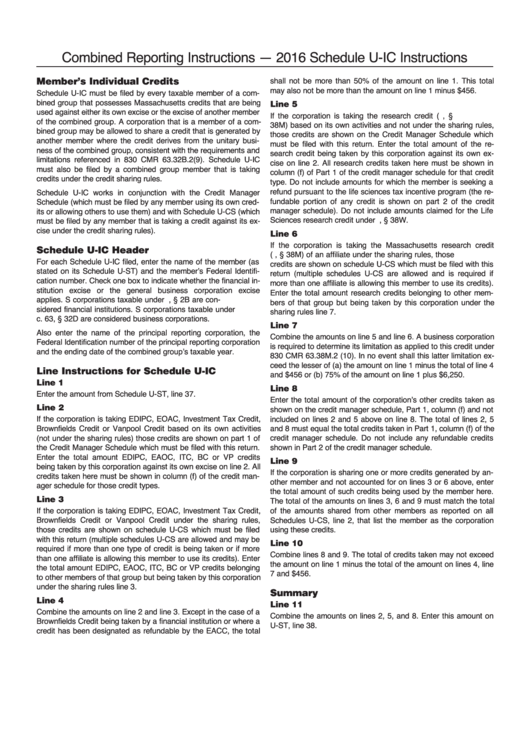

Schedule U-Ic Instructions - Combined Reporting Instructions - 2016

ADVERTISEMENT

Combined Reporting Instructions — 2016 Schedule U-IC Instructions

Member’s Individual Credits

shall not be more than 50% of the amount on line 1. This total

may also not be more than the amount on line 1 minus $456.

Schedule U-IC must be filed by every taxable member of a com-

bined group that possesses Massachusetts credits that are being

Line 5

used against either its own excise or the excise of another member

If the corporation is taking the research credit (M.G.L. c. 63, §

of the combined group. A corporation that is a member of a com-

38M) based on its own activities and not under the sharing rules,

bined group may be allowed to share a credit that is generated by

those credits are shown on the Credit Manager Schedule which

another member where the credit derives from the unitary busi-

must be filed with this return. Enter the total amount of the re-

ness of the combined group, consistent with the requirements and

search credit being taken by this corporation against its own ex-

limitations referenced in 830 CMR 63.32B.2(9). Schedule U-IC

cise on line 2. All research credits taken here must be shown in

must also be filed by a combined group member that is taking

column (f) of Part 1 of the credit manager schedule for that credit

credits under the credit sharing rules.

type. Do not include amounts for which the member is seeking a

refund pursuant to the life sciences tax incentive program (the re-

Schedule U-IC works in conjunction with the Credit Manager

fundable portion of any credit is shown on part 2 of the credit

Schedule (which must be filed by any member using its own cred-

manager schedule). Do not include amounts claimed for the Life

its or allowing others to use them) and with Schedule U-CS (which

Sciences research credit under M.G.L. c. 63, § 38W.

must be filed by any member that is taking a credit against its ex-

cise under the credit sharing rules).

Line 6

If the corporation is taking the Massachusetts research credit

Schedule U-IC Header

(M.G.L. c. 63, § 38M) of an affiliate under the sharing rules, those

For each Schedule U-IC filed, enter the name of the member (as

credits are shown on schedule U-CS which must be filed with this

stated on its Schedule U-ST) and the member’s Federal Identifi-

return (multiple schedules U-CS are allowed and is required if

cation number. Check one box to indicate whether the financial in-

more than one affiliate is allowing this member to use its credits).

stitution excise or the general business corporation excise

Enter the total amount research credits belonging to other mem-

applies. S corporations taxable under M.G.L. c. 63, § 2B are con-

bers of that group but being taken by this corporation under the

sidered financial institutions. S corporations taxable under M.G.L.

sharing rules line 7.

c. 63, § 32D are considered business corporations.

Line 7

Also enter the name of the principal reporting corporation, the

Combine the amounts on line 5 and line 6. A business corporation

Federal Identification number of the principal reporting corporation

is required to determine its limitation as applied to this credit under

and the ending date of the combined group’s taxable year.

830 CMR 63.38M.2 (10). In no event shall this latter limitation ex-

ceed the lesser of (a) the amount on line 1 minus the total of line 4

Line Instructions for Schedule U-IC

and $456 or (b) 75% of the amount on line 1 plus $6,250.

Line 1

Line 8

Enter the amount from Schedule U-ST, line 37.

Enter the total amount of the corporation’s other credits taken as

Line 2

shown on the credit manager schedule, Part 1, column (f) and not

included on lines 2 and 5 above on line 8. The total of lines 2, 5

If the corporation is taking EDIPC, EOAC, Investment Tax Credit,

Brownfields Credit or Vanpool Credit based on its own activities

and 8 must equal the total credits taken in Part 1, column (f) of the

credit manager schedule. Do not include any refundable credits

(not under the sharing rules) those credits are shown on part 1 of

the Credit Manager Schedule which must be filed with this return.

shown in Part 2 of the credit manager schedule.

Enter the total amount EDIPC, EAOC, ITC, BC or VP credits

Line 9

being taken by this corporation against its own excise on line 2. All

If the corporation is sharing one or more credits generated by an-

credits taken here must be shown in column (f) of the credit man-

other member and not accounted for on lines 3 or 6 above, enter

ager schedule for those credit types.

the total amount of such credits being used by the member here.

Line 3

The total of the amounts on lines 3, 6 and 9 must match the total

of the amounts shared from other members as reported on all

If the corporation is taking EDIPC, EOAC, Investment Tax Credit,

Brownfields Credit or Vanpool Credit under the sharing rules,

Schedules U-CS, line 2, that list the member as the corporation

using these credits.

those credits are shown on schedule U-CS which must be filed

with this return (multiple schedules U-CS are allowed and may be

Line 10

required if more than one type of credit is being taken or if more

Combine lines 8 and 9. The total of credits taken may not exceed

than one affiliate is allowing this member to use its credits). Enter

the amount on line 1 minus the total of the amount on lines 4, line

the total amount EDIPC, EAOC, ITC, BC or VP credits belonging

7 and $456.

to other members of that group but being taken by this corporation

under the sharing rules line 3.

Summary

Line 4

Line 11

Combine the amounts on line 2 and line 3. Except in the case of a

Combine the amounts on lines 2, 5, and 8. Enter this amount on

Brownfields Credit being taken by a financial institution or where a

U-ST, line 38.

credit has been designated as refundable by the EACC, the total

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2