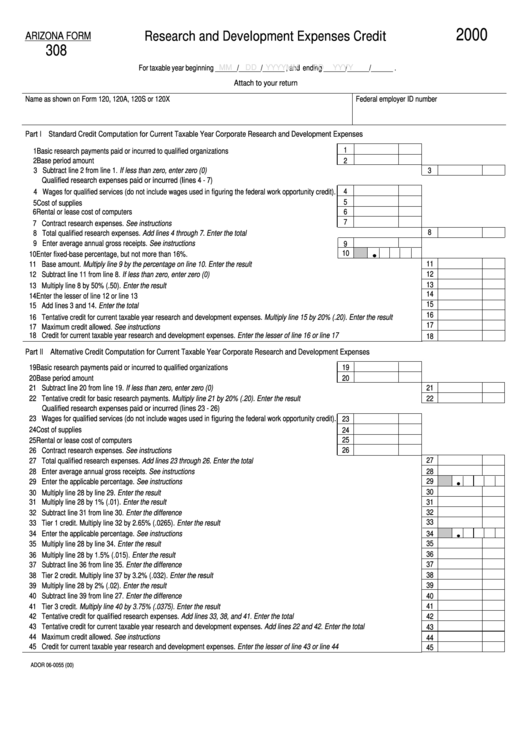

Form 308 - Research And Development Expenses Credit - 2000

ADVERTISEMENT

2000

Research and Development Expenses Credit

ARIZONA FORM

308

For taxable year beginning ______/______/______ , and ending ______/______/______ .

MM

DD

YYYY

MM

DD

YYYY

Attach to your return

Name as shown on Form 120, 120A, 120S or 120X

Federal employer ID number

Part I Standard Credit Computation for Current Taxable Year Corporate Research and Development Expenses

1

1 Basic research payments paid or incurred to qualified organizations .......................................................

2 Base period amount ..................................................................................................................................

2

3 Subtract line 2 from line 1. If less than zero, enter zero (0) .......................................................................................................................

3

Qualified research expenses paid or incurred (lines 4 - 7)

4

4 Wages for qualified services (do not include wages used in figuring the federal work opportunity credit).

5

5 Cost of supplies .........................................................................................................................................

6 Rental or lease cost of computers .............................................................................................................

6

7

7 Contract research expenses. See instructions ..........................................................................................

8

8 Total qualified research expenses. Add lines 4 through 7. Enter the total ................................................................................................

9 Enter average annual gross receipts. See instructions .............................................................................

9

10

10 Enter fixed-base percentage, but not more than 16%. ..............................................................................

11

11 Base amount. Multiply line 9 by the percentage on line 10. Enter the result .............................................................................................

12

12 Subtract line 11 from line 8. If less than zero, enter zero (0) .....................................................................................................................

13

13 Multiply line 8 by 50% (.50). Enter the result .............................................................................................................................................

14

14 Enter the lesser of line 12 or line 13 ..........................................................................................................................................................

15

15 Add lines 3 and 14. Enter the total ............................................................................................................................................................

16

16 Tentative credit for current taxable year research and development expenses. Multiply line 15 by 20% (.20). Enter the result ..............

17

17 Maximum credit allowed. See instructions ................................................................................................................................................

18 Credit for current taxable year research and development expenses. Enter the lesser of line 16 or line 17 .............................................

18

Part II Alternative Credit Computation for Current Taxable Year Corporate Research and Development Expenses

19 Basic research payments paid or incurred to qualified organizations .......................................................

19

20 Base period amount ..................................................................................................................................

20

21 Subtract line 20 from line 19. If less than zero, enter zero (0) ...................................................................................................................

21

22 Tentative credit for basic research payments. Multiply line 21 by 20% (.20). Enter the result ..................................................................

22

Qualified research expenses paid or incurred (lines 23 - 26)

23 Wages for qualified services (do not include wages used in figuring the federal work opportunity credit).

23

24 Cost of supplies .........................................................................................................................................

24

25

25 Rental or lease cost of computers .............................................................................................................

26

26 Contract research expenses. See instructions ..........................................................................................

27

27 Total qualified research expenses. Add lines 23 through 26. Enter the total .............................................................................................

28 Enter average annual gross receipts. See instructions .............................................................................................................................

28

29

29 Enter the applicable percentage. See instructions ....................................................................................................................................

30

30 Multiply line 28 by line 29. Enter the result ................................................................................................................................................

31 Multiply line 28 by 1% (.01). Enter the result .............................................................................................................................................

31

32

32 Subtract line 31 from line 30. Enter the difference .....................................................................................................................................

33

33 Tier 1 credit. Multiply line 32 by 2.65% (.0265). Enter the result ...............................................................................................................

34 Enter the applicable percentage. See instructions ....................................................................................................................................

34

35 Multiply line 28 by line 34. Enter the result ................................................................................................................................................

35

36

36 Multiply line 28 by 1.5% (.015). Enter the result ........................................................................................................................................

37

37 Subtract line 36 from line 35. Enter the difference .....................................................................................................................................

38

38 Tier 2 credit. Multiply line 37 by 3.2% (.032). Enter the result ...................................................................................................................

39 Multiply line 28 by 2% (.02). Enter the result .............................................................................................................................................

39

40 Subtract line 39 from line 27. Enter the difference .....................................................................................................................................

40

41 Tier 3 credit. Multiply line 40 by 3.75% (.0375). Enter the result ...............................................................................................................

41

42 Tentative credit for qualified research expenses. Add lines 33, 38, and 41. Enter the total ......................................................................

42

43 Tentative credit for current taxable year research and development expenses. Add lines 22 and 42. Enter the total ..............................

43

44 Maximum credit allowed. See instructions .................................................................................................................................................

44

45 Credit for current taxable year research and development expenses. Enter the lesser of line 43 or line 44 .............................................

45

ADOR 06-0055 (00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2