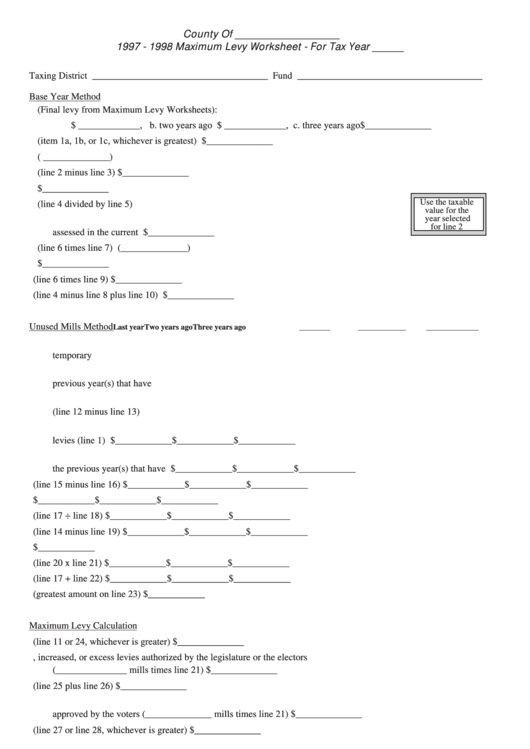

County Of ____________________

1997 - 1998 Maximum Levy Worksheet - For Tax Year ______

Taxing District _____________________________________ Fund _______________________________________

Base Year Method

1. Taxes levied in the last three years (Final levy from Maximum Levy Worksheets):

a. last year $ _____________, b. two years ago $ _____________, c. three years ago $ ______________

2. Base year taxes levied (item 1a, 1b, or 1c, whichever is greatest) ..............................................$ ______________

3. Temporary increased or excess levies in effect for the base year but now expired .....................( ______________)

4. Base year taxes excluding expired levies (line 2 minus line 3) ...................................................$ ______________

5. Base year taxable value ............................................................................ $ ______________

Use the taxable

6. Mill rate for taxes levied the base year (line 4 divided by line 5) ............ ______________

value for the

year selected

7. Taxable value of property taxable in the base year which is not

for line 2

assessed in the current year ...................................................................... $ ______________

8. Adjustment for property no longer taxable (line 6 times line 7) ..................................................(______________)

9. Taxable value of property which was not assessed in the base year ........$ ______________

10. Adjustment for property added since the base year (line 6 times line 9) ....................................$ ______________

11. Maximum allowable base year levy (line 4 minus line 8 plus line 10) .......................................$ ______________

Unused Mills Method

Last year

Two years ago

Three years ago

12. Maximum mill rate otherwise provided by law including

temporary levies..................................................................... ____________

____________

____________

13. Adjustment for temporary mill levies in effect in the

previous year(s) that have expired ......................................... ____________

____________

____________

14. Adjusted maximum mill rate available

(line 12 minus line 13) ........................................................... ____________

____________

____________

15. Total dollars actually levied including temporary

levies (line 1) ......................................................................... $____________ $____________ $____________

16. Adjustment for dollars of temporary levies in

the previous year(s) that have expired ................................... $____________ $____________ $____________

17. Adjusted dollars levied (line 15 minus line 16)..................... $____________ $____________ $____________

18. Taxable values ....................................................................... $____________ $____________ $____________

19. Mill rate for adjusted dollars levied (line 17 ÷ line 18) ........ $____________ $____________ $____________

20. Unused mill levy authority (line 14 minus line 19) ............... $____________ $____________ $____________

21. Current year taxable value ........................ $____________

22. Allowable increase for unused mills (line 20 x line 21) ........ $____________ $____________ $____________

23. Allowable levy in dollars (line 17 + line 22)......................... $____________ $____________ $____________

24. Maximum allowable levy including unused levies (greatest amount on line 23) ........................... $____________

Maximum Levy Calculation

25. Maximum levy before new levies (line 11 or 24, whichever is greater) .....................................$ ______________

26. New, increased, or excess levies authorized by the legislature or the electors

(_______________ mills times line 21) ......................................................................................$ ______________

27. Total (line 25 plus line 26) ..........................................................................................................$ ______________

28. Maximum levy otherwise provided by law including increased or excess levies

approved by the voters (______________ mills times line 21) ..................................................$ ______________

29. Total allowable maximum levy (line 27 or line 28, whichever is greater) ..................................$ ______________

30. Levy certified by the taxing district for the current year .............................................................$ ______________

31. Final levy (line 29 or line 30, whichever is less) .........................................................................$ ______________

32. Final mill rate (line 31 divided by line 21) .................................................... _____________ mills

24766 (Revised 4/97)

1

1