Instructions For Schedule Nld - Illinois Net Loss Deduction

ADVERTISEMENT

Schedule NLD Instructions

General Information

Specific Instructions

Line 1 instructions for the appropriate line

reference for your return type. If you are

submitting this schedule as support for an

What is new?

Part I: Figure your Illinois net

amended return, write the amount shown on

loss deduction (NLD)

Form IL-1120-X, Part IV, Line 1, Column C,

You must attach copies of the original loss

minus Part IV, Line 2, Column A; Form

year returns, front and back, amended

Column A —

Write the month and year of

IL-1120X-PY, Part I, Line 8, Column C, minus

returns, or audit reports reflecting the loss

the tax year in which the earliest Illinois net

Part I, Line 9, Column A; or, the appropriate

amounts that you are claiming on this

loss occurred.

line from your revised Illinois return that was

schedule. Failure to do so will result in

Line 1 —

Write the Illinois net loss from

attached to your Form IL-843. If this is a

processing delays.

your loss year

negative amount, you should not be using

• Form IL-1120, Part IV, Line 1

Schedule NLD.

What is the purpose of this

• Form IL-1120-ST, Part II, Line 1a

Line 5 —

Write the lesser of Line 3 or

schedule?

• Form IL-1065, Part II, Line 1a

Line 4. This is your Illinois net loss deduction

• Form IL-1041, Part III, Line 1a

(NLD) to be used this year.

The purpose of Schedule NLD is to calculate

• Form IL-990-T, Part III, Line 1a

Line 6 —

your total amount of Illinois net loss available,

Subtract Line 5 from Line 4. The

If the loss originated from a company other

the amount deductible for this year, and the

than the one filing this return, complete Part II.

last column amount on this line is your

remaining NLD available for use in other

Illinois income after NLD.

Note: Form IL-1041 filers only, you must

years. This Illinois net loss is allowed as a

Line 7 —

Subtract Line 5 from Line 3. Do

modify the Illinois net loss reported on the

carryback or carryforward deduction in the

not write this amount on this year’s return.

loss year by adding or subtracting the

manner allowed under Internal Revenue

This is your remaining NLD to be carried to

exceptions and limitations provided for in

Code (IRC), Section 172, including, for

subsequent years.

IRC, Section 1.642(d)-1. Write the result on

example, the conditions and limitations of

Line 1. If any of the income reported in the

Note: If there is an NLD remaining after this

IRC, Sections 381 and 382.

loss year, to which the IRC, Section

year (Line 7 is greater than zero), the

1.642(d)-1, adjustments apply, was subject

amount on Line 5 must be included on any

When must I use this

to Illinois apportionment or allocation, the

subsequent year’s Schedule NLD, Line 2.

schedule?

IRC adjustments required here should be

Columns B and C —

Complete all lines of

similarly apportioned or allocated. You must

the columns as needed for additional Illinois

You must use this schedule to carry forward

attach a worksheet showing your computa-

net loss years.

or back an Illinois net loss. An Illinois net loss

tion of the adjustment amount made.

Lines 1 through 3 —

Follow the instruc-

deduction (NLD) can be used to reduce the

Lines 2a through 2c —

Write the month

tions for Column A.

base income allocable to Illinois only if the

and year to which the loss has been previ-

loss year return has been filed and the loss

Line 4 —

Write the amount from Line 6 of

ously carried and the amount of Illinois net

was not used to offset income from any other

.

the preceding column

loss previously used to offset base income

tax year. If you are a member of a unitary

allocable to Illinois. This amount is shown on

Line 5 —

Follow the instructions for

group, you must use Schedule UB/NLD.

the prior year

Column A. Add Columns A, B, and C. This is

Note: If corrections have been made to the

• Form IL-1120, Part IV, Line 2

your total NLD to be used this year. Write

loss amount ( e.g., federal audit, or amended

• Form IL-1120-ST, Part II, Line 1b

this amount in the box and on the “Illinois net

return), you must report the corrected

• Form IL-1065, Part II, Line 1b

loss deduction” line of this year’s return or

amount when you file this schedule.

• Form IL-1041, Part III, Line 1b

amended return. See Line 2 instructions for

• Form IL-990-T, Part III, Line 1b

the appropriate line reference for your return

What if I need additional

• Form IL-1120-X, Part IV, Line 2, Column C

or amended return.

• Form IL-1120X-PY, Part I, Line 9, Column C

assistance?

Lines 6 and 7 —

Follow the instructions

• revised Illinois return attached to your

.

for Column A

Form IL-843

For further information you may write to

Part II: Identify the loss year

Illinois Department of Revenue, P.O. Box

Note: If the loss has been carried to more

19044, Springfield, IL 62794-9044. If you

than three years and additional space is

company

prefer, you may call 1 800 732-8866,

needed, complete and attach an additional

Lines 8 through 10 —

Follow the instruc-

217 782-3336, or the TDD-telecommunica-

sheet in the same format as Line 2a.

tions device for the deaf 1 800 544-5304.

tions on the form.

Line 4 —

Write the amount of base income

allocable to Illinois for the carry year. See

A

B

C

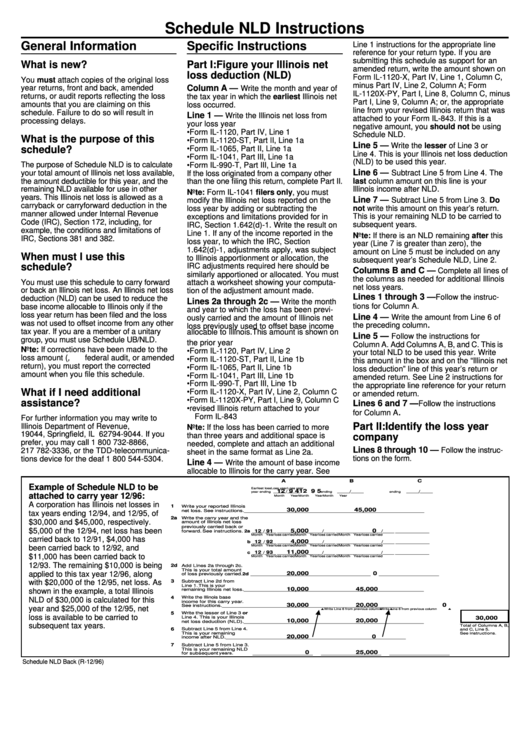

Example of Schedule NLD to be

Earliest loss

Loss year

Loss year

12 9 5

12 9 4

_____/_____

_____/_____

_____/_____

year ending

ending

ending

attached to carry year 12/96:

Month

Year

Month

Year

Month

Year

A corporation has Illinois net losses in

1

Write your reported Illinois

30,000

45,000

net loss. See instructions.

____________________

____________________

____________________

tax years ending 12/94, and 12/95, of

2a

Write the carry year and the

$30,000 and $45,000, respectively.

amount of Illinois net loss

previously carried back or

$5,000 of the 12/94, net loss has been

5,000

0

forward. See instructions. 2a ____/____ ____________

12

91

____/____ ____________

____/____ ____________

Month Year

loss carried

Month Year

loss carried

Month Year

loss carried

carried back to 12/91, $4,000 has

4,000

12

92

b ____/____ ____________

____/____ ____________

____/____ ____________

Month Year

loss carried

Month Year

loss carried

Month Year

loss carried

been carried back to 12/92, and

11,000

12

93

c ____/____ ____________

____/____ ____________

____/____ ____________

$11,000 has been carried back to

Month Year

loss carried

Month Year

loss carried

Month Year

loss carried

12/93. The remaining $10,000 is being

2d

Add Lines 2a through 2c.

This is your total amount

applied to this tax year 12/96, along

20,000

0

of loss previously carried. 2d ____________________

____________________

____________________

with $20,000 of the 12/95, net loss. As

3

Subtract Line 2d from

Line 1. This is your

10,000

45,000

shown in the example, a total Illinois

remaining Illinois net loss.

____________________

____________________

____________________

Write the Illinois base

4

NLD of $30,000 is calculated for this

income for this carry year.

30,000

20,000

0

See instructions.

____________________

____________________

____________________

year and $25,000 of the 12/95, net

Write Line 6 from previous column

Write Line 6 from previous column

5

Write the lesser of Line 3 or

loss is available to be carried to

Line 4. This is your Illinois

30,000

10,000

20,000

net loss deduction (NLD).

____________________

____________________

____________________

subsequent tax years.

Total of Columns A, B,

6

Subtract Line 5 from Line 4.

and C, Line 5.

This is your remaining

See instructions.

20,000

0

income after NLD.

____________________

____________________

____________________

7

Subtract Line 5 from Line 3.

This is your remaining NLD

0

25,000

for subsequent

years.

____________________

____________________

____________________

Schedule NLD Back (R-12/96)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1