Instructions For 2003 Form 10 - Underpayment Of 2003 Oregon Estimated Tax

ADVERTISEMENT

INSTRUCTIONS FOR 2003 FORM 10

O R E G O N

D E PA R T M E N T

Underpayment of 2003 Oregon Estimated Tax

O F R E V E N U E

If Measure 30 passes. Interest is not charged on any 2003 underpayment of estimated tax caused by the

passage of Measure 30. Refigure and use your Oregon tax without House Bill 2152 changes (addition for

depreciation on certain vehicles and reduction in the Oregon special medical deduction) when completing

your Form 10.

General Information

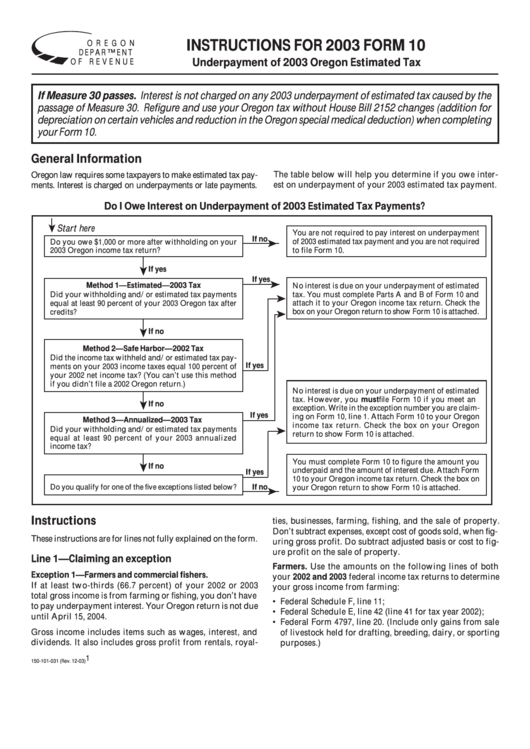

The table below will help you determine if you owe inter-

Oregon law requires some taxpayers to make estimated tax pay-

est on underpayment of your 2003 estimated tax payment.

ments. Interest is charged on underpayments or late payments.

Do I Owe Interest on Underpayment of 2003 Estimated Tax Payments?

Start here

You are not required to pay interest on underpayment

If no

Do you owe $1,000 or more after withholding on your

of 2003 estimated tax payment and you are not required

2003 Oregon income tax return?

to file Form 10.

If yes

If yes

Method 1—Estimated—2003 Tax

No interest is due on your underpayment of estimated

tax. You must complete Parts A and B of Form 10 and

Did your withholding and/or estimated tax payments

attach it to your Oregon income tax return. Check the

equal at least 90 percent of your 2003 Oregon tax after

box on your Oregon return to show Form 10 is attached.

credits?

If no

Method 2—Safe Harbor—2002 Tax

Did the income tax withheld and/or estimated tax pay-

If yes

ments on your 2003 income taxes equal 100 percent of

your 2002 net income tax? (You can’t use this method

if you didn’t file a 2002 Oregon return.)

No interest is due on your underpayment of estimated

tax. However, you must file Form 10 if you meet an

If no

exception. Write in the exception number you are claim-

If yes

ing on Form 10, line 1. Attach Form 10 to your Oregon

Method 3—Annualized—2003 Tax

income tax return. Check the box on your Oregon

Did your withholding and/or estimated tax payments

return to show Form 10 is attached.

equal at least 90 percent of your 2003 annualized

income tax?

You must complete Form 10 to figure the amount you

If no

underpaid and the amount of interest due. Attach Form

If yes

10 to your Oregon income tax return. Check the box on

Do you qualify for one of the five exceptions listed below?

If no

your Oregon return to show Form 10 is attached.

Instructions

ties, businesses, farming, fishing, and the sale of property.

Don’t subtract expenses, except cost of goods sold, when fig-

These instructions are for lines not fully explained on the form.

uring gross profit. Do subtract adjusted basis or cost to fig-

ure profit on the sale of property.

Line 1—Claiming an exception

Farmers. Use the amounts on the following lines of both

Exception 1—Farmers and commercial fishers.

your 2002 and 2003 federal income tax returns to determine

If at least two-thirds (66.7 percent) of your 2002 or 2003

your gross income from farming:

total gross income is from farming or fishing, you don’t have

• Federal Schedule F, line 11;

to pay underpayment interest. Your Oregon return is not due

• Federal Schedule E, line 42 (line 41 for tax year 2002);

until April 15, 2004.

• Federal Form 4797, line 20. (Include only gains from sale

Gross income includes items such as wages, interest, and

of livestock held for drafting, breeding, dairy, or sporting

dividends. It also includes gross profit from rentals, royal-

purposes.)

1

150-101-031 (Rev. 12-03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4