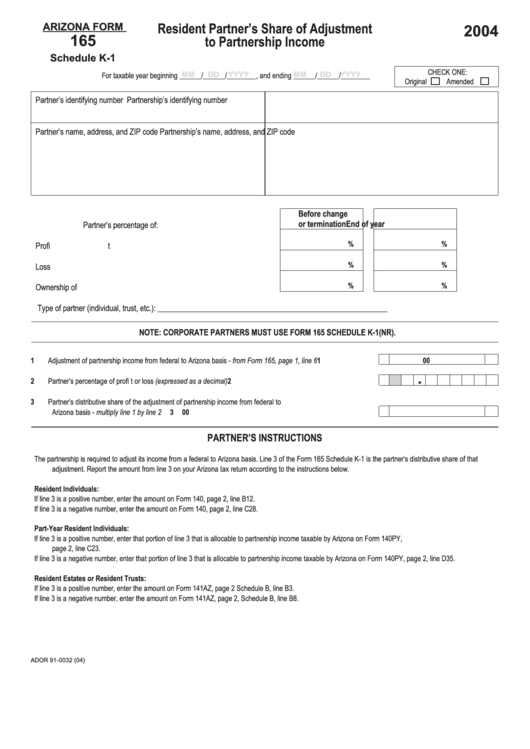

ARIZONA FORM

Resident Partner’s Share of Adjustment

2004

165

to Partnership Income

Schedule K-1

CHECK ONE:

MM

MM

DD

DD

YYYY

YYYY

MM

MM

DD

DD

YYYY

YYYY

For taxable year beginning ______/______/________, and ending ______/______/________

Original

Amended

Partner’s identifying number

Partnership’s identifying number

Partner’s name, address, and ZIP code

Partnership’s name, address, and ZIP code

Before change

or termination

End of year

Partner’s percentage of:

%

%

Profi t sharing......................................................................

%

%

Loss sharing.......................................................................

%

%

Ownership of capital ..........................................................

Type of partner (individual, trust, etc.): ___________________________________________________________

NOTE: CORPORATE PARTNERS MUST USE FORM 165 SCHEDULE K-1(NR).

1

Adjustment of partnership income from federal to Arizona basis - from Form 165, page 1, line 6 .............................

1

00

.

2

Partner’s percentage of profi t or loss (expressed as a decimal).................................................................................

2

3

Partner’s distributive share of the adjustment of partnership income from federal to

Arizona basis - multiply line 1 by line 2.......................................................................................................................

3

00

PARTNER’S INSTRUCTIONS

The partnership is required to adjust its income from a federal to Arizona basis. Line 3 of the Form 165 Schedule K-1 is the partner’s distributive share of that

adjustment. Report the amount from line 3 on your Arizona tax return according to the instructions below.

Resident Individuals:

If line 3 is a positive number, enter the amount on Form 140, page 2, line B12.

If line 3 is a negative number, enter the amount on Form 140, page 2, line C28.

Part-Year Resident Individuals:

If line 3 is a positive number, enter that portion of line 3 that is allocable to partnership income taxable by Arizona on Form 140PY,

page 2, line C23.

If line 3 is a negative number, enter that portion of line 3 that is allocable to partnership income taxable by Arizona on Form 140PY, page 2, line D35.

Resident Estates or Resident Trusts:

If line 3 is a positive number, enter the amount on Form 141AZ, page 2 Schedule B, line B3.

If line 3 is a negative number, enter the amount on Form 141AZ, page 2, Schedule B, line B8.

ADOR 91-0032 (04)

1

1 2

2