Instructions - Exempt Organizations - South Carolina Department Of Revenue

ADVERTISEMENT

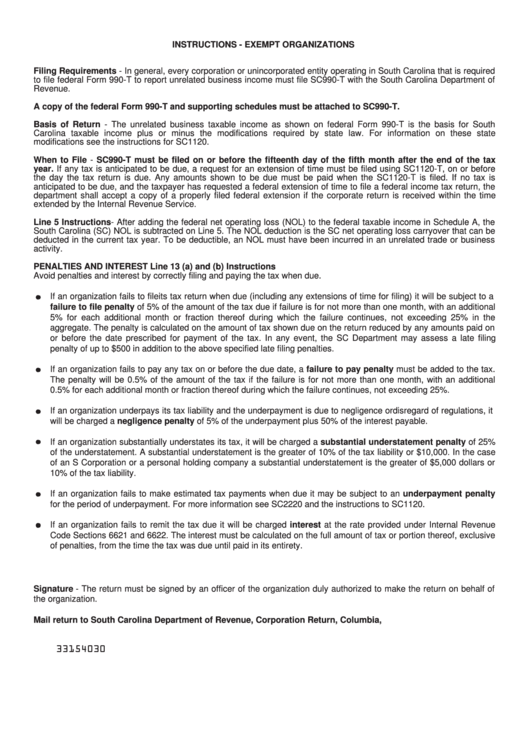

INSTRUCTIONS - EXEMPT ORGANIZATIONS

Filing Requirements - In general, every corporation or unincorporated entity operating in South Carolina that is required

to file federal Form 990-T to report unrelated business income must file SC990-T with the South Carolina Department of

Revenue.

A copy of the federal Form 990-T and supporting schedules must be attached to SC990-T.

Basis of Return - The unrelated business taxable income as shown on federal Form 990-T is the basis for South

Carolina taxable income plus or minus the modifications required by state law. For information on these state

modifications see the instructions for SC1120.

When to File - SC990-T must be filed on or before the fifteenth day of the fifth month after the end of the tax

year. If any tax is anticipated to be due, a request for an extension of time must be filed using SC1120-T, on or before

the day the tax return is due. Any amounts shown to be due must be paid when the SC1120-T is filed. If no tax is

anticipated to be due, and the taxpayer has requested a federal extension of time to file a federal income tax return, the

department shall accept a copy of a properly filed federal extension if the corporate return is received within the time

extended by the Internal Revenue Service.

Line 5 Instructions- After adding the federal net operating loss (NOL) to the federal taxable income in Schedule A, the

South Carolina (SC) NOL is subtracted on Line 5. The NOL deduction is the SC net operating loss carryover that can be

deducted in the current tax year. To be deductible, an NOL must have been incurred in an unrelated trade or business

activity.

PENALTIES AND INTEREST Line 13 (a) and (b) Instructions

Avoid penalties and interest by correctly filing and paying the tax when due.

If an organization fails to file its tax return when due (including any extensions of time for filing) it will be subject to a

failure to file penalty of 5% of the amount of the tax due if failure is for not more than one month, with an additional

5% for each additional month or fraction thereof during which the failure continues, not exceeding 25% in the

aggregate. The penalty is calculated on the amount of tax shown due on the return reduced by any amounts paid on

or before the date prescribed for payment of the tax. In any event, the SC Department may assess a late filing

penalty of up to $500 in addition to the above specified late filing penalties.

If an organization fails to pay any tax on or before the due date, a failure to pay penalty must be added to the tax.

The penalty will be 0.5% of the amount of the tax if the failure is for not more than one month, with an additional

0.5% for each additional month or fraction thereof during which the failure continues, not exceeding 25%.

If an organization underpays its tax liability and the underpayment is due to negligence or disregard of regulations, it

will be charged a negligence penalty of 5% of the underpayment plus 50% of the interest payable.

If an organization substantially understates its tax, it will be charged a substantial understatement penalty of 25%

of the understatement. A substantial understatement is the greater of 10% of the tax liability or $10,000. In the case

of an S Corporation or a personal holding company a substantial understatement is the greater of $5,000 dollars or

10% of the tax liability.

If an organization fails to make estimated tax payments when due it may be subject to an underpayment penalty

for the period of underpayment. For more information see SC2220 and the instructions to SC1120.

If an organization fails to remit the tax due it will be charged interest at the rate provided under Internal Revenue

Code Sections 6621 and 6622. The interest must be calculated on the full amount of tax or portion thereof, exclusive

of penalties, from the time the tax was due until paid in its entirety.

Signature - The return must be signed by an officer of the organization duly authorized to make the return on behalf of

the organization.

Mail return to South Carolina Department of Revenue, Corporation Return, Columbia, S.C. 29214-0100.

33154030

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1