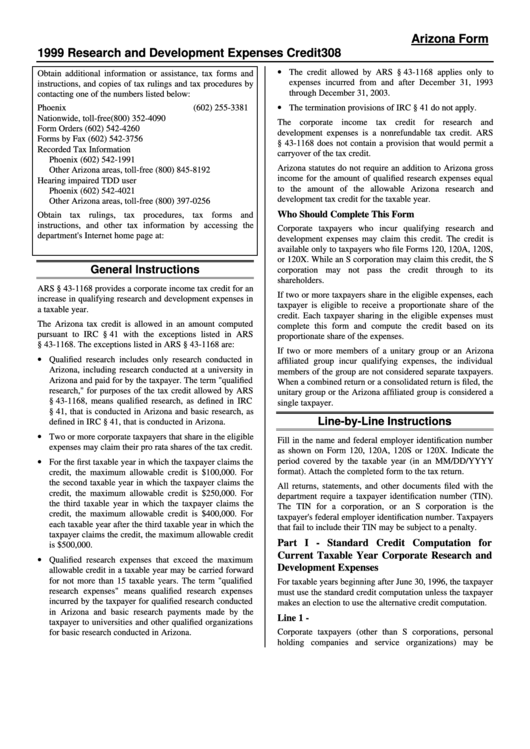

Arizona Form

1999 Research and Development Expenses Credit

308

• The credit allowed by ARS § 43-1168 applies only to

Obtain additional information or assistance, tax forms and

expenses incurred from and after December 31, 1993

instructions, and copies of tax rulings and tax procedures by

through December 31, 2003.

contacting one of the numbers listed below:

• The termination provisions of IRC § 41 do not apply.

Phoenix

(602) 255-3381

Nationwide, toll-free

(800) 352-4090

The corporate income tax credit for research and

Form Orders

(602) 542-4260

development expenses is a nonrefundable tax credit. ARS

Forms by Fax

(602) 542-3756

§ 43-1168 does not contain a provision that would permit a

Recorded Tax Information

carryover of the tax credit.

Phoenix

(602) 542-1991

Arizona statutes do not require an addition to Arizona gross

Other Arizona areas, toll-free

(800) 845-8192

income for the amount of qualified research expenses equal

Hearing impaired TDD user

to the amount of the allowable Arizona research and

Phoenix

(602) 542-4021

development tax credit for the taxable year.

Other Arizona areas, toll-free

(800) 397-0256

Who Should Complete This Form

Obtain tax rulings, tax procedures, tax forms and

instructions, and other tax information by accessing the

Corporate taxpayers who incur qualifying research and

department's Internet home page at:

development expenses may claim this credit. The credit is

available only to taxpayers who file Forms 120, 120A, 120S,

or 120X. While an S corporation may claim this credit, the S

General Instructions

corporation may not pass the credit through to its

shareholders.

ARS § 43-1168 provides a corporate income tax credit for an

If two or more taxpayers share in the eligible expenses, each

increase in qualifying research and development expenses in

taxpayer is eligible to receive a proportionate share of the

a taxable year.

credit. Each taxpayer sharing in the eligible expenses must

The Arizona tax credit is allowed in an amount computed

complete this form and compute the credit based on its

pursuant to IRC § 41 with the exceptions listed in ARS

proportionate share of the expenses.

§ 43-1168. The exceptions listed in ARS § 43-1168 are:

If two or more members of a unitary group or an Arizona

• Qualified research includes only research conducted in

affiliated group incur qualifying expenses, the individual

Arizona, including research conducted at a university in

members of the group are not considered separate taxpayers.

Arizona and paid for by the taxpayer. The term "qualified

When a combined return or a consolidated return is filed, the

research," for purposes of the tax credit allowed by ARS

unitary group or the Arizona affiliated group is considered a

§ 43-1168, means qualified research, as defined in IRC

single taxpayer.

§ 41, that is conducted in Arizona and basic research, as

Line-by-Line Instructions

defined in IRC § 41, that is conducted in Arizona.

• Two or more corporate taxpayers that share in the eligible

Fill in the name and federal employer identification number

expenses may claim their pro rata shares of the tax credit.

as shown on Form 120, 120A, 120S or 120X. Indicate the

• For the first taxable year in which the taxpayer claims the

period covered by the taxable year (in an MM/DD/YYYY

format). Attach the completed form to the tax return.

credit, the maximum allowable credit is $100,000. For

the second taxable year in which the taxpayer claims the

All returns, statements, and other documents filed with the

credit, the maximum allowable credit is $250,000. For

department require a taxpayer identification number (TIN).

the third taxable year in which the taxpayer claims the

The TIN for a corporation, or an S corporation is the

credit, the maximum allowable credit is $400,000. For

taxpayer's federal employer identification number. Taxpayers

each taxable year after the third taxable year in which the

that fail to include their TIN may be subject to a penalty.

taxpayer claims the credit, the maximum allowable credit

Part I - Standard Credit Computation for

is $500,000.

Current Taxable Year Corporate Research and

• Qualified research expenses that exceed the maximum

Development Expenses

allowable credit in a taxable year may be carried forward

for not more than 15 taxable years. The term "qualified

For taxable years beginning after June 30, 1996, the taxpayer

research expenses" means qualified research expenses

must use the standard credit computation unless the taxpayer

incurred by the taxpayer for qualified research conducted

makes an election to use the alternative credit computation.

in Arizona and basic research payments made by the

Line 1 -

taxpayer to universities and other qualified organizations

Corporate taxpayers (other than S corporations, personal

for basic research conducted in Arizona.

holding companies and service organizations) may be

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8