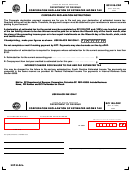

Form D-20es - Corporation Declaration Of Estimated Franchise Tax - 2001 Page 2

ADVERTISEMENT

TAXPAYER NAME :

FEDERAL EMPLOYER ID NUMBER :

01020012000

Under penalties of law, including criminal penalties for false statements and tax preparer penalties under D.C. Code secs. 22-2514 and 47-161, et seq., I declare that I have examined this return

and, to the best of my knowledge and belief, it is true, correct and complete. If prepared by a person other than the taxpayer, this declaration is based on all information available to the preparer.

PLEASE

TELEPHONE NUMBER

SIGN

HERE

-

-

OFFICER’S SIGNATURE

TITLE

DATE

PREPARER’S SSN OR PTIN

PREPARER’S SIGNATURE (If other than taxpayer)

DATE

PAID

PREPARER

PREPARER’S FEDERAL EMPLOYER ID NUMBER

ONLY

FIRM NAME

FIRM ADDRESS

Mail return and payment to: Government of the District of Columbia, Corporation Estimated Tax, P.O. Box 96019, Washington, D.C. 20090-6019.

Make check or money order payable to the D.C. Treasurer. Include your Federal Employer ID Number, D-20ES and tax year on your payment.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3