Instructions For Form Sc4768 - South Carolina Department Of Revenue - 1994

ADVERTISEMENT

51

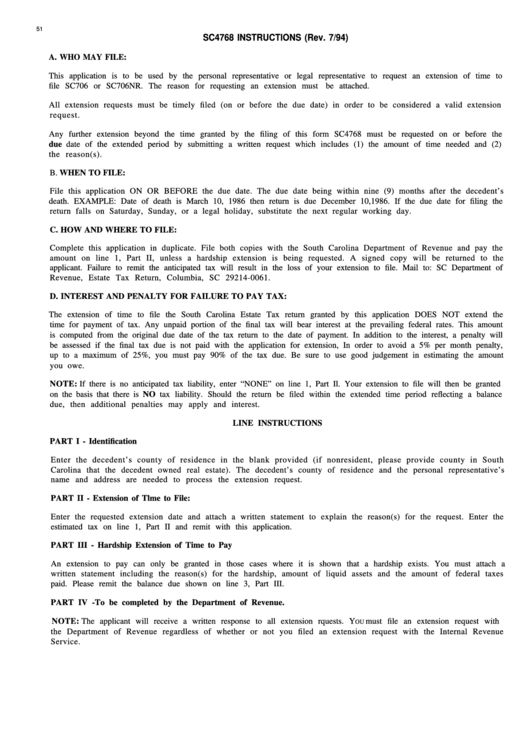

SC4768 INSTRUCTIONS (Rev. 7/94)

A. WHO MAY FILE:

This application is to be used by the personal representative or legal representative to request an extension of time to

file SC706 or SC706NR. The reason for requesting an extension must

be attached.

All extension requests must be timely filed (on or before the due date) in order to be considered a valid extension

request.

Any further extension beyond the time granted by the filing of this form SC4768 must be requested on or before the

due date of the extended period by submitting a written request which includes (1) the amount of time needed and (2)

the reason(s).

B. WHEN TO FILE:

File this application ON OR BEFORE the due date. The due date being within nine (9) months after the decedent’s

death. EXAMPLE: Date of death is March 10, 1986 then return is due December 10,1986. If the due date for filing the

return falls on Saturday, Sunday, or a legal holiday, substitute the next regular working day.

C. HOW AND WHERE TO FILE:

Complete this application in duplicate. File both copies with the South Carolina Department of Revenue and pay the

amount on line 1, Part II, unless a hardship extension is being requested. A signed copy will be returned to the

applicant. Failure to remit the anticipated tax will result in the loss of your extension to file. Mail to: SC Department of

Revenue, Estate Tax Return, Columbia, SC 29214-0061.

D. INTEREST AND PENALTY FOR FAILURE TO PAY TAX:

The extension of time to file the South Carolina Estate Tax return granted by this application DOES NOT extend the

time for payment of tax. Any unpaid portion of the final tax will bear interest at the prevailing federal rates. This amount

is computed from the original due date of the tax return to the date of payment. In addition to the interest, a penalty will

be assessed if the final tax due is not paid with the application for extension, In order to avoid a 5% per month penalty,

up to a maximum of 25%, you must pay 90% of the tax due. Be sure to use good judgement in estimating the amount

you owe.

NOTE: If there is no anticipated tax liability, enter “NONE” on line 1, Part Il. Your extension to file will then be granted

on the basis that there is NO tax liability. Should the return be filed within the extended time period reflecting a balance

due, then additional penalties may apply and interest.

LINE INSTRUCTIONS

PART I - Identification

Enter the decedent’s county of residence in the blank provided (if nonresident, please provide county in South

Carolina that the decedent owned real estate). The decedent’s county of residence and the personal representative’s

name and address are needed to process the extension request.

PART II - Extension of Tlme to File:

Enter the requested extension date and attach a written statement to explain the reason(s) for the request. Enter the

estimated tax on line 1, Part II and remit with this application.

PART III - Hardship Extension of Time to Pay

An extension to pay can only be granted in those cases where it is shown that a hardship exists. You must attach a

written statement including the reason(s) for the hardship, amount of liquid assets and the amount of federal taxes

paid. Please remit the balance due shown on line 3, Part III.

PART IV -To be completed by the Department of Revenue.

NOTE: The applicant will receive a written response to all extension rquests. Y

must file an extension request with

OU

the Department of Revenue regardless of whether or not you filed an extension request with the Internal Revenue

Service.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1