Form Sc1040tc Worksheet Instructions - Credit For Taxes Paid To Another State - South Carolina Department Of Revenue

ADVERTISEMENT

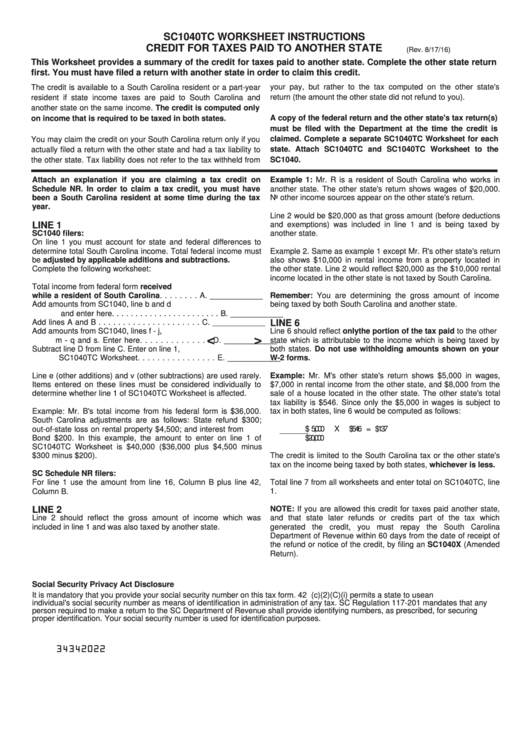

SC1040TC WORKSHEET INSTRUCTIONS

CREDIT FOR TAXES PAID TO ANOTHER STATE

(Rev. 8/17/16)

This Worksheet provides a summary of the credit for taxes paid to another state. Complete the other state return

first. You must have filed a return with another state in order to claim this credit.

The credit is available to a South Carolina resident or a part-year

your pay, but rather to the tax computed on the other state's

resident if state income taxes are paid to South Carolina and

return (the amount the other state did not refund to you).

another state on the same income. The credit is computed only

A copy of the federal return and the other state's tax return(s)

on income that is required to be taxed in both states.

must be filed with the Department at the time the credit is

You may claim the credit on your South Carolina return only if you

claimed. Complete a separate SC1040TC Worksheet for each

state. Attach SC1040TC and SC1040TC Worksheet to the

actually filed a return with the other state and had a tax liability to

SC1040.

the other state. Tax liability does not refer to the tax withheld from

Attach an explanation if you are claiming a tax credit on

Example 1: Mr. R is a resident of South Carolina who works in

Schedule NR. In order to claim a tax credit, you must have

another state. The other state's return shows wages of $20,000.

been a South Carolina resident at some time during the tax

No other income sources appear on the other state's return.

year.

Line 2 would be $20,000 as that gross amount (before deductions

and exemptions) was included in line 1 and is being taxed by

LINE 1

SC1040 filers:

another state.

On line 1 you must account for state and federal differences to

determine total South Carolina income. Total federal income must

Example 2. Same as example 1 except Mr. R's other state's return

be adjusted by applicable additions and subtractions.

also shows $10,000 in rental income from a property located in

Complete the following worksheet:

the other state. Line 2 would reflect $20,000 as the $10,000 rental

income located in the other state is not taxed by South Carolina.

Total income from federal form received

while a resident of South Carolina. . . . . . . . A. ____________

Remember: You are determining the gross amount of income

Add amounts from SC1040, line b and d

being taxed by both South Carolina and another state.

and enter here. . . . . . . . . . . . . . . . . . . . . . . B. ____________

Add lines A and B . . . . . . . . . . . . . . . . . . . . . C. ____________

LINE 6

Add amounts from SC1040, lines f - j,

Line 6 should reflect only the portion of the tax paid to the other

<

>

m - q and s. Enter here. . . . . . . . . . . . . . D. ____________

state which is attributable to the income which is being taxed by

Subtract line D from line C. Enter on line 1,

both states. Do not use withholding amounts shown on your

SC1040TC Worksheet. . . . . . . . . . . . . . . . E. ____________

W-2 forms.

Line e (other additions) and v (other subtractions) are used rarely.

Example: Mr. M's other state's return shows $5,000 in wages,

Items entered on these lines must be considered individually to

$7,000 in rental income from the other state, and $8,000 from the

determine whether line 1 of SC1040TC Worksheet is affected.

sale of a house located in the other state. The other state's total

tax liability is $546. Since only the $5,000 in wages is subject to

Example: Mr. B's total income from his federal form is $36,000.

tax in both states, line 6 would be computed as follows:

South Carolina adjustments are as follows: State refund $300;

out-of-state loss on rental property $4,500; and interest from U.S.

$ 5,000

X

$546 = $137

Bond $200. In this example, the amount to enter on line 1 of

$20,000

SC1040TC Worksheet is $40,000 ($36,000 plus $4,500 minus

$300 minus $200).

The credit is limited to the South Carolina tax or the other state's

.

tax on the income being taxed by both states, whichever is less

SC Schedule NR filers:

For line 1 use the amount from line 16, Column B plus line 42,

Total line 7 from all worksheets and enter total on SC1040TC, line

Column B.

1.

LINE 2

NOTE: If you are allowed this credit for taxes paid another state,

Line 2 should reflect the gross amount of income which was

and that state later refunds or credits part of the tax which

included in line 1 and was also taxed by another state.

generated the credit, you must repay the South Carolina

Department of Revenue within 60 days from the date of receipt of

the refund or notice of the credit, by filing an SC1040X (Amended

Return).

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form. 42 U.S.C 405(c)(2)(C)(i) permits a state to use an

individual's social security number as means of identification in administration of any tax. SC Regulation 117-201 mandates that any

person required to make a return to the SC Department of Revenue shall provide identifying numbers, as prescribed, for securing

proper identification. Your social security number is used for identification purposes.

34342022

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3