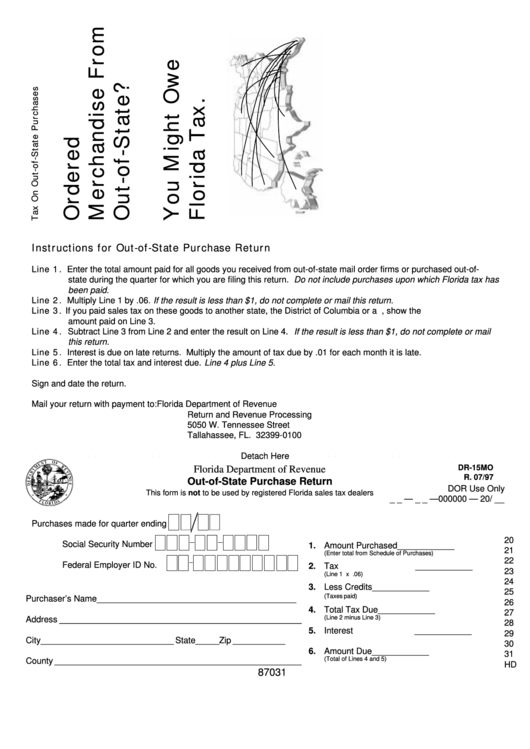

Instructions for Out-of-State Purchase Return

Line 1. Enter the total amount paid for all goods you received from out-of-state mail order firms or purchased out-of-

state during the quarter for which you are filing this return. Do not include purchases upon which Florida tax has

been paid.

Line 2. Multiply Line 1 by .06. If the result is less than $1, do not complete or mail this return.

Line 3. If you paid sales tax on these goods to another state, the District of Columbia or a U.S. territory, show the

amount paid on Line 3.

Line 4. Subtract Line 3 from Line 2 and enter the result on Line 4. If the result is less than $1, do not complete or mail

this return.

Line 5. Interest is due on late returns. Multiply the amount of tax due by .01 for each month it is late.

Line 6. Enter the total tax and interest due. Line 4 plus Line 5.

Sign and date the return.

Mail your return with payment to:

Florida Department of Revenue

Return and Revenue Processing

5050 W. Tennessee Street

Tallahassee, FL. 32399-0100

Detach Here

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

DR-15MO

Florida Department of Revenue

R. 07/97

Out-of-State Purchase Return

DOR Use Only

This form is not to be used by registered Florida sales tax dealers

_ _ — _ _ —000000 — 20/ __

Purchases made for quarter ending

20

Social Security Number

1. Amount Purchased

____________

21

(Enter total from Schedule of Purchases)

22

Federal Employer ID No.

2. Tax

____________

23

(Line 1 x .06)

24

3. Less Credits

____________

25

(Taxes paid)

Purchaser’s Name __________________________________________

26

4. Total Tax Due

____________

27

(Line 2 minus Line 3)

Address ___________________________________________________

28

5. Interest

____________

29

City ____________________________ State _____ Zip ___________

30

6. Amount Due

____________

31

(Total of Lines 4 and 5)

County ____________________________________________________

HD

87031

1

1 2

2