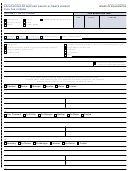

Form 41a720rc - Schedule Rc - Application For Income Tax/llet Credit For Recycling And/or Composting Equipment Or Major Recycling Project - 2016 Page 2

ADVERTISEMENT

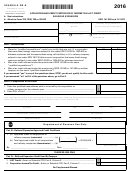

41A720RC (10–16)

Page 2

*1600010233*

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Name of Pass-through Entity

Federal Identification Number

Complete this section if you are a partner, member or shareholder

of a pass–through entity that was approved for a Major Recycling

Project.

___ ___ ___ ___ ___ ___ ___ ___ ___

MAJOR RECYCLING PROJECT

PART IV—Requirements Questionnaire

Yes

No

1. Was the investment in recycling or composting equipment more than $10,000,000 and used

exclusively in Kentucky? ...................................................................................................................................................

1

2. Were there more than 750 full–time employees with an average hourly wage of more than

300 percent of the federal minimum wage? ...................................................................................................................

2

a. Average minimum wage ........................................................ $

b. Number of employees earning this wage ............................

3. Did plant and equipment have a total cost of more than $500,000,000? ....................................................................

3

a. Total cost .................................................................................. $

If "yes" to all three requirements, you are entitled to the Major Recycling Credit. If "no" to any of the three questions, you are not

entitled to the Major Recycling Credit.

PART V—Credit Calculation

LLET

Income Tax

1. Enter the LLET liability from Form 720, 720S, 725

00

or 765 (see instructions) ...........................................................................................

1

2. Enter the income tax liability from Form 720, 740, 740-NP

00

or 741 (see instructions) ...........................................................................................

2

3. Baseline tax liability (see instructions) ....................................................................

3

00

4. Excess of tax liability over baseline tax liability (line 1 or line 2 less

line 3).........................................................................................................................

4

00

00

5. Limitation (line 4 multiplied by 50% (.50)) .............................................................

5

00

00

00

00

6. Enter the lesser of line 5 or $2,500,000 ...................................................................

6

7. LLET Credit (see instructions) ..................................................................................

7

00

8. Corporation Income Tax Credit (see instructions) ..................................................

8

00

9. Individual Income Tax Credit—Enter on Form 740, 740–NP or 741 .......................

9

00

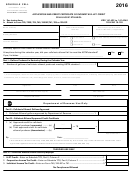

PART VI—Amount of Credit Claimed

A

B

C

Taxable Year Credit Taken

Balance of Major

Amount of Credit Used

Recycling Project Credit

(Month/Year)

LLET

Income Tax

LLET

Income Tax

1.

__ __ / __ __ __ __

00

00

00

00

2.

__ __ / __ __ __ __

00

00

00

00

3.

__ __ / __ __ __ __

00

00

00

00

4.

__ __ / __ __ __ __

00

00

00

00

5.

__ __ / __ __ __ __

00

00

00

00

6.

__ __ / __ __ __ __

00

00

00

00

7.

__ __ / __ __ __ __

00

00

00

00

8.

__ __ / __ __ __ __

00

00

00

00

9.

__ __ / __ __ __ __

00

00

00

00

10.

__ __ / __ __ __ __

00

00

00

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3