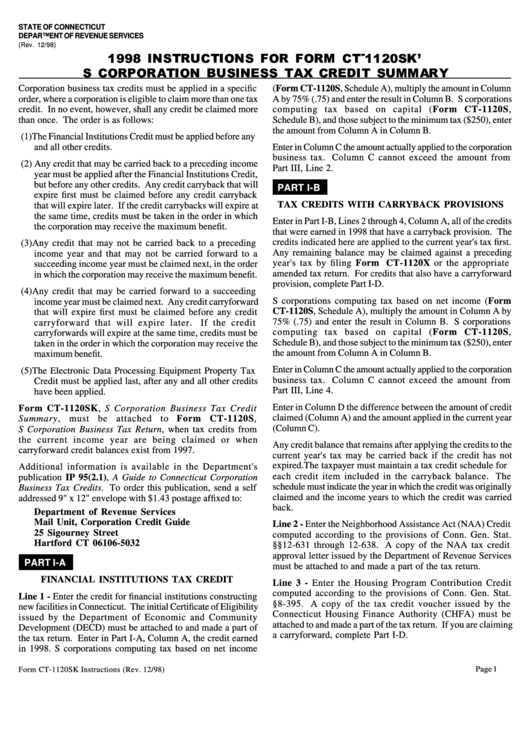

Instructions For Form Ct-1120sk - S Corporation Business Tax Credit Summary - 1998

ADVERTISEMENT

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

(Rev. 12/98)

Corporation business tax credits must be applied in a specific

(Form CT-1120S, Schedule A), multiply the amount in Column

order, where a corporation is eligible to claim more than one tax

A by 75% (.75) and enter the result in Column B. S corporations

credit. In no event, however, shall any credit be claimed more

computing tax based on capital (Form CT-1120S,

than once. The order is as follows:

Schedule B), and those subject to the minimum tax ($250), enter

the amount from Column A in Column B.

(1) The Financial Institutions Credit must be applied before any

and all other credits.

Enter in Column C the amount actually applied to the corporation

business tax. Column C cannot exceed the amount from

(2) Any credit that may be carried back to a preceding income

Part III, Line 2.

year must be applied after the Financial Institutions Credit,

but before any other credits. Any credit carryback that will

PART I-B

expire first must be claimed before any credit carryback

TAX CREDITS WITH CARRYBACK PROVISIONS

that will expire later. If the credit carrybacks will expire at

the same time, credits must be taken in the order in which

Enter in Part I-B, Lines 2 through 4, Column A, all of the credits

the corporation may receive the maximum benefit.

that were earned in 1998 that have a carryback provision. The

credits indicated here are applied to the current year's tax first.

(3) Any credit that may not be carried back to a preceding

Any remaining balance may be claimed against a preceding

income year and that may not be carried forward to a

year's tax by filing Form CT-1120X or the appropriate

succeeding income year must be claimed next, in the order

amended tax return. For credits that also have a carryforward

in which the corporation may receive the maximum benefit.

provision, complete Part I-D.

(4) Any credit that may be carried forward to a succeeding

S corporations computing tax based on net income (Form

income year must be claimed next. Any credit carryforward

CT-1120S, Schedule A), multiply the amount in Column A by

that will expire first must be claimed before any credit

75% (.75) and enter the result in Column B. S corporations

carryforward that will expire later.

If the credit

computing tax based on capital (Form CT-1120S,

carryforwards will expire at the same time, credits must be

Schedule B), and those subject to the minimum tax ($250), enter

taken in the order in which the corporation may receive the

the amount from Column A in Column B.

maximum benefit.

Enter in Column C the amount actually applied to the corporation

(5) The Electronic Data Processing Equipment Property Tax

business tax. Column C cannot exceed the amount from

Credit must be applied last, after any and all other credits

Part III, Line 4.

have been applied.

Enter in Column D the difference between the amount of credit

Form CT-1120SK, S Corporation Business Tax Credit

claimed (Column A) and the amount applied in the current year

Summary, must be attached to Form CT-1120S,

(Column C).

S Corporation Business Tax Return, when tax credits from

the current income year are being claimed or when

Any credit balance that remains after applying the credits to the

carryforward credit balances exist from 1997.

current year's tax may be carried back if the credit has not

expired. The taxpayer must maintain a tax credit schedule for

Additional information is available in the Department's

each credit item included in the carryback balance. The

publication IP 95(2.1), A Guide to Connecticut Corporation

schedule must indicate the year in which the credit was originally

Business Tax Credits. To order this publication, send a self

claimed and the income years to which the credit was carried

addressed 9" x 12" envelope with $1.43 postage affixed to:

back.

Department of Revenue Services

Mail Unit, Corporation Credit Guide

Line 2 - Enter the Neighborhood Assistance Act (NAA) Credit

25 Sigourney Street

computed according to the provisions of Conn. Gen. Stat.

Hartford CT 06106-5032

§§12-631 through 12-638. A copy of the NAA tax credit

approval letter issued by the Department of Revenue Services

PART I-A

must be attached to and made a part of the tax return.

FINANCIAL INSTITUTIONS TAX CREDIT

Line 3 - Enter the Housing Program Contribution Credit

computed according to the provisions of Conn. Gen. Stat.

Line 1 - Enter the credit for financial institutions constructing

§8-395. A copy of the tax credit voucher issued by the

new facilities in Connecticut. The initial Certificate of Eligibility

Connecticut Housing Finance Authority (CHFA) must be

issued by the Department of Economic and Community

attached to and made a part of the tax return. If you are claiming

Development (DECD) must be attached to and made a part of

a carryforward, complete Part I-D.

the tax return. Enter in Part I-A, Column A, the credit earned

in 1998. S corporations computing tax based on net income

Page 1

Form CT-1120SK Instructions (Rev. 12/98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4