Form 83-A-7 - Wage Tax Refund Petiti X Refund Petition (1999) - Philadelphia

ADVERTISEMENT

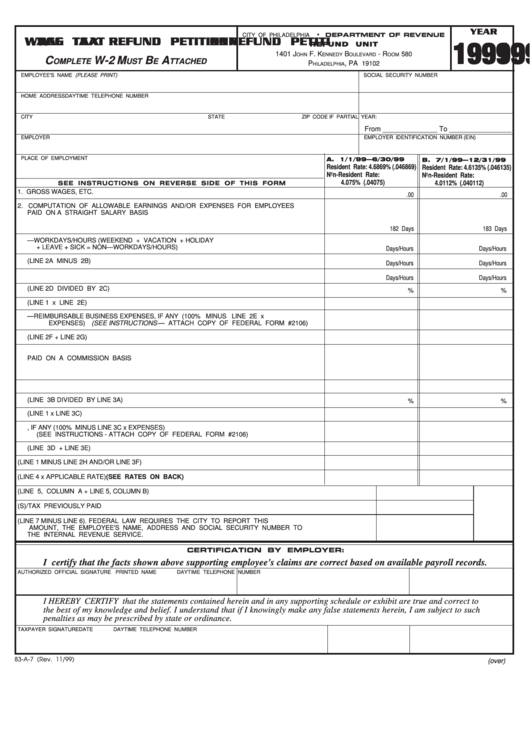

YEAR

•

CITY OF PHILADELPHIA

DEPARTMENT OF REVENUE

W

W

W A A A A A G G G G G E T

E T

E T

E TA A A A A X REFUND PETITI

X REFUND PETITI

X REFUND PETITI

X REFUND PETITIO O O O O N N N N N

W

W

E T

X REFUND PETITI

REFUND

UNIT

199

199 9 9 9 9 9

199

199

199

1401 J

F. K

B

- R

580

OHN

ENNEDY

OULEVARD

OOM

C

W-2 M

B

A

OMPLETE

UST

E

TTACHED

P

, PA

19102

HILADELPHIA

EMPLOYEE'S NAME (PLEASE PRINT)

SOCIAL SECURITY NUMBER

HOME ADDRESS

DAYTIME TELEPHONE NUMBER

CITY

STATE

ZIP CODE

IF PARTIAL YEAR:

From ______________ To ________________

EMPLOYER

EMPLOYER IDENTIFICATION NUMBER (EIN)

A. 1/1/99—6/30/99

PLACE OF EMPLOYMENT

B. 7/1/99—12/31/99

Resident Rate: 4.6869% (.046869)

Resident Rate: 4.6135% (.046135)

Non-Resident Rate:

Non-Resident Rate:

4.075% (.04075)

4.0112% (.040112)

SEE INSTRUCTIONS ON REVERSE SIDE OF THIS FORM

1. GROSS WAGES, ETC.

.00

.00

2. COMPUTATION OF ALLOWABLE EARNINGS AND/OR EXPENSES FOR EMPLOYEES

PAID ON A STRAIGHT SALARY BASIS

A. NUMBER OF DAYS /HOURS

182 Days

183 Days

B. NUMBER OF NON—WORKDAYS/HOURS (WEEKEND + VACATION + HOLIDAY

+ LEAVE + SICK = NON—WORKDAYS/HOURS)

Days/Hours

Days/Hours

C. NET NUMBER OF WORKDAYS/HOURS (LINE 2A MINUS 2B)

Days/Hours

Days/Hours

D. NUMBER OF DAYS/HOURS WORKED OUTSIDE PHILADELPHIA IN LINE 2C

Days/Hours

Days/Hours

E. PERCENTAGE OF TIME WORKED OUTSIDE PHILADELPHIA (LINE 2D DIVIDED BY 2C)

%

%

F. COMPENSATION EARNED OUTSIDE PHILADELPHIA (LINE 1 x LINE 2E)

G. NON—REIMBURSABLE BUSINESS EXPENSES, IF ANY (100% MINUS LINE 2E x

EXPENSES) (SEE INSTRUCTIONS — ATTACH COPY OF FEDERAL FORM #2106)

H. EXEMPT INCOME (LINE 2F + LINE 2G)

3. COMPUTATION OF ALLOWABLE COMPENSATION AND/OR EXPENSES FOR EMPLOYEES

PAID ON A COMMISSION BASIS

A. TOTAL SALES

B. TOTAL SALES OUTSIDE OF PHILADELPHIA

C. PERCENTAGE OF SALES OUTSIDE OF PHILADELPHIA (LINE 3B DIVIDED BY LINE 3A)

%

%

D. SHARE OF COMMISSIONS EARNED OUTSIDE OF PHILADELPHIA (LINE 1 x LINE 3C)

E. NON-REIMBURSABLE BUSINESS EXPENSES, IF ANY (100% MINUS LINE 3C x EXPENSES)

(SEE INSTRUCTIONS - ATTACH COPY OF FEDERAL FORM #2106)

F. EXEMPT COMMISSIONS (LINE 3D + LINE 3E)

4. TAXABLE COMPENSATION (LINE 1 MINUS LINE 2H AND/OR LINE 3F)

5. TAX DUE (LINE 4 x APPLICABLE RATE) (SEE RATES ON BACK)

6. TOTAL TAX DUE (LINE 5, COLUMN A + LINE 5, COLUMN B)

7. TAX WITHHELD PER W-2(S)/TAX PREVIOUSLY PAID

8. REFUND (LINE 7 MINUS LINE 6). FEDERAL LAW REQUIRES THE CITY TO REPORT THIS

AMOUNT, THE EMPLOYEE'S NAME, ADDRESS AND SOCIAL SECURITY NUMBER TO

THE INTERNAL REVENUE SERVICE.

CERTIFICATION BY EMPLOYER:

I certify that the facts shown above supporting employee's claims are correct based on available payroll records.

AUTHORIZED OFFICIAL SIGNATURE

PRINTED NAME

DAYTIME TELEPHONE NUMBER

I HEREBY CERTIFY that the statements contained herein and in any supporting schedule or exhibit are true and correct to

the best of my knowledge and belief. I understand that if I knowingly make any false statements herein, I am subject to such

penalties as may be prescribed by state or ordinance.

TAXPAYER SIGNATURE

DATE

DAYTIME TELEPHONE NUMBER

83-A-7 (Rev. 11/99)

(over)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1