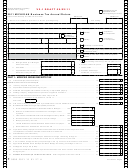

Form 4567 Draft - Michigan Business Tax Annual Return - 2009 Page 3

ADVERTISEMENT

1

1

2

2

3

3

4567, Page 3

FEIN or TR Number

4

4

5

5

6

6

PART 3: TOTAL MICHIGAN BUSINESS TAX

7

7

8

00

8

51. Total Michigan Business Tax Before Surcharge and Credits. Add lines 27 and 50 ...................................

51.

9

00

9

52. Annual Surcharge. Enter the lesser of $6,000,000 or line 51 multiplied by 21.99% (0.2199) ...........................

52.

00

10

10

53. Total Liability Before All Credits. Add lines 51 and 52 ...................................................................................

53.

11

00

11

54. Nonrefundable credits from Form 4568, line 40 ................................................................................................

54.

12

00

12

55. Total Tax After Nonrefundable Credits. Subtract line 54 from line 53. If less than zero, enter zero ............

55.

13

00

13

56. Recapture of Certain Business Tax Credits and Deductions from Form 4587, line 12 ......................................

56.

14

00

14

57. Total Tax Liability. Add lines 55 and 56 ...........................................................................................................

57.

15

15

16

16

PART 4: PAYMENTS, REFUNDABLE CREDITS AND TAX DUE

17

17

00

18

18

58. Overpayment credited from prior MBT return ....................................................................................................

58.

19

00

19

59. Estimated tax payments ....................................................................................................................................

59.

20

00

20

60. Tax paid with request for extension ...................................................................................................................

60.

21

00

21

61. Refundable credits from Form 4574, line 25 .....................................................................................................

61.

00

22

62. Payment and credit total. Add lines 58 through 61. (If not amending, then skip to line 64.) .............................

62.

22

23

23

00

a. Payment made with the original return ......................

63a.

AMENDED

24

00

24

b. Overpayment received on the original return ............

63b.

63.

RETURN

25

25

ONLY

c. Add lines 62 and 63a and subtract line 63b

from the sum.............................................................. ........................................................

63c.

00

26

26

27

00

27

64. TAX DUE. Subtract line 62 (or line 63c, if amending) from line 57. If less than zero, leave blank ....................

64.

28

00

28

65. Underpaid estimate penalty and interest from Form 4582, line 38 ....................................................................

65.

29

29

30

% =

00

00

00

30

66. Annual return penalty (a)

(b)

plus interest (c)

. Total ...... 66d.

31

31

00

67. PAYMENT DUE. If line 64 is blank, go to line 68. Otherwise, add lines 64, 65 and 66d .................................

67.

32

32

33

PART 5: REFUND OR CREDIT FORWARD

33

34

34

35

35

68.

.

Overpayment. Subtract lines 57, 65 and 66d from line 62 (or line 63c, if amending)

36

00

36

If less th

68.

an zero, leave blank (see instructions) .................................................................................................

00

37

37

69. CREDIT FORWARD. Amount of overpayment on line 68 to be credited forward .............................................

69.

38

00

38

70. REFUND. Amount of overpayment on line 68 to be refunded ...........................................................................

70.

39

39

40

40

Taxpayer Certification.

Preparer Certification.

41

I declare under penalty of perjury that the information in this

I declare under penalty of perjury that this

41

return and attachments is true and complete to the best of my knowledge.

return is based on all information of which I have any knowledge.

42

42

Preparer’s PTIN, FEIN or SSN

By checking this box, I authorize Treasury to discuss my return with my preparer.

43

43

44

44

Authorized Signature for Tax Matters

Preparer’s Business Name (print or type)

45

45

46

46

Authorized Signer’s Name (print or type)

Date

Preparer’s Business Address and Telephone Number (print or type)

47

47

48

48

Title

Telephone Number

49

49

50

50

51

51

Return is due April 30 or on or before the last day of the 4th month after the close of the tax year.

52

52

53

53

WITHOUT PAYMENT. Mail return to:

WITH PAYMENT. Pay amount on line 67. Mail check and return to:

Michigan Department of Treasury, P.O. Box 30783, Lansing, MI 48909

Michigan Department of Treasury, P.O. Box 30113, Lansing, MI 48909

54

54

55

55

Make check payable to “State of Michigan.” Print taxpayer’s FEIN or TR

56

56

Number, the taxpayer’s name, and “MBT” on the front of the check. Do not

57

57

staple the check to the return.

58

58

59

59

60

60

61

61

62

62

+

0000 2009 11 03 27 5

63

63

64

64

65

65

66

66

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3