Instructions For Schedule It-2210a - Annualized Income Schedule For The Underpayment Of Indiana Individual Estimated Tax

ADVERTISEMENT

Annualized Income Schedule for the Underpayment of

Schedule

IT-2210A

Indiana Individual Estimated Tax: Line-by-line Instructions

Revised 6/98

Section I

Line G: Prior Year’s Tax Exception: If you filed

Indiana individual income tax return. See the

If you are a farmer or fisherman you will not

a 1997 IT-40 as a full year resident, add lines

example below.

owe a penalty if you meet both of the following

16 and 17 (your income tax) and subtract the

requirements: 1) your gross income from farm-

totals of lines 21 and 22 (your credits). Enter

Example:

ing or fishing is at least 2/3 of your annual gross

the result here. If you filed a 1997 IT-40PNR

• Kay moved out of Indiana on April 15, 1998,

income for 1997 or 1998; and 2) you filed your

as a full-year nonresident, add lines 10 and 11

so she was a resident for 3.5 months.

Indiana income tax return and paid the state and

from that return and subtract the total of the lines

• Her 1998 IT-40PNR line 1B income is

county income taxes due by March 1, 1999.

18 and 19 credits. Enter the result here.

$10,000.

• Her 1998 total exemptions are $2,500.

If you meet both of these tests, complete only

If you filed a 1997 IT-40PNR as a part-year

• The 1998 adjusted gross income tax rate is

Section I of Schedule IT-2210A to show that

resident of Indiana, you must figure the tax for

3.4% (.034). Her 1998 county tax rate is

you meet this exception. If you do not meet

that prior year on an annualized basis. You can

1% (for a 4.4% combined state and county

both of these tests, complete this schedule to

accomplish this by multiplying the IT-40PNR

tax rate).

determine if you owe a penalty.

line 1 income by 12 months and dividing the

result by the number of months you were an

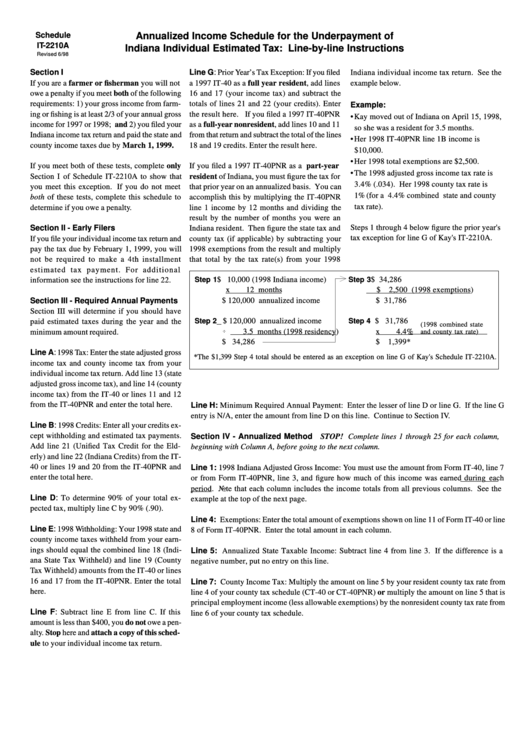

Steps 1 through 4 below figure the prior year's

Section II - Early Filers

Indiana resident. Then figure the state tax and

tax exception for line G of Kay's IT-2210A.

If you file your individual income tax return and

county tax (if applicable) by subtracting your

pay the tax due by February 1, 1999, you will

1998 exemptions from the result and multiply

not be required to make a 4th installment

that total by the tax rate(s) from your 1998

estimated tax payment. For additional

$ 10,000 (1998 Indiana income)

$ 34,286

Step 1

Step 3

information see the instructions for line 22.

x

12 months

$ 2,500 (1998 exemptions)

Section III - Required Annual Payments

$ 120,000 annualized income

$ 31,786

Section III will determine if you should have

Step 2

$ 120,000 annualized income

Step 4

$ 31,786

paid estimated taxes during the year and the

(1998 combined state

3.5 months (1998 residency)

x

4.4%

minimum amount required.

and county tax rate)

$ 34,286

$ 1,399*

Line A: 1998 Tax: Enter the state adjusted gross

*The $1,399 Step 4 total should be entered as an exception on line G of Kay's Schedule IT-2210A.

income tax and county income tax from your

individual income tax return. Add line 13 (state

adjusted gross income tax), and line 14 (county

income tax) from the IT-40 or lines 11 and 12

from the IT-40PNR and enter the total here.

Line H: Minimum Required Annual Payment: Enter the lesser of line D or line G. If the line G

entry is N/A, enter the amount from line D on this line. Continue to Section IV.

Line B: 1998 Credits: Enter all your credits ex-

cept withholding and estimated tax payments.

Section IV - Annualized Method STOP! Complete lines 1 through 25 for each column,

Add line 21 (Unified Tax Credit for the Eld-

beginning with Column A, before going to the next column.

erly) and line 22 (Indiana Credits) from the IT-

40 or lines 19 and 20 from the IT-40PNR and

Line 1: 1998 Indiana Adjusted Gross Income: You must use the amount from Form IT-40, line 7

enter the total here.

or from Form IT-40PNR, line 3, and figure how much of this income was earned during each

period. Note that each column includes the income totals from all previous columns. See the

Line D: To determine 90% of your total ex-

example at the top of the next page.

pected tax, multiply line C by 90% (.90).

Line 4: Exemptions: Enter the total amount of exemptions shown on line 11 of Form IT-40 or line

Line E: 1998 Withholding: Your 1998 state and

8 of Form IT-40PNR. Enter the total amount in each column.

county income taxes withheld from your earn-

ings should equal the combined line 18 (Indi-

Line 5: Annualized State Taxable Income: Subtract line 4 from line 3. If the difference is a

ana State Tax Withheld) and line 19 (County

negative number, put no entry on this line.

Tax Withheld) amounts from the IT-40 or lines

16 and 17 from the IT-40PNR. Enter the total

Line 7: County Income Tax: Multiply the amount on line 5 by your resident county tax rate from

here.

line 4 of your county tax schedule (CT-40 or CT-40PNR) or multiply the amount on line 5 that is

principal employment income (less allowable exemptions) by the nonresident county tax rate from

Line F: Subtract line E from line C. If this

line 6 of your county tax schedule.

amount is less than $400, you do not owe a pen-

alty. Stop here and attach a copy of this sched-

ule to your individual income tax return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2