Instructions For Form Ct-1120cr - Combined Corporation Business Tax Return - 2012

ADVERTISEMENT

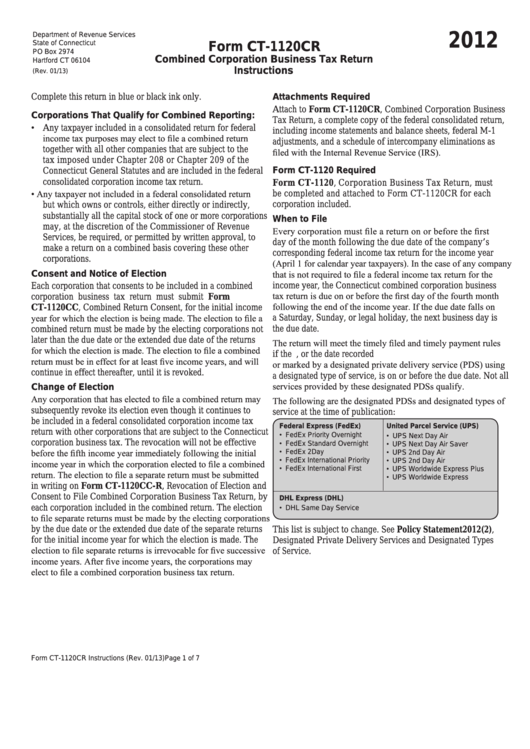

2012

Department of Revenue Services

State of Connecticut

Form CT-1120CR

PO Box 2974

Combined Corporation Business Tax Return

Hartford CT 06104

Instructions

(Rev. 01/13)

Complete this return in blue or black ink only.

Attachments Required

Attach to Form CT-1120CR, Combined Corporation Business

Corporations That Qualify for Combined Reporting:

Tax Return, a complete copy of the federal consolidated return,

• Any taxpayer included in a consolidated return for federal

including income statements and balance sheets, federal M-1

income tax purposes may elect to file a combined return

adjustments, and a schedule of intercompany eliminations as

together with all other companies that are subject to the

filed with the Internal Revenue Service (IRS).

tax imposed under Chapter 208 or Chapter 209 of the

Form CT-1120 Required

Connecticut General Statutes and are included in the federal

consolidated corporation income tax return.

Form CT-1120, Corporation Business Tax Return, must

• Any taxpayer not included in a federal consolidated return

be completed and attached to Form CT-1120CR for each

corporation included.

but which owns or controls, either directly or indirectly,

substantially all the capital stock of one or more corporations

When to File

may, at the discretion of the Commissioner of Revenue

Every corporation must file a return on or before the first

Services, be required, or permitted by written approval, to

day of the month following the due date of the company’s

make a return on a combined basis covering these other

corresponding federal income tax return for the income year

corporations.

(April 1 for calendar year taxpayers). In the case of any company

that is not required to file a federal income tax return for the

Consent and Notice of Election

income year, the Connecticut combined corporation business

Each corporation that consents to be included in a combined

tax return is due on or before the first day of the fourth month

corporation business tax return must submit Form

following the end of the income year. If the due date falls on

CT-1120CC, Combined Return Consent, for the initial income

year for which the election is being made. The election to file a

a Saturday, Sunday, or legal holiday, the next business day is

the due date.

combined return must be made by the electing corporations not

later than the due date or the extended due date of the returns

The return will meet the timely filed and timely payment rules

for which the election is made. The election to file a combined

if the U.S. Postal Service cancellation date, or the date recorded

return must be in effect for at least five income years, and will

or marked by a designated private delivery service (PDS) using

continue in effect thereafter, until it is revoked.

a designated type of service, is on or before the due date. Not all

services provided by these designated PDSs qualify.

Change of Election

Any corporation that has elected to file a combined return may

The following are the designated PDSs and designated types of

subsequently revoke its election even though it continues to

service at the time of publication:

be included in a federal consolidated corporation income tax

Federal Express (FedEx)

United Parcel Service (UPS)

return with other corporations that are subject to the Connecticut

• FedEx Priority Overnight

• UPS Next Day Air

• FedEx Standard Overnight

corporation business tax. The revocation will not be effective

• UPS Next Day Air Saver

• FedEx 2Day

before the fifth income year immediately following the initial

• UPS 2nd Day Air

• FedEx International Priority

• UPS 2nd Day Air A.M.

income year in which the corporation elected to file a combined

• FedEx International First

• UPS Worldwide Express Plus

return. The election to file a separate return must be submitted

• UPS Worldwide Express

in writing on Form CT-1120CC-R, Revocation of Election and

Consent to File Combined Corporation Business Tax Return, by

DHL Express (DHL)

• DHL Same Day Service

each corporation included in the combined return. The election

to file separate returns must be made by the electing corporations

by the due date or the extended due date of the separate returns

This list is subject to change. See Policy Statement 2012(2),

for the initial income year for which the election is made. The

Designated Private Delivery Services and Designated Types

election to file separate returns is irrevocable for five successive

of Service.

income years. After five income years, the corporations may

elect to file a combined corporation business tax return.

Form CT-1120CR Instructions (Rev. 01/13)

Page 1 of 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7