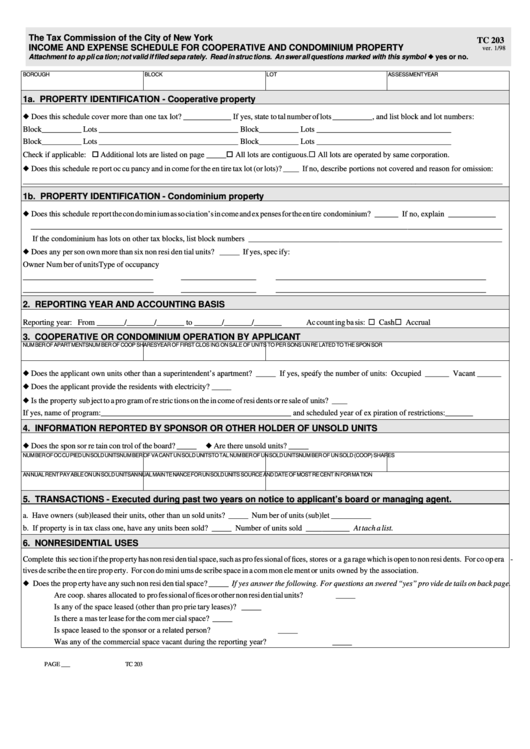

The Tax Com mis sion of the City of New York

TC 203

IN COME AND EX PENSE SCHED ULE FOR CO OP ERA TIVE AND CON DO MIN IUM PROP ERTY

ver. 1/98

At tach ment to ap pli ca tion; not valid if filed sepa rately. Read in struc tions. An swer all ques tions marked with this sym bol u yes or no.

BOR OUGH

BLOCK

LOT

AS SESS MENT YEAR

1a. PROP ERTY IDEN TI FI CA TION - Co op era tive prop erty

u Does this sched ule cover more than one tax lot? ____________ If yes, state to tal number of lots __________, and list block and lot num bers:

Block__________ Lots ___________________________________

Block__________ Lots __________________________________

Block__________ Lots ___________________________________

Block__________ Lots __________________________________

Check if ap pli ca ble: o Ad di tional lots are listed on page _____

o All lots are con tigu ous.

¨ All lots are op er ated by same cor po ra tion.

u Does this sched ule re port oc cu pancy and in come for the en tire tax lot (or lots)? ____ If no, de scribe por tions not cov ered and rea son for omis sion:

_________________________________________________________________________________________________________________________

1b. PROP ERTY IDEN TI FI CA TION - Con do min ium prop erty

u Does this sched ule re port the con do min ium as so cia tion’s in come and ex penses for the en tire con do min ium? ______ If no, ex plain ____________

_______________________________________________________________________________________________________________________

If the con do min ium has lots on other tax blocks, list block num bers ________________________________________________________________

u Does any per son own more than six non resi den tial units? _____ If yes, spec ify:

Owner

Num ber of units

Type of oc cu pancy

_________________________________

___________________

_____________________________________________________

_________________________________

___________________

_____________________________________________________

2. RE PORT ING YEAR AND AC COUNT ING BA SIS

Ac count ing ba sis: ¨ Cash

¨ Ac crual

Re port ing year: From _______/_______/_______ to _______/_______/_______

3. CO OP ERA TIVE OR CON DO MIN IUM OP ERA TION BY AP PLI CANT

NUM BER OF APART MENTS

NUM BER OF COOP SHARES

YEAR OF FIRST CLOS ING ON SALE OF UNITS TO PER SONS UN RE LATED TO THE SPON SOR

u Does the ap pli cant own units other than a su per in ten dent’s apart ment? _____ If yes, spec ify the number of units: Oc cu pied ______ Va cant ______

u Does the ap pli cant pro vide the resi dents with elec tric ity? _____

u Is the prop erty sub ject to a pro gram of re stric tions on the in come of resi dents or re sale of units? ____

If yes, name of pro gram:________________________________________________ and sched uled year of ex pi ra tion of re stric tions:_______

4. IN FOR MA TION RE PORTED BY SPON SOR OR OTHER HOLDER OF UN SOLD UNITS

u Does the spon sor re tain con trol of the board? _____

u Are there un sold units? _____

NUM BER OF OC CU PIED UN SOLD UNITS

NUM BER OF VA CANT UN SOLD UNITS

TO TAL NUM BER OF UN SOLD UNITS

NUM BER OF UN SOLD (COOP) SHARES

AN NUAL RENT PAY ABLE ON UN SOLD UNITS

AN NUAL MAIN TE NANCE FOR UN SOLD UNITS

SOURCE AND DATE OF MOST RE CENT IN FOR MA TION

5. TRANS AC TIONS - Exe cuted dur ing past two years on no tice to ap pli cant’s board or man ag ing agent.

a. Have own ers (sub)leased their units, other than un sold units? _____ Num ber of units (sub)let __________

b. If prop erty is in tax class one, have any units been sold? _____ Num ber of units sold ___________ At tach a list.

6. NON RESI DEN TIAL USES

Com plete this sec tion if the prop erty has non resi den tial space, such as pro fes sional of fices, stores or a ga rage which is open to non resi dents. For co op era -

tives de scribe the en tire prop erty. For con do mini ums de scribe space in a com mon ele ment or units owned by the as so cia tion.

u Does the prop erty have any such non resi den tial space? _____ If yes an swer the fol low ing. For ques tions an swered “yes” pro vide de tails on back page.

Are coop. shares al lo cated to pro fes sional of fices or other non resi den tial units?

_____

Is any of the space leased (other than pro prie tary leases)?

_____

Is there a mas ter lease for the com mer cial space?

_____

Is space leased to the spon sor or a re lated per son?

_____

Was any of the com mer cial space va cant dur ing the re port ing year?

_____

PAGE ___

TC 203

1

1 2

2