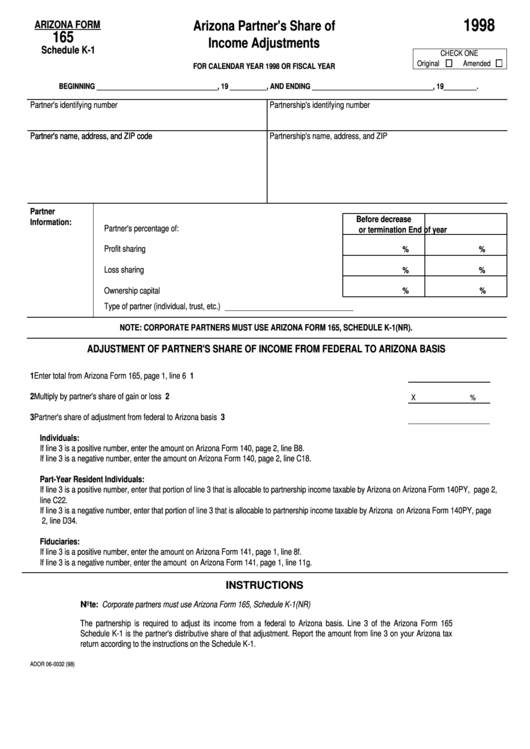

1998

Arizona Partner's Share of

ARIZONA FORM

165

Income Adjustments

Schedule K-1

CHECK ONE

Original

Amended

FOR CALENDAR YEAR 1998 OR FISCAL YEAR

BEGINNING _________________________________, 19 __________, AND ENDING _________________________________, 19_________.

Partner's identifying number

Partnership's identifying number

Partner's name, address, and ZIP code

Partner's name, address, and ZIP code

Partnership's name, address, and ZIP

Partner

Before decrease

Information:

Partner's percentage of:

or termination

End of year

Profit sharing ...........................................................................................

%

%

Loss sharing ............................................................................................

%

%

Ownership capital ....................................................................................

%

%

Type of partner (individual, trust, etc.)

NOTE: CORPORATE PARTNERS MUST USE ARIZONA FORM 165, SCHEDULE K-1(NR).

ADJUSTMENT OF PARTNER'S SHARE OF INCOME FROM FEDERAL TO ARIZONA BASIS

1 Enter total from Arizona Form 165, page 1, line 6 ..................................................................................................... 1

2 Multiply by partner's share of gain or loss ................................................................................................................. 2

X

%

3 Partner's share of adjustment from federal to Arizona basis ..................................................................................... 3

Individuals:

If line 3 is a positive number, enter the amount on Arizona Form 140, page 2, line B8.

If line 3 is a negative number, enter the amount on Arizona Form 140, page 2, line C18.

Part-Year Resident Individuals:

If line 3 is a positive number, enter that portion of line 3 that is allocable to partnership income taxable by Arizona on Arizona Form 140PY, page 2,

line C22.

If line 3 is a negative number, enter that portion of line 3 that is allocable to partnership income taxable by Arizona on Arizona Form 140PY, page

2, line D34.

Fiduciaries:

If line 3 is a positive number, enter the amount on Arizona Form 141, page 1, line 8f.

If line 3 is a negative number, enter the amount on Arizona Form 141, page 1, line 11g.

INSTRUCTIONS

Note: Corporate partners must use Arizona Form 165, Schedule K-1(NR)

The partnership is required to adjust its income from a federal to Arizona basis. Line 3 of the Arizona Form 165

Schedule K-1 is the partner's distributive share of that adjustment. Report the amount from line 3 on your Arizona tax

return according to the instructions on the Schedule K-1.

ADOR 06-0032 (98)

1

1